Answered step by step

Verified Expert Solution

Question

1 Approved Answer

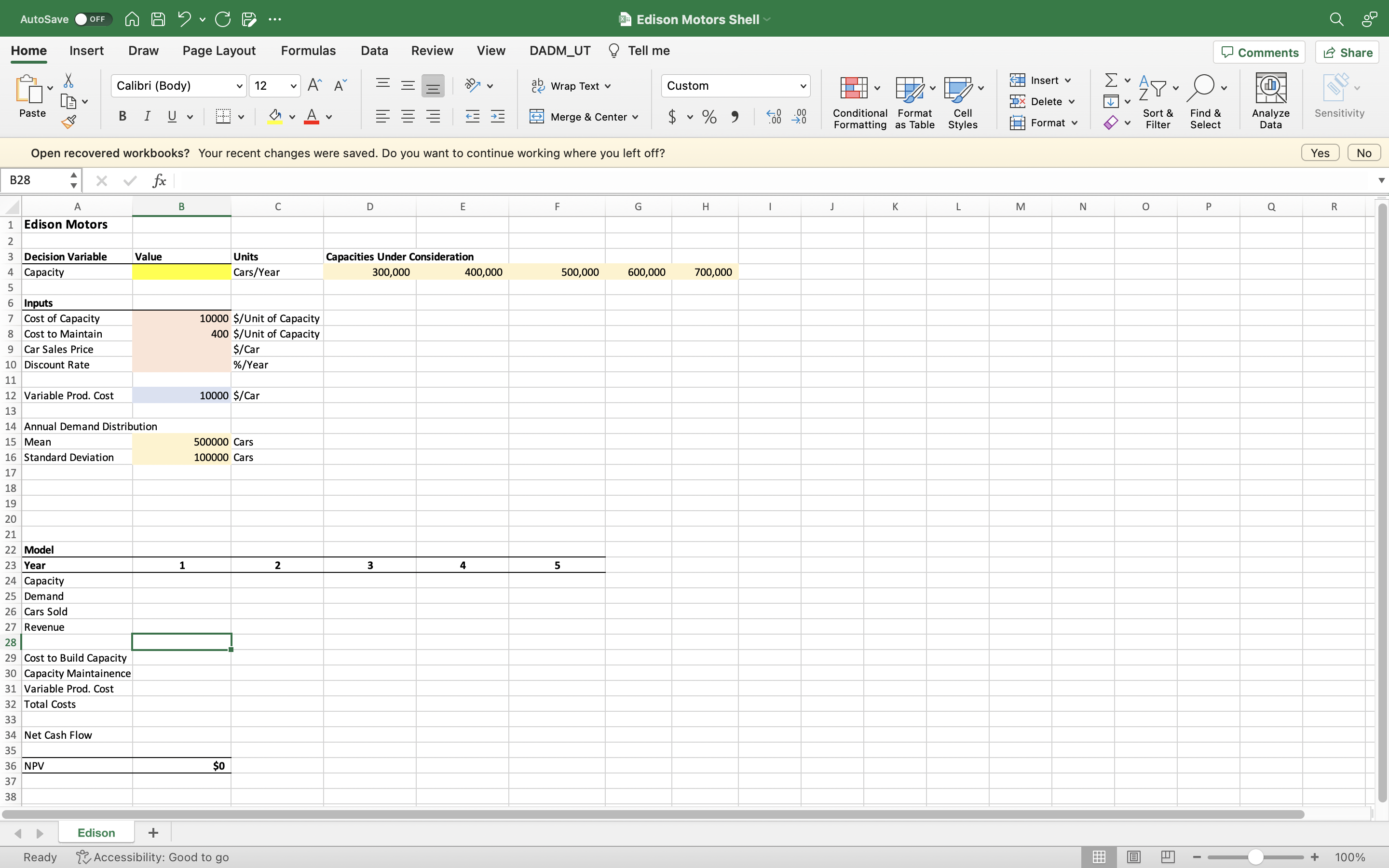

An electric car company, Edison Motors, is trying to determine the proper production capacity level for its new electric car. A unit of capacity gives

An electric car company, Edison Motors, is trying to determine the proper production capacity level for its new electric car. A unit of capacity gives us the potential to produce one car per year. It costs $ to build a unit of capacity and the cost is charged equally over the next years, at $ per year. It also costs $ per year to maintain a unit of capacity whether or not it is used

Each car sells for $ and incurs a variable production cost of $

The annual demand for the electric car during each of the next years is believed to be normally distributed with mean and standard deviation The demands during different years are assumed to be independent.

Profits are discounted at a annual interest rate.

The company is working with a year planning horizon. Capacity levels of and are under consideration. In each year, the company does not produce more than the demand for that year, so no inventory is carried from one year to the next. Perform simulations to analyze this problem.

In this problem, you will build the model as before, but with less given in the starter shell file. You will need to fill in the inputs from the problem statement and the logic to calculate cash flow. The NPV formula is provided for you in cell B

Some things to note when you work on this problem:

For all simulations, run at least replications.

What is the capacity level that maximizes expected mean NPV

What is the expected mean NPV at the optimal capacity level you determined in Question

Enter your answer in dollars not millions of dollars, for example

Use the additional information below for questions and :

Due to supply shortages for several key parts used to build the electric car, the variable production cost is uncertain, but expected to be higher over the first years.

The company believes the distribution of variable costs for these years is triangular, with a minimum of $ and maximum of $

In year the most likely value is $ In year the most likely value is the actual value from year After year variable cost is expected to return to $

For example, if the year variable cost sampled from the year distribution is $ then the most likely value for the year distribution is $ but the minimum is still $ and the maximum is still $

Based on this new information, what is the optimal capacity level?

What is the probability that the company loses money at the new optimal capacity level you found in question

Enter the probability as a decimal value rounded to two decimal places. For example, would be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started