Question

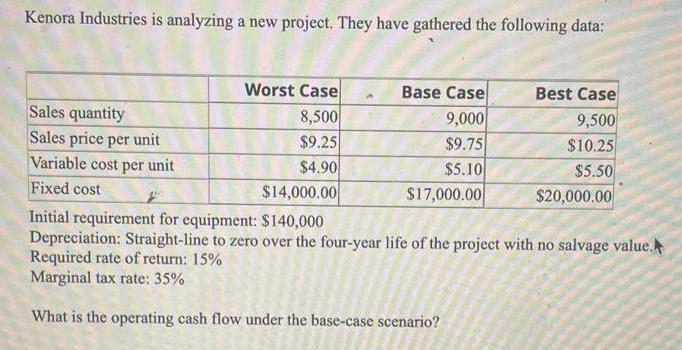

Kenora Industries is analyzing a new project. They have gathered the following data: Worst Case 8,500 $9.25 $4.90 $14,000.00 Initial requirement for equipment: $140,000

Kenora Industries is analyzing a new project. They have gathered the following data: Worst Case 8,500 $9.25 $4.90 $14,000.00 Initial requirement for equipment: $140,000 Depreciation: Straight-line to zero over the four-year life of the project with no salvage value. Required rate of return: 15% Marginal tax rate: 35% What is the operating cash flow under the base-case scenario? Sales quantity Sales price per unit Variable cost per unit Fixed cost Base Case 9,000 $9.75 $5.10 $17,000.00 Best Case 9,500 $10.25 $5.50 $20,000.00

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Economics

Authors: Robert Frank, Ben Bernanke

5th edition

73511404, 978-0073511405

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App