Answered step by step

Verified Expert Solution

Question

1 Approved Answer

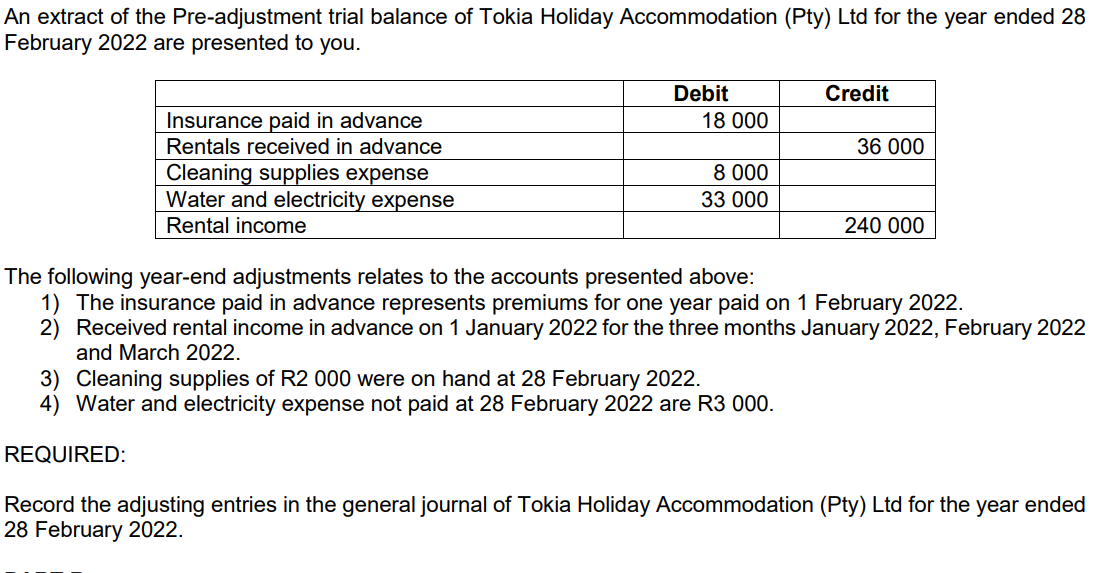

An extract of the Pre-adjustment trial balance of Tokia Holiday Accommodation (Pty) Ltd for the year ended 28 February 2022 are presented to you.

An extract of the Pre-adjustment trial balance of Tokia Holiday Accommodation (Pty) Ltd for the year ended 28 February 2022 are presented to you. Debit Credit Insurance paid in advance 18 000 Rentals received in advance 36 000 Cleaning supplies expense Water and electricity expense Rental income 8 000 33 000 240 000 The following year-end adjustments relates to the accounts presented above: 1) The insurance paid in advance represents premiums for one year paid on 1 February 2022. 2) Received rental income in advance on 1 January 2022 for the three months January 2022, February 2022 and March 2022. 3) Cleaning supplies of R2 000 were on hand at 28 February 2022. 4) Water and electricity expense not paid at 28 February 2022 are R3 000. REQUIRED: Record the adjusting entries in the general journal of Tokia Holiday Accommodation (Pty) Ltd for the year ended 28 February 2022.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Tokia Holiday Accommodation Pty Ltd Working for Adjustment 1 Amount R Note Prepaid I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started