Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An e-business company called DMD Co creates and offers computer programs (apps) for smartphones. The business is looking at three financing possibilities as it seeks

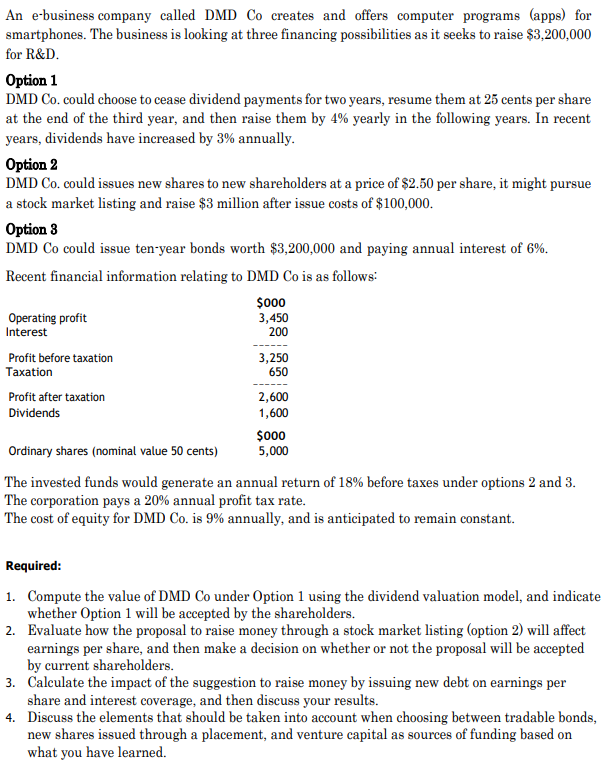

An e-business company called DMD Co creates and offers computer programs (apps) for smartphones. The business is looking at three financing possibilities as it seeks to raise $3,200,000 for R&D. Option 1 DMD Co. could choose to cease dividend payments for two years, resume them at 25 cents per share at the end of the third year, and then raise them by 4% yearly in the following years. In recent years, dividends have increased by 3% annually. Option 2 DMD Co. could issues new shares to new shareholders at a price of $2.50 per share, it might pursue a stock market listing and raise $3 million after issue costs of $100,000. Option 3 DMD Co could issue ten-year bonds worth $3,200,000 and paying annual interest of 6%. Recent financial information relating to DMD Co is as follows: The invested funds would generate an annual return of 18% before taxes under options 2 and 3 . The corporation pays a 20% annual profit tax rate. The cost of equity for DMD Co. is 9% annually, and is anticipated to remain constant. Required: 1. Compute the value of DMD Co under Option 1 using the dividend valuation model, and indicate whether Option 1 will be accepted by the shareholders. 2. Evaluate how the proposal to raise money through a stock market listing (option 2) will affect earnings per share, and then make a decision on whether or not the proposal will be accepted by current shareholders. 3. Calculate the impact of the suggestion to raise money by issuing new debt on earnings per share and interest coverage, and then discuss your results. 4. Discuss the elements that should be taken into account when choosing between tradable bonds, new shares issued through a placement, and venture capital as sources of funding based on what you have learned

An e-business company called DMD Co creates and offers computer programs (apps) for smartphones. The business is looking at three financing possibilities as it seeks to raise $3,200,000 for R&D. Option 1 DMD Co. could choose to cease dividend payments for two years, resume them at 25 cents per share at the end of the third year, and then raise them by 4% yearly in the following years. In recent years, dividends have increased by 3% annually. Option 2 DMD Co. could issues new shares to new shareholders at a price of $2.50 per share, it might pursue a stock market listing and raise $3 million after issue costs of $100,000. Option 3 DMD Co could issue ten-year bonds worth $3,200,000 and paying annual interest of 6%. Recent financial information relating to DMD Co is as follows: The invested funds would generate an annual return of 18% before taxes under options 2 and 3 . The corporation pays a 20% annual profit tax rate. The cost of equity for DMD Co. is 9% annually, and is anticipated to remain constant. Required: 1. Compute the value of DMD Co under Option 1 using the dividend valuation model, and indicate whether Option 1 will be accepted by the shareholders. 2. Evaluate how the proposal to raise money through a stock market listing (option 2) will affect earnings per share, and then make a decision on whether or not the proposal will be accepted by current shareholders. 3. Calculate the impact of the suggestion to raise money by issuing new debt on earnings per share and interest coverage, and then discuss your results. 4. Discuss the elements that should be taken into account when choosing between tradable bonds, new shares issued through a placement, and venture capital as sources of funding based on what you have learned Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started