An excel workbook with the following six (6) sheets: Sheet 1: Background Information Sheet 2: Consolidation Journal Entries Sheet 3: Consolidated Worksheet Sheet 4: Consolidated Income Statement Sheet 5: Consolidated Balance Sheet / Statement of Financial Position Sheet 6: Discussion on Part c Required: a) Record the consolidated journal entries necessary to prepare consolidated accounts for the year ending 30 June 2021 for the group comprising Parent Ltd and Subsidiary Ltd (In Sheet 2:Consolidated Journal Entries). b) Complete the consolidated worksheet for the year ending 30 June 2021 (In Sheet 3: Consolidated Worksheet). I. Entering the consolidated journal entries in Part (a) above to the appropriate debit and credit columns in the Consolidated Worksheet; and II. Completing the Group figures in the Consolidated Worksheet. c) XXX Ltd is a 51 per cent shareholder in C Ltd and currently has two out of five board seats. YYY Ltd is the remaining 49 per cent shareholder in C Ltd and currently has the other three seats. XXX Ltd is a passive shareholder as it is happy with the way YYY Ltd has been running the company. Advise XXX Ltd (In Sheet 6: Discussion on Part c) whether it is required to prepare consolidated financial statements

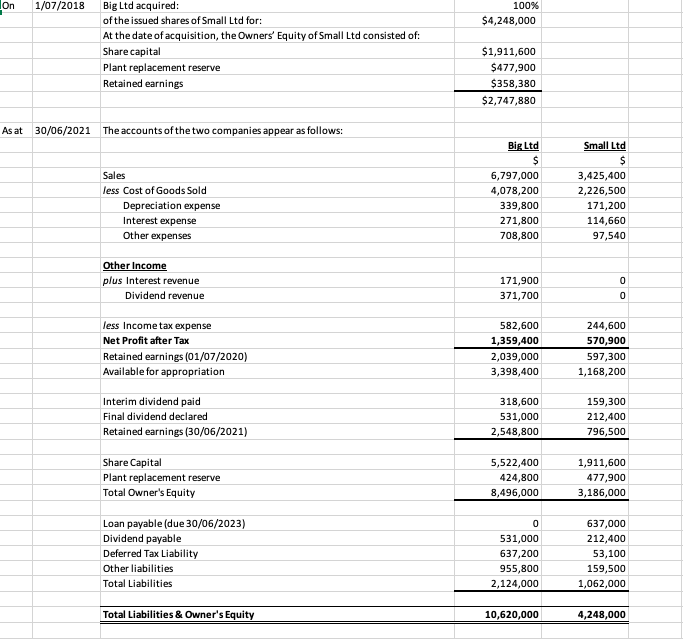

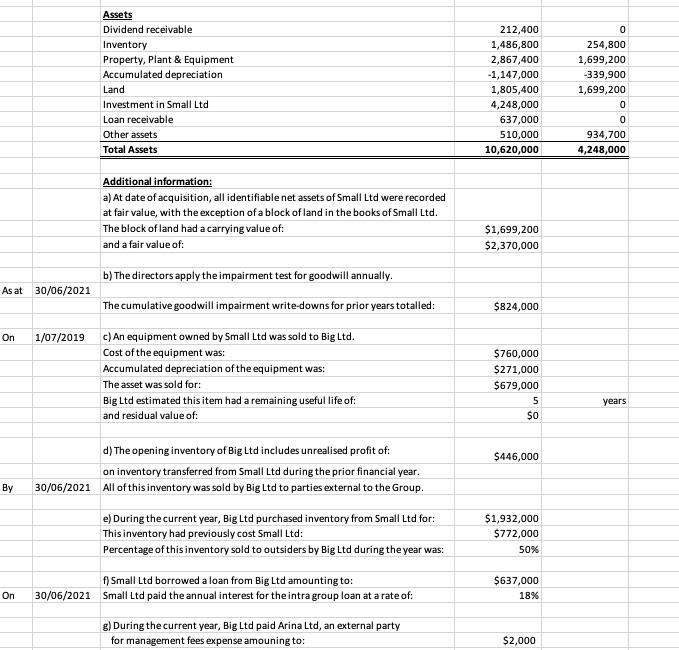

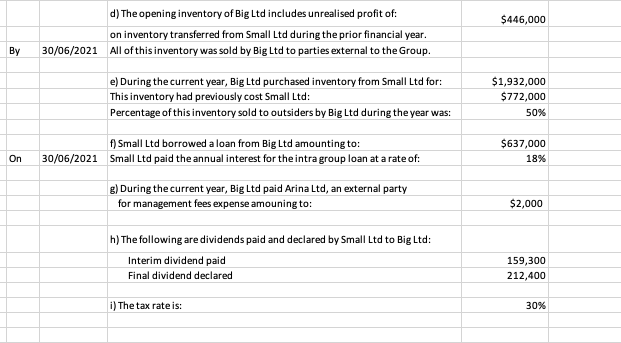

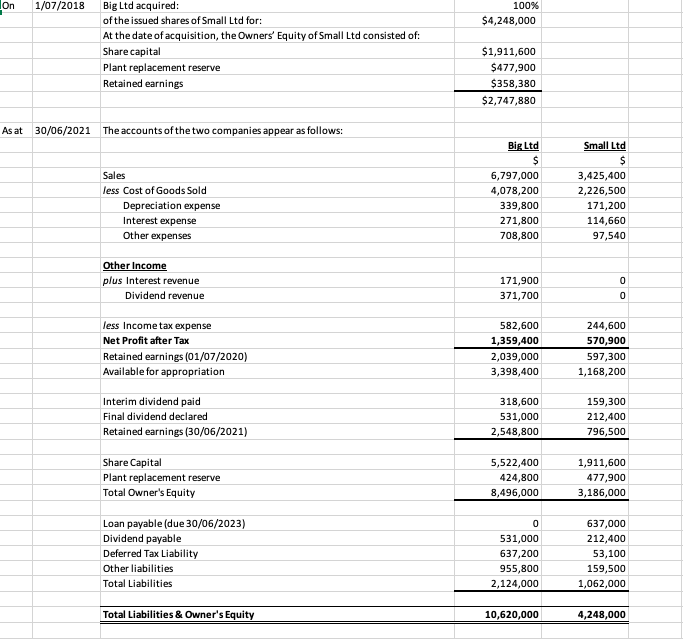

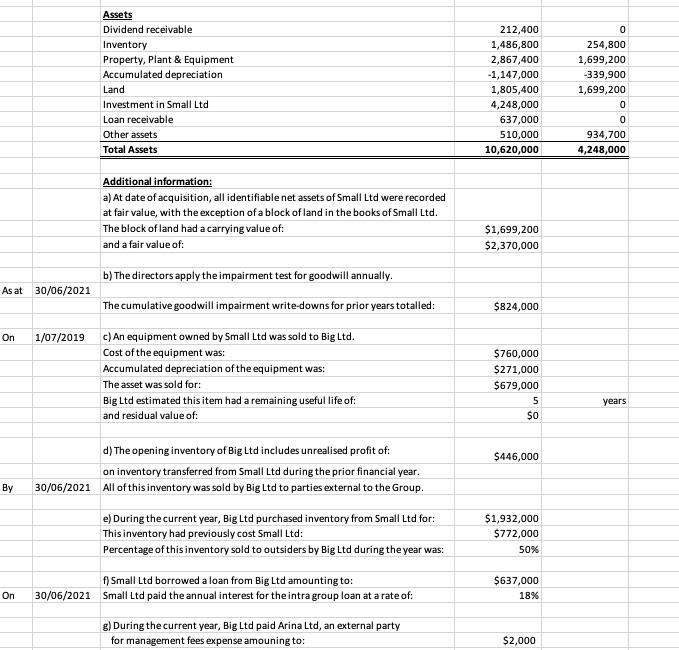

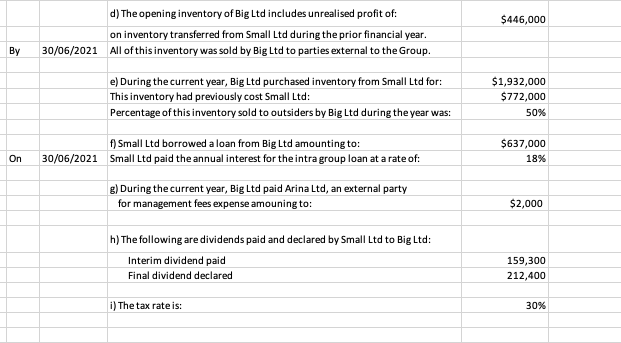

On 1/07/2018 100% $4,248,000 Big Ltd acquired: of the issued shares of Small Ltd for: At the date of acquisition, the Owners' Equity of Small Ltd consisted of: Share capital Plant replacement reserve Retained earnings $1,911,600 $477,900 $358,380 $2,747,880 As at 30/06/2021 The accounts of the two companies appear as follows: Sales less Cost of Goods Sold Depreciation expense Interest expense Other expenses Big Ltd $ 6,797,000 4,078,200 339,800 271,800 708,800 Small Ltd $ 3,425,400 2,226,500 171,200 114,660 97,540 Other Income plus Interest revenue Dividend revenue 0 171,900 371,700 0 less Income tax expense Net Profit after Tax Retained earnings (01/07/2020) Available for appropriation 582,600 1,359,400 2,039,000 3,398,400 244,600 570,900 597,300 1,168,200 Interim dividend paid Final dividend declared Retained earnings (30/06/2021) 318,600 531,000 2,548,800 159,300 212,400 796,500 Share Capital Plant replacement reserve Total Owner's Equity 5,522,400 424,800 8,496,000 1,911,600 477,900 3,186,000 Loan payable (due 30/06/2023) Dividend payable Deferred Tax Liability Other liabilities Total Liabilities 0 531,000 637,200 955,800 2,124,000 637,000 212,400 53,100 159,500 1,062,000 Total Liabilities & Owner's Equity 10,620,000 4,248,000 Assets Dividend receivable Inventory Property, Plant & Equipment Accumulated depreciation Land Investment in Small Ltd Loan receivable Other assets Total Assets 212,400 1,486,800 2,867,400 -1,147,000 1,805,400 4,248,000 637,000 510,000 10,620,000 0 254,800 1,699,200 -339,900 1,699,200 0 0 934,700 4,248,000 Additional information: a) At date of acquisition, all identifiable net assets of Small Ltd were recorded at fair value, with the exception of a block of land in the books of Small Ltd. The block of land had a carrying value of: and a fair value of: $1,699,200 $2,370,000 b) The directors apply the impairment test for goodwill annually. As at 30/06/2021 The cumulative goodwill impairment write-downs for prior years totalled: $824,000 On 1/07/2019 c) An equipment owned by Small Ltd was sold to Big Ltd. Cost of the equipment was: Accumulated depreciation of the equipment was: The asset was sold for: Big Ltd estimated this item had a remaining useful life of: and residual value of: $760,000 $271,000 $679,000 5 years $o $446,000 d) The opening inventory of Big Ltd includes unrealised profit of: on inventory transferred from Small Ltd during the prior financial year. 30/06/2021 All of this inventory was sold by Big Ltd to parties external to the Group. e) During the current year, Big Ltd purchased inventory from Small Ltd for: This inventory had previously cost Small Ltd: Percentage of this inventory sold to outsiders by Big Ltd during the year was: $1,932,000 $772,000 50% $637,000 18% On f) Small Ltd borrowed a loan from Big Ltd amounting to: 30/06/2021 Small Ltd paid the annual interest for the intra group loan at a rate of: g) During the current year, Big Ltd paid Arina Ltd, an external party for management fees expense amouning to: $2,000 $446,000 d) The opening inventory of Big Ltd includes unrealised profit of: on inventory transferred from Small Ltd during the prior financial year. 30/06/2021 All of this inventory was sold by Big Ltd to parties external to the Group. e) During the current year, Big Ltd purchased inventory from Small Ltd for: This inventory had previously cost Small Ltd: Percentage of this inventory sold to outsiders by Big Ltd during the year was: $1,932,000 $772,000 50% f) Small Ltd borrowed a loan from Big Ltd amounting to: 30/06/2021 Small Ltd paid the annual interest for the intra group loan at a rate of: $637,000 18% On g) During the current year, Big Ltd paid Arina Ltd, an external party for management fees expense amouning to: $2,000 h) The following are dividends paid and declared by Small Ltd to Big Ltd: Interim dividend paid Final dividend declared 159,300 212,400 i) The tax rate is: 30% On 1/07/2018 100% $4,248,000 Big Ltd acquired: of the issued shares of Small Ltd for: At the date of acquisition, the Owners' Equity of Small Ltd consisted of: Share capital Plant replacement reserve Retained earnings $1,911,600 $477,900 $358,380 $2,747,880 As at 30/06/2021 The accounts of the two companies appear as follows: Sales less Cost of Goods Sold Depreciation expense Interest expense Other expenses Big Ltd $ 6,797,000 4,078,200 339,800 271,800 708,800 Small Ltd $ 3,425,400 2,226,500 171,200 114,660 97,540 Other Income plus Interest revenue Dividend revenue 0 171,900 371,700 0 less Income tax expense Net Profit after Tax Retained earnings (01/07/2020) Available for appropriation 582,600 1,359,400 2,039,000 3,398,400 244,600 570,900 597,300 1,168,200 Interim dividend paid Final dividend declared Retained earnings (30/06/2021) 318,600 531,000 2,548,800 159,300 212,400 796,500 Share Capital Plant replacement reserve Total Owner's Equity 5,522,400 424,800 8,496,000 1,911,600 477,900 3,186,000 Loan payable (due 30/06/2023) Dividend payable Deferred Tax Liability Other liabilities Total Liabilities 0 531,000 637,200 955,800 2,124,000 637,000 212,400 53,100 159,500 1,062,000 Total Liabilities & Owner's Equity 10,620,000 4,248,000 Assets Dividend receivable Inventory Property, Plant & Equipment Accumulated depreciation Land Investment in Small Ltd Loan receivable Other assets Total Assets 212,400 1,486,800 2,867,400 -1,147,000 1,805,400 4,248,000 637,000 510,000 10,620,000 0 254,800 1,699,200 -339,900 1,699,200 0 0 934,700 4,248,000 Additional information: a) At date of acquisition, all identifiable net assets of Small Ltd were recorded at fair value, with the exception of a block of land in the books of Small Ltd. The block of land had a carrying value of: and a fair value of: $1,699,200 $2,370,000 b) The directors apply the impairment test for goodwill annually. As at 30/06/2021 The cumulative goodwill impairment write-downs for prior years totalled: $824,000 On 1/07/2019 c) An equipment owned by Small Ltd was sold to Big Ltd. Cost of the equipment was: Accumulated depreciation of the equipment was: The asset was sold for: Big Ltd estimated this item had a remaining useful life of: and residual value of: $760,000 $271,000 $679,000 5 years $o $446,000 d) The opening inventory of Big Ltd includes unrealised profit of: on inventory transferred from Small Ltd during the prior financial year. 30/06/2021 All of this inventory was sold by Big Ltd to parties external to the Group. e) During the current year, Big Ltd purchased inventory from Small Ltd for: This inventory had previously cost Small Ltd: Percentage of this inventory sold to outsiders by Big Ltd during the year was: $1,932,000 $772,000 50% $637,000 18% On f) Small Ltd borrowed a loan from Big Ltd amounting to: 30/06/2021 Small Ltd paid the annual interest for the intra group loan at a rate of: g) During the current year, Big Ltd paid Arina Ltd, an external party for management fees expense amouning to: $2,000 $446,000 d) The opening inventory of Big Ltd includes unrealised profit of: on inventory transferred from Small Ltd during the prior financial year. 30/06/2021 All of this inventory was sold by Big Ltd to parties external to the Group. e) During the current year, Big Ltd purchased inventory from Small Ltd for: This inventory had previously cost Small Ltd: Percentage of this inventory sold to outsiders by Big Ltd during the year was: $1,932,000 $772,000 50% f) Small Ltd borrowed a loan from Big Ltd amounting to: 30/06/2021 Small Ltd paid the annual interest for the intra group loan at a rate of: $637,000 18% On g) During the current year, Big Ltd paid Arina Ltd, an external party for management fees expense amouning to: $2,000 h) The following are dividends paid and declared by Small Ltd to Big Ltd: Interim dividend paid Final dividend declared 159,300 212,400 i) The tax rate is: 30%