Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An Electronics, Inc. ( AEI ) commenced operations in 2 0 X 1 , manufacturing a small component used in various electronic products. In the

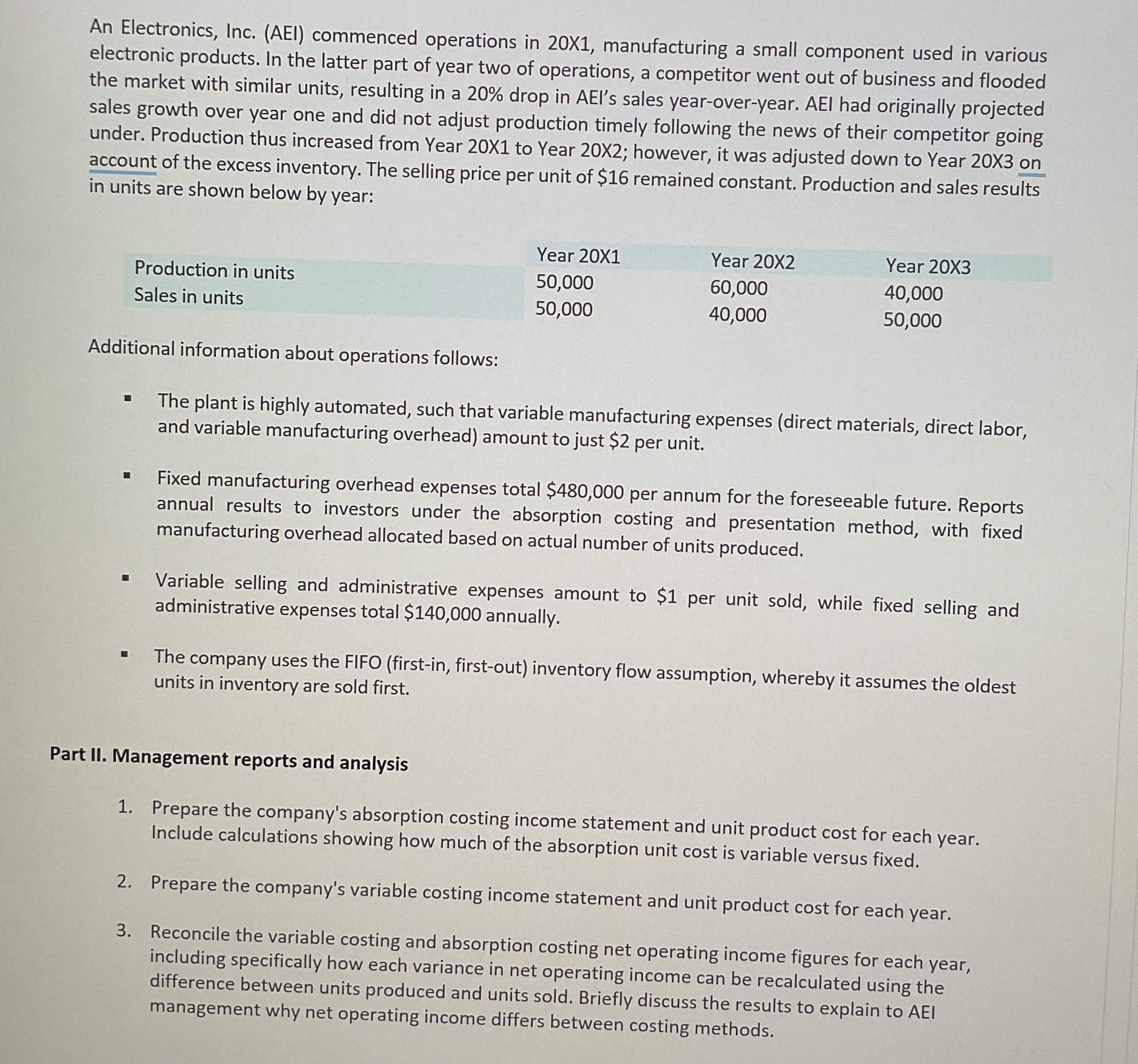

An Electronics, Inc. AEI commenced operations in X manufacturing a small component used in various electronic products. In the latter part of year two of operations, a competitor went out of business and flooded the market with similar units, resulting in a drop in AEI's sales yearoveryear. AEI had originally projected sales growth over year one and did not adjust production timely following the news of their competitor going under. Production thus increased from Year X to Year X; however, it was adjusted down to Year X on account of the excess inventory. The selling price per unit of $ remained constant. Production and sales results in units are shown below by year:

tableYear XYear XYear XProduction in units,Sales in units,

Additional information about operations follows:

The plant is highly automated, such that variable manufacturing expenses direct materials, direct labor, and variable manufacturing overhead amount to just $ per unit.

Fixed manufacturing overhead expenses total $ per annum for the foreseeable future. Reports annual results to investors under the absorption costing and presentation method, with fixed manufacturing overhead allocated based on actual number of units produced.

Variable selling and administrative expenses amount to $ per unit sold, while fixed selling and administrative expenses total $ annually.

The company uses the FIFO firstin firstout inventory flow assumption, whereby it assumes the oldest units in inventory are sold first.

Part II Management reports and analysis

Prepare the company's absorption costing income statement and unit product cost for each year. Include calculations showing how much of the absorption unit cost is variable versus fixed.

Prepare the company's variable costing income statement and unit product cost for each year.

Reconcile the variable costing and absorption costing net operating income figures for each year, including specifically how each variance in net operating income can be recalculated using the difference between units produced and units sold. Briefly discuss the results to explain to AEI management why net operating income differs between costing methods.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started