Answered step by step

Verified Expert Solution

Question

1 Approved Answer

an executive summary of the case background and issues involved. what are the main financial decisions involved? data and analysis as a financial manager

an executive summary of the case• background and issues involved. what are the main financial decisions involved? • data and analysis as a financial manager would present before the board. this should be supported by appropriate calculations, presentation of results in an easy to understand format using tables and charts whenever necessary. • response to any specific questions raised in the body of the case • conclusion and your recommendations.

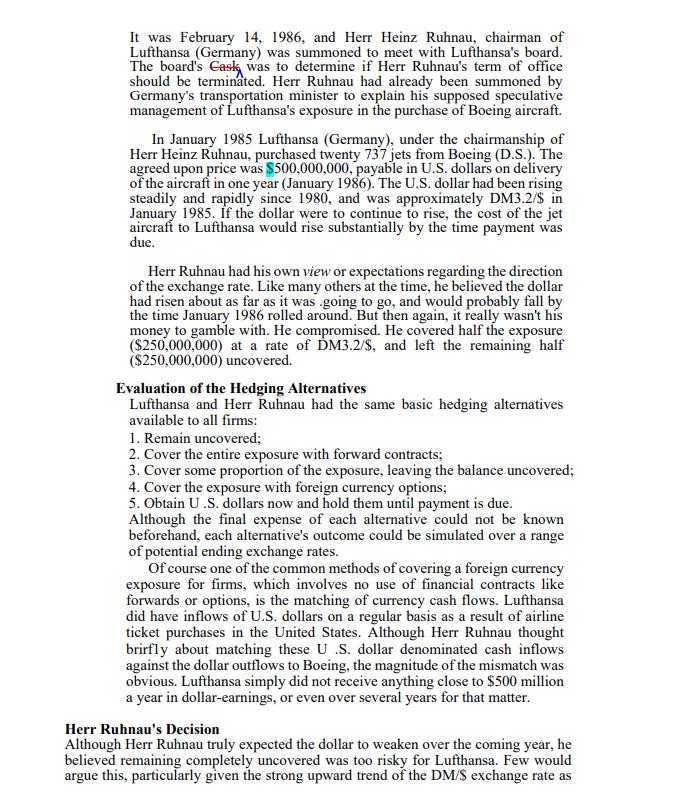

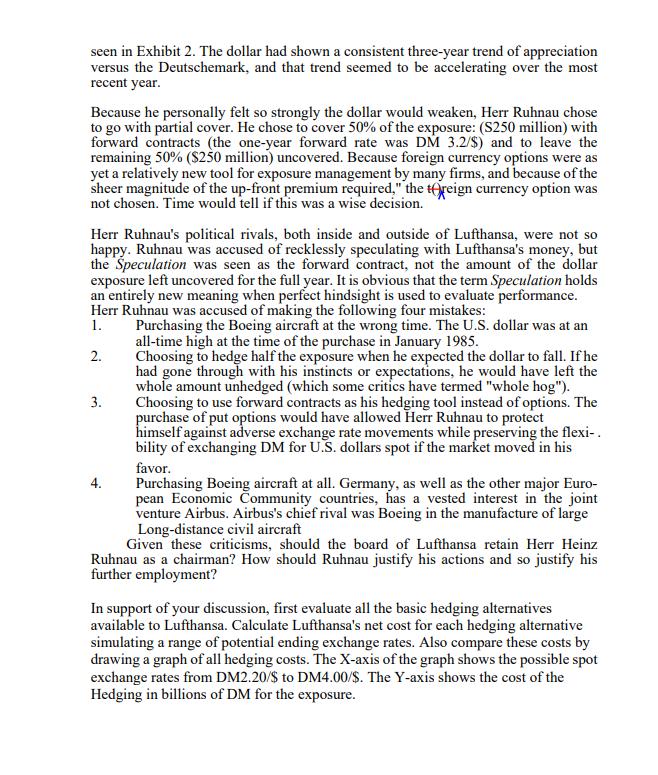

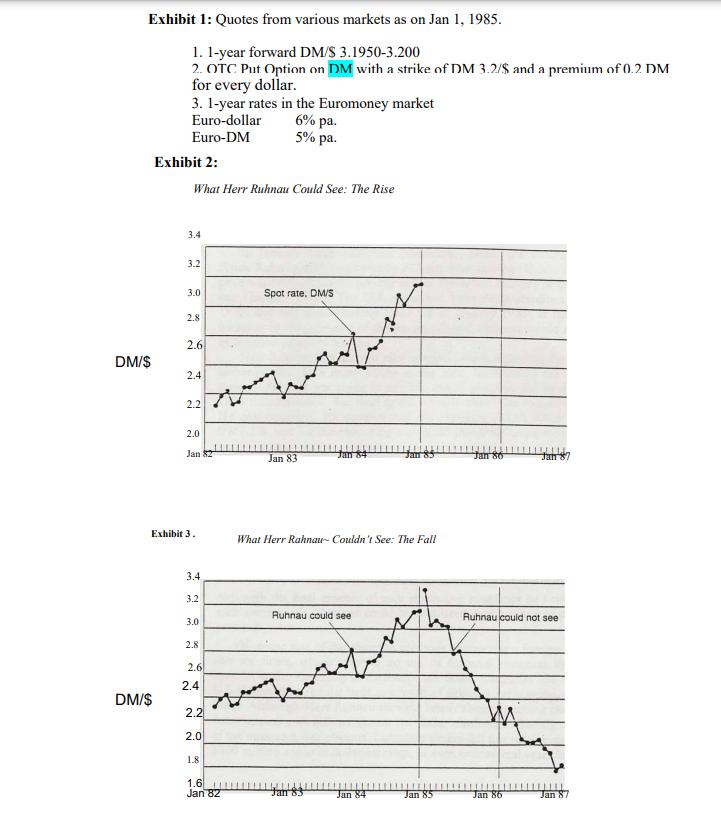

It was February 14, 1986, and Herr Heinz Ruhnau, chairman of Lufthansa (Germany) was summoned to meet with Lufthansa's board. The board's Cask was to determine if Herr Ruhnau's term of office should be terminated. Herr Ruhnau had already been summoned by Germany's transportation minister to explain his supposed speculative management of Lufthansa's exposure in the purchase of Boeing aircraft. In January 1985 Lufthansa (Germany), under the chairmanship of Herr Heinz Ruhnau, purchased twenty 737 jets from Boeing (D.S.). The agreed upon price was $500,000,000, payable in U.S. dollars on delivery of the aircraft in one year (January 1986). The U.S. dollar had been rising steadily and rapidly since 1980, and was approximately DM3.2/$ in January 1985. If the dollar were to continue to rise, the cost of the jet aircraft to Lufthansa would rise substantially by the time payment was due. Herr Ruhnau had his own view or expectations regarding the direction of the exchange rate. Like many others at the time, he believed the dollar had risen about as far as it was going to go, and would probably fall by the time January 1986 rolled around. But then again, it really wasn't his money to gamble with. He compromised. He covered half the exposure ($250,000,000) at a rate of DM3.2/$, and left the remaining half ($250,000,000) uncovered. Evaluation of the Hedging Alternatives Lufthansa and Herr Ruhnau had the same basic hedging alternatives available to all firms: 1. Remain uncovered; 2. Cover the entire exposure with forward contracts; 3. Cover some proportion of the exposure, leaving the balance uncovered; 4. Cover the exposure with foreign currency options; 5. Obtain U.S. dollars now and hold them until payment is due. Although the final expense of each alternative could not be known beforehand, each alternative's outcome could be simulated over a range of potential ending exchange rates. Of course one of the common methods of covering a foreign currency exposure for firms, which involves no use of financial contracts like forwards or options, is the matching of currency cash flows. Lufthansa did have inflows of U.S. dollars on a regular basis as a result of airline ticket purchases in the United States. Although Herr Ruhnau thought brirfly about matching these U.S. dollar denominated cash inflows against the dollar outflows to Boeing, the magnitude of the mismatch was obvious. Lufthansa simply did not receive anything close to $500 million a year in dollar-earnings, or even over several years for that matter. Herr Ruhnau's Decision Although Herr Ruhnau truly expected the dollar to weaken over the coming year, he believed remaining completely uncovered was too risky for Lufthansa. Few would argue this, particularly given the strong upward trend of the DM/S exchange rate as

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 The case The case is about the financial decision of the board of directors of the company The main financial decision involved is whether the company should buy a new factory or not The data and an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started