Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An Excavation Contractor purchased a bulldozer four years ago for RM70,000 estimating that it would have an economic life of 8 years with no

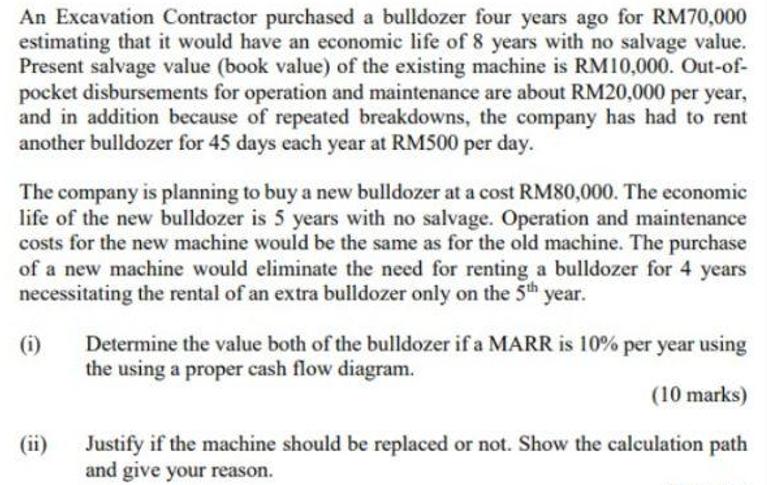

An Excavation Contractor purchased a bulldozer four years ago for RM70,000 estimating that it would have an economic life of 8 years with no salvage value. Present salvage value (book value) of the existing machine is RM10,000. Out-of- pocket disbursements for operation and maintenance are about RM20,000 per year, and in addition because of repeated breakdowns, the company has had to rent another bulldozer for 45 days each year at RM500 per day. The company is planning to buy a new bulldozer at a cost RM80,000. The economic life of the new bulldozer is 5 years with no salvage. Operation and maintenance costs for the new machine would be the same as for the old machine. The purchase of a new machine would eliminate the need for renting a bulldozer for 4 years necessitating the rental of an extra bulldozer only on the 5th year. Determine the value both of the bulldozer if a MARR is 10% per year using the using a proper cash flow diagram. (i) (10 marks) (ii) Justify if the machine should be replaced or not. Show the calculation path and give your reason.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

i Amount RM Timelinen Today 0 Year 1 Year 2 Year 3 Y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started