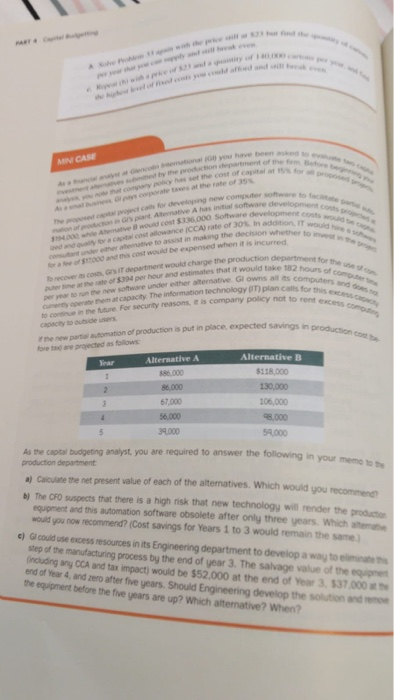

AN CAN wcomers initial software development Software development costs 1000 Soft the 000 and this cost be expensed when it is in IT department would charge me production departe of per hour and estates that it would take new software under the temative Glow matcapacity. The information technology IT plan ca there for security reasons. It is company policy not to gs in production con b e utomation of production is put in place expected savings rected as follows Alternative Alternative B 6.000 6000 130,000 67.000 56 000 $100 106.000 34000 54,000 As the budgeting analyst you are required to answer the following in production department the following in your memo to the a) Calculate the net present value of each of the alternatives. Which would you recom # The CFO suspects that there is a high risk that new technology will render the produce equipment and this automation software obsolete after only three years. Which would you now recommend? (Cost savings for Years 1 to 3 would remain the same) c) GI could use excess resources in its Engineering department to develop a way to eliminates step of the manufacturing process by the end of year 3. The salvage value of the including any CCA and tax impact) would be $52.000 at the end of Year 3.537.000 end of War 4 and pero after five years. Should Engineering develop the otion and the equipment before the five years are up? Which alternative? When? AN CAN wcomers initial software development Software development costs 1000 Soft the 000 and this cost be expensed when it is in IT department would charge me production departe of per hour and estates that it would take new software under the temative Glow matcapacity. The information technology IT plan ca there for security reasons. It is company policy not to gs in production con b e utomation of production is put in place expected savings rected as follows Alternative Alternative B 6.000 6000 130,000 67.000 56 000 $100 106.000 34000 54,000 As the budgeting analyst you are required to answer the following in production department the following in your memo to the a) Calculate the net present value of each of the alternatives. Which would you recom # The CFO suspects that there is a high risk that new technology will render the produce equipment and this automation software obsolete after only three years. Which would you now recommend? (Cost savings for Years 1 to 3 would remain the same) c) GI could use excess resources in its Engineering department to develop a way to eliminates step of the manufacturing process by the end of year 3. The salvage value of the including any CCA and tax impact) would be $52.000 at the end of Year 3.537.000 end of War 4 and pero after five years. Should Engineering develop the otion and the equipment before the five years are up? Which alternative? When