Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An automotive part manufacturer purchases between two and three thousand tons of a certain type of raw material per year. For the production plan

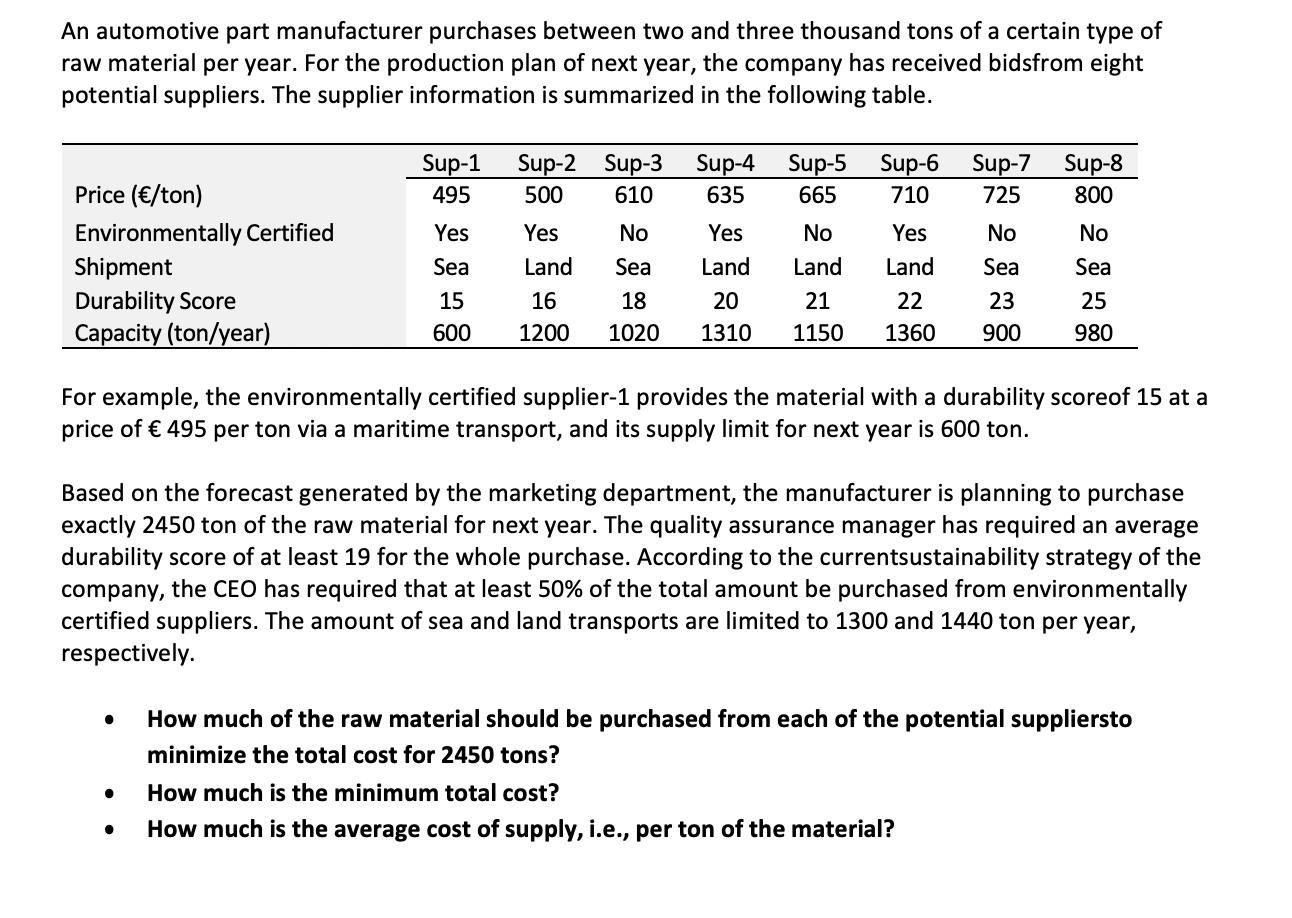

An automotive part manufacturer purchases between two and three thousand tons of a certain type of raw material per year. For the production plan of next year, the company has received bidsfrom eight potential suppliers. The supplier information is summarized in the following table. Sup-1 Sup-2 Sup-3 Sup-4 Sup-5 Sup-6 Sup-7 Sup-8 Price (/ton) 495 500 610 635 665 710 725 800 Environmentally Certified Yes Yes No Yes No Yes No No Shipment Sea Land Sea Land Land Land Sea Sea Durability Score 15 16 18 20 21 22 23 25 Capacity (ton/year) 600 1200 1020 1310 1150 1360 900 980 For example, the environmentally certified supplier-1 provides the material with a durability scoreof 15 at a price of 495 per ton via a maritime transport, and its supply limit for next year is 600 ton. Based on the forecast generated by the marketing department, the manufacturer is planning to purchase exactly 2450 ton of the raw material for next year. The quality assurance manager has required an average durability score of at least 19 for the whole purchase. According to the currentsustainability strategy of the company, the CEO has required that at least 50% of the total amount be purchased from environmentally certified suppliers. The amount of sea and land transports are limited to 1300 and 1440 ton per year, respectively. How much of the raw material should be purchased from each of the potential suppliersto minimize the total cost for 2450 tons? How much is the minimum total cost? . How much is the average cost of supply, i.e., per ton of the material?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started