Answered step by step

Verified Expert Solution

Question

1 Approved Answer

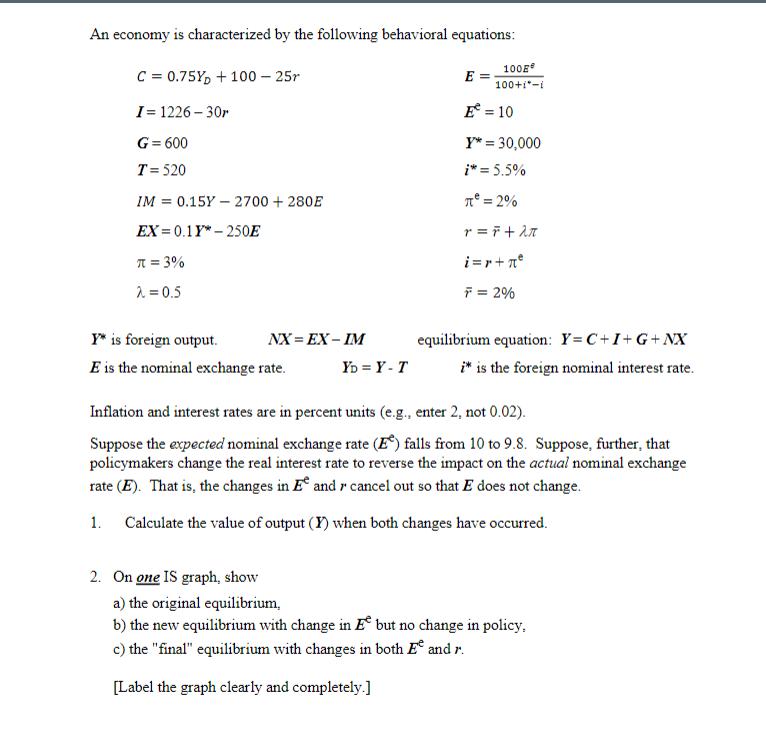

An economy is characterized by the following behavioral equations: C = 0.75% + 100-25r I=1226-30r G = 600 T=520 IM = 0.15Y - 2700

An economy is characterized by the following behavioral equations: C = 0.75% + 100-25r I=1226-30r G = 600 T=520 IM = 0.15Y - 2700 + 280E EX=0.1Y* 250E = 3% = 0.5 Y* is foreign output. E is the nominal exchange rate. NX=EX-IM 2. On one IS graph, show YD = Y - T E = 100E 100+1*-1 E = 10 Y*= 30,000 i* = 5.5% = 2% r = F + A i=r+n F = 2% equilibrium equation: Y=C+I+G+ NX i* is the foreign nominal interest rate. Inflation and interest rates are in percent units (e.g., enter 2, not 0.02). Suppose the expected nominal exchange rate (E) falls from 10 to 9.8. Suppose, further, that policymakers change the real interest rate to reverse the impact on the actual nominal exchange rate (E). That is, the changes in E and r cancel out so that E does not change. 1. Calculate the value of output (I) when both changes have occurred. a) the original equilibrium, b) the new equilibrium with change in E but no change in policy. c) the "final" equilibrium with changes in both E and r. [Label the graph clearly and completely.]

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of output Y when both changes have occurred we need to analyze the equilibriu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started