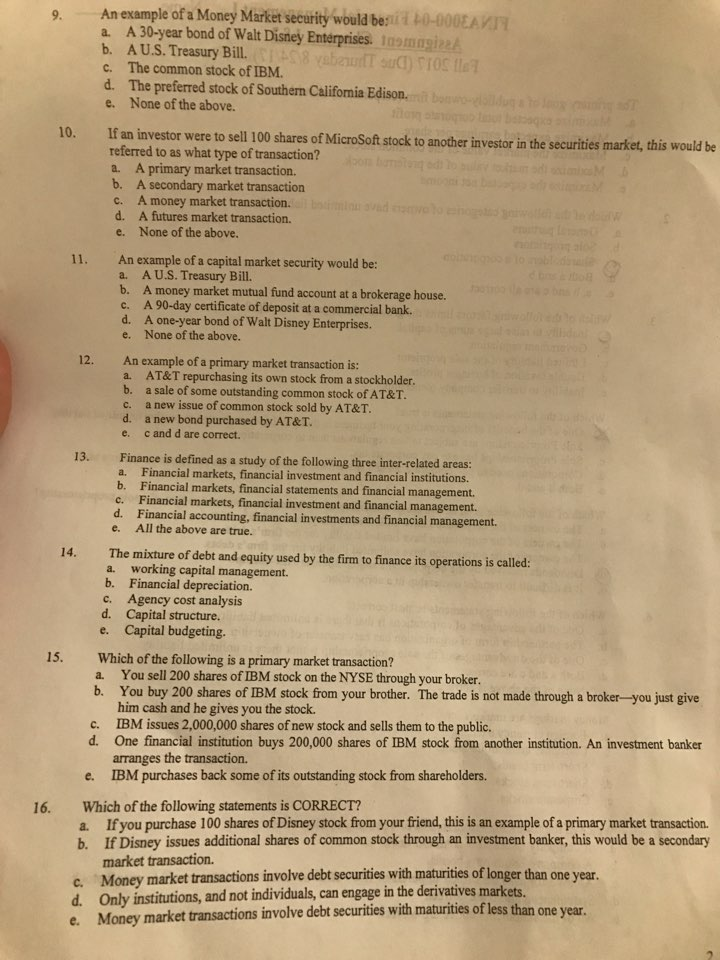

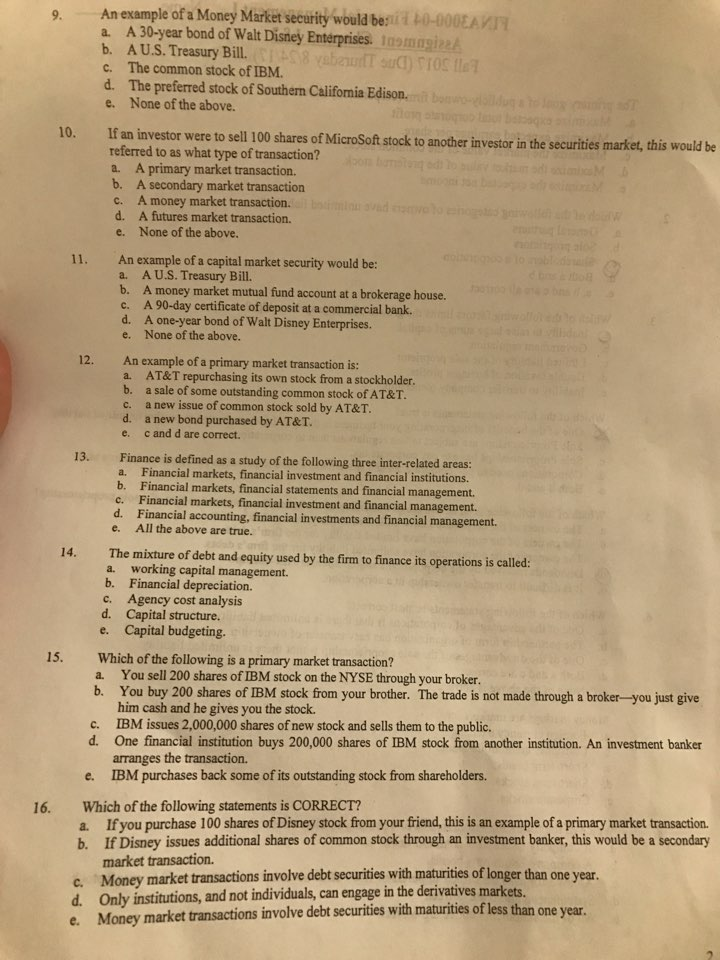

An example of a Money Market security would be: A 30-year bond of Walt Disney Enterprises. A U.S. Treasury Bill. The common stock of IBM. The preferred stock of IBM. The preferred stock of Southern California Edison. None of the above. If an investor were to sell 100 shares of MicroSoft stock to another investor in the securities market, this would be referred to as what type of transaction? A primary market transaction. A secondary market transaction c. A money market transaction. A futures market transaction. None of the above. An example of a capital market security would be: A U.S. Treasury Bill. A money market mutual fund account at a brokerage house. A 90-day certificate of deposit at a commercial bank. A one-year bond of Walt Disney Enterprises. None of the above. An example of a primary market transaction is: AT&T repurchasing its own stock from a stockholder. a sale of some outstanding common stock of AT&T. a new issue of common stock sold by AT&T. a new bond purchased by AT&T. c and d are correct. Finance is defined as a study of the following three inter-related areas: Financial markets, financial investment and financial institutions. Financial markets, financial statements and financial management. Financial markets, financial investment and financial management. Financial accounting, financial investments and financial management. All the above are true. The mixture of debt and equity used by the firm to finance its operations is called: working capital management. Financial depreciation. Agency cost analysis. Capital structure. Capital budgeting. Which of the following is a primary market transaction? You sell 200 shares of IBM stock on the NYSE through your broker. You buy 200 shares of IBM stock from your brother. The trade is not made through a broker-you just give him cash and he gives you the stock. IBM issues 2,000,000 shares of new stock and sells them to the public. One financial institution buys 200,000 shares of IBM stock from another institution. An investment banker arranges the transaction. IBM purchases back some of its outstanding stock from shareholders. Which of the following statements is CORRECT? If you purchase 100 shares of Disney stock from your friend, this is an example of a primary market transaction. If Disney issues additional shares of common stock through an investment banker, this would be a secondary market transaction. Money market transactions involve debt securities with maturities of longer than one year. Only institutions, and not individuals, can engage in the derivatives markets. Money market transactions involve debt securities with maturities of less than one year