Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reneilwe works for McDonalds as a cashier. The outlet where Reneilwe works operates 24 hours per day. She is employed permanently but is remunerated

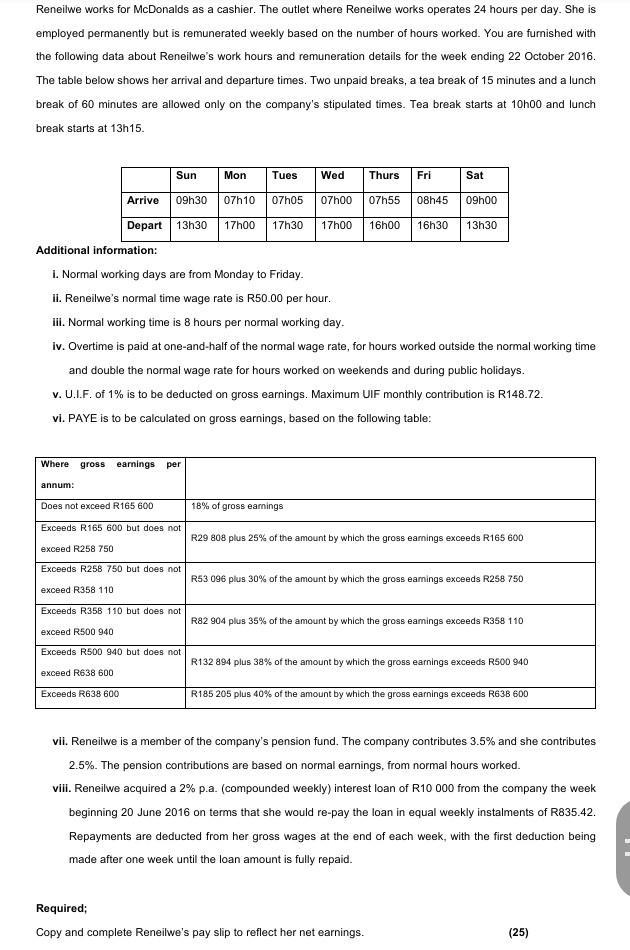

Reneilwe works for McDonalds as a cashier. The outlet where Reneilwe works operates 24 hours per day. She is employed permanently but is remunerated weekly based on the number of hours worked. You are furnished with the following data about Reneilwe's work hours and remuneration details for the week ending 22 October 2016. The table below shows her arrival and departure times. Two unpaid breaks, a tea break of 15 minutes and a lunch break of 60 minutes are allowed only on the company's stipulated times. Tea break starts at 10h00 and lunch break starts at 13h15. Arrive Depart Sun annum: Where gross earnings per Mon 09h30 07h10 07h05 13h30 17h00 17h30 Additional information: i. Normal working days are from Monday to Friday. ii. Reneilwe's normal time wage rate is R50.00 per hour. iii. Normal working time is 8 hours per normal working day. iv. Overtime is paid at one-and-half of the normal wage rate, for hours worked outside the normal working time and double the normal wage rate for hours worked on weekends and during public holidays. v. U.I.F. of 1% is to be deducted on gross earnings. Maximum UIF monthly contribution is R148.72. vi. PAYE is to be calculated on gross earnings, based on the following table: Sat Tues Wed Thurs Fri 07h00 07h55 08h45 17h00 16h00 16h30 13h30 09h00 Does not exceed R165 600 Exceeds R165 600 but does not exceed R258 750 Exceeds R258 750 but does not exceed R358 110 Exceeds R358 110 but does not exceed R500 940 Exceeds R500 940 but does not exceed R638 600 Exceeds R638 600 18% of gross earnings R29 808 plus 25% of the amount by which the gross earnings exceeds R165 600 R53 096 plus 30% of the amount by which the gross earnings exceeds R258 750 R82 904 plus 35% of the amount by which the gross eamings exceeds R358 110 R132 894 plus 38% of the amount by which the gross earnings exceeds R500 940 R185 205 plus 40% of the amount by which the gross earnings exceeds R638 600 vii. Reneilwe is a member of the company's pension fund. The company contributes 3.5% and she contributes 2.5%. The pension contributions are based on normal earnings, from normal hours worked. viii. Reneilwe acquired a 2% p.a. (compounded weekly) interest loan of R10 000 from the company the week beginning 20 June 2016 on terms that she would re-pay the loan in equal weekly instalments of R835.42. Repayments are deducted from her gross wages at the end of each week, with the first deduction being made after one week until the loan amount is fully repaid. Required; Copy and complete Reneilwe's pay slip to reflect her net earnings. (25)

Step by Step Solution

★★★★★

3.47 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Weekly Gross inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started