Question

An entity revalued its land and buildings at the start of the year to $60 million ($15 million for the land). The property cost

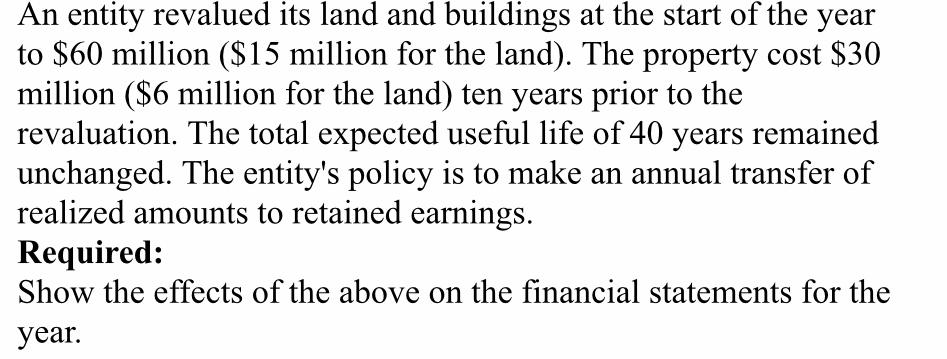

An entity revalued its land and buildings at the start of the year to $60 million ($15 million for the land). The property cost $30 million ($6 million for the land) ten years prior to the revaluation. The total expected useful life of 40 years remained unchanged. The entity's policy is to make an annual transfer of realized amounts to retained earnings. Required: Show the effects of the above on the financial statements for the year.

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The revaluation of land and buildings will have several effects on the financial statements of the e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting

Authors: Barry Elliott, Jamie Elliott

18th edition

1292162406, 978-1292162409

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App