Question

An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio

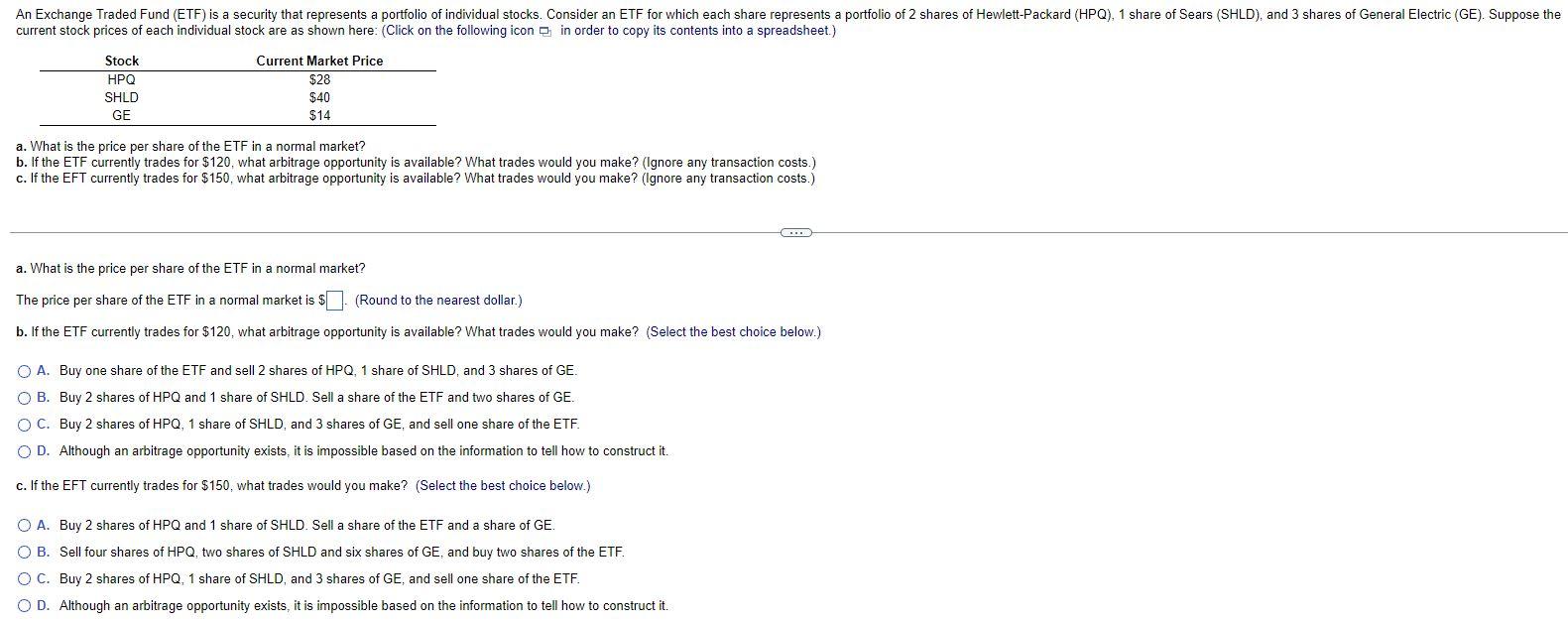

An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of 2 shares of Hewlett-Packard (HPQ), 1 share of Sears (SHLD), and 3 shares of General Electric (GE). Suppose the current stock prices of each individual stock are as shown here:

| Stock | Current Market Price |

| HPQ | $28 |

| SHLD | $40 |

| GE | $14 |

a. What is the price per share of the ETF in a normal market?

b. If the ETF currently trades for $120, what arbitrage opportunity is available? What trades would you make? (Ignore any transaction costs.)

c. If the EFT currently trades for $150, what arbitrage opportunity is available? What trades would you make? (Ignore any transaction costs.)

current stock prices of each individual stock are as shown here: (Click on the following icon in order to copy its contents into a spreadsheet.) a. What is the price per share of the ETF in a normal market? b. If the ETF currently trades for $120, what arbitrage opportunity is available? What trades would you make? (Ignore any transaction costs.) c. If the EFT currently trades for $150, what arbitrage opportunity is available? What trades would you make? (Ignore any transaction costs.) a. What is the price per share of the ETF in a normal market? The price per share of the ETF in a normal market is : (Round to the nearest dollar.) b. If the ETF currently trades for $120, what arbitrage opportunity is available? What trades would you make? (Select the best choice below.) A. Buy one share of the ETF and sell 2 shares of HPQ, 1 share of SHLD, and 3 shares of GE. B. Buy 2 shares of HPQ and 1 share of SHLD. Sell a share of the ETF and two shares of GE. C. Buy 2 shares of HPQ, 1 share of SHLD, and 3 shares of GE, and sell one share of the ETF. D. Although an arbitrage opportunity exists, it is impossible based on the information to tell how to construct it. c. If the EFT currently trades for $150, what trades would you make? (Select the best choice below.) A. Buy 2 shares of HPQ and 1 share of SHLD. Sell a share of the ETF and a share of GE. B. Sell four shares of HPQ, two shares of SHLD and six shares of GE, and buy two shares of the ETF. C. Buy 2 shares of HPQ, 1 share of SHLD, and 3 shares of GE, and sell one share of the ETF. D. Although an arbitrage opportunity exists, it is impossible based on the information to tell how to construct it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started