Question

An entity purchased 5-year debt instruments with a face value of P5,000,000 on January 1, 2019, to collect contractual cash flows that are solely payments

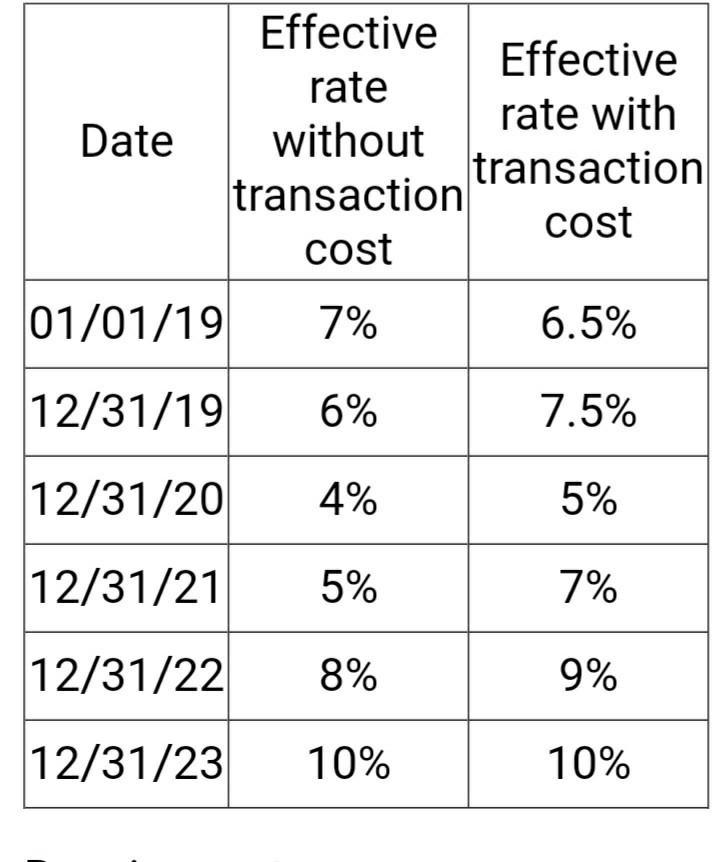

An entity purchased 5-year debt instruments with a face value of P5,000,000 on January 1, 2019, to collect contractual cash flows that are solely payments of principal and interest and to sell the financial asset. Interest is paid semi-annually at a nominal rate of 10% that is paid every June 30 and December 31. The following information is in the photo uploaded:

Requirements:

What is the purchase price of the bond investment?

How much does the direct transaction cost?

What is the 2019 interest income?

What is the December 31, 2019 carrying amount?

How much was the 2019 unrealized gain recognized in the statement of comprehensive income?

What is the 2020 interest income?

How much was the 2020 unrealized gain recognized in the statement of comprehensive income?

What is the cumulative unrealized gain inequity on December 31, 2020?

If the debt investment is sold net of the transaction cost on January 1, 2021, what is the gain or loss on disposal?

If the entity changes its business model in 2020 to collect contractual cash flows only, what is the carrying amount of the bonds on December 31, 2021?

If the entity changes its business model in 2020 to collect contractual cash flows only, what is the 2021 interest income?

If the entity changes its business model in 2020 to hold the financial asset for trading purposes, what is the total or net amount recognized in profit or loss in 2021?

Effective Effective rate rate with Date without transaction transaction cost cost 01/01/19 7% 6.5% 12/31/19 6% 7.5% 12/31/20 4% 5% 12/31/21 5% 7% 12/31/22 8% 9% 12/31/23 10% 10%

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Purchase price of the bond is the cost of servicing the bond value through out the tenure In this case it is 5 years The cost includes primarily the coupon payments in annual terms or biannual terms I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started