Answered step by step

Verified Expert Solution

Question

1 Approved Answer

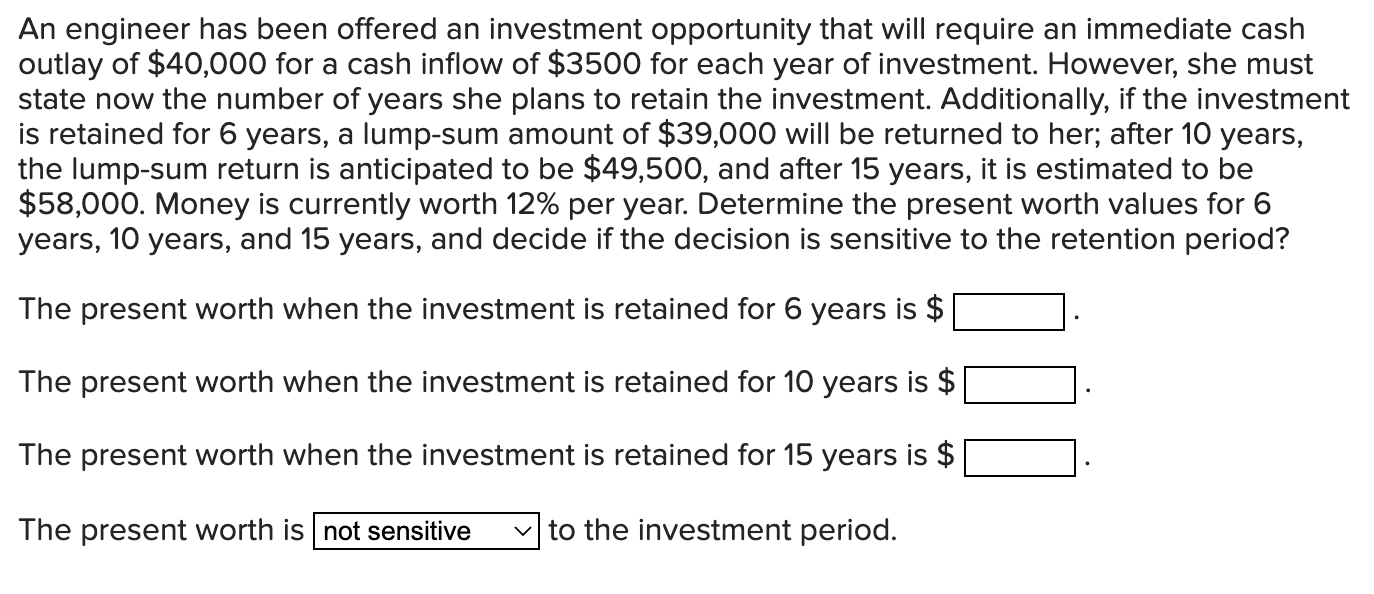

An engineer has been offered an investment opportunity that will require an immediate cash outlay of $ 4 0 , 0 0 0 for a

An engineer has been offered an investment opportunity that will require an immediate cash outlay of $ for a cash inflow of $ for each year of investment. However, she must state now the number of years she plans to retain the investment. Additionally, if the investment is retained for years, a lumpsum amount of $ will be returned to her; after years, the lumpsum return is anticipated to be $ and after years, it is estimated to be $ Money is currently worth per year. Determine the present worth values for years, years, and years, and decide if the decision is sensitive to the retention period? The present worth when the investment is retained for years is $ The present worth when the investment is retained for years is $ The present worth when the investment is retained for years is $ The present worth is to the investment period.

An engineer has been offered an investment opportunity that will require an immediate cash

outlay of $ for a cash inflow of $ for each year of investment. However, she must

state now the number of years she plans to retain the investment. Additionally, if the investment

is retained for years, a lumpsum amount of $ will be returned to her; after years,

the lumpsum return is anticipated to be $ and after years, it is estimated to be

$ Money is currently worth per year. Determine the present worth values for

years, years, and years, and decide if the decision is sensitive to the retention period?

The present worth when the investment is retained for years is $

The present worth when the investment is retained for years is $

The present worth when the investment is retained for years is $

The present worth is

to the investment period.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started