Answered step by step

Verified Expert Solution

Question

1 Approved Answer

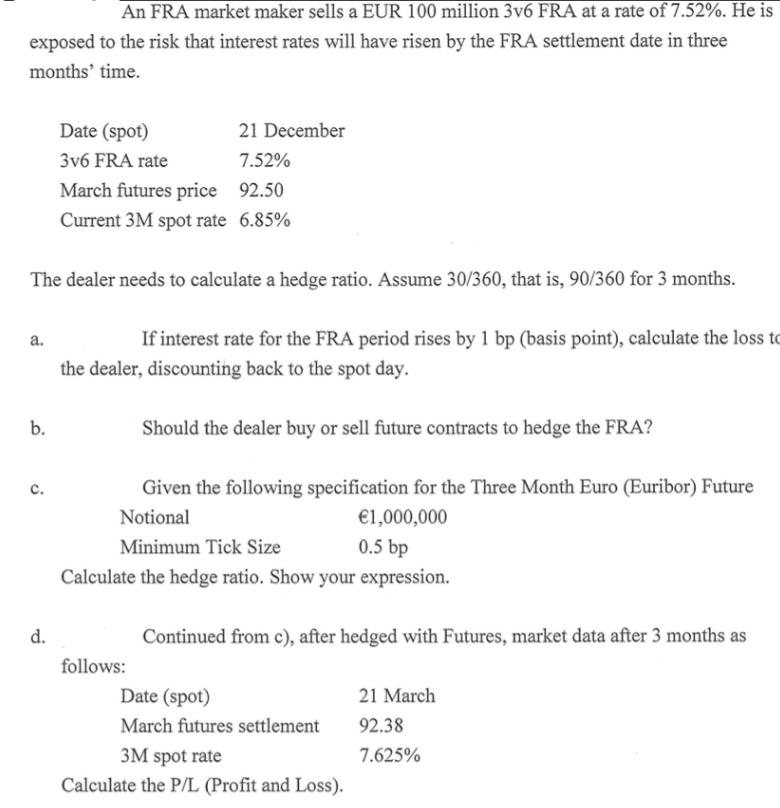

An FRA market maker sells a EUR 100 million 3v6 FRA at a rate of 7.52%. He is exposed to the risk that interest

An FRA market maker sells a EUR 100 million 3v6 FRA at a rate of 7.52%. He is exposed to the risk that interest rates will have risen by the FRA settlement date in three months' time. a. b. The dealer needs to calculate a hedge ratio. Assume 30/360, that is, 90/360 for 3 months. C. Date (spot) 3v6 FRA rate d. March futures price Current 3M spot rate 21 December 7.52% 92.50 6.85% If interest rate for the FRA period rises by 1 bp (basis point), calculate the loss to the dealer, discounting back to the spot day. Should the dealer buy or sell future contracts to hedge the FRA? Given the following specification for the Three Month Euro (Euribor) Future Notional 1,000,000 Minimum Tick Size 0.5 bp Calculate the hedge ratio. Show your expression. follows: Continued from c), after hedged with Futures, market data after 3 months as Date (spot) March futures settlement 3M spot rate Calculate the P/L (Profit and Loss). 21 March 92.38 7.625%

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The loss to the dealer would be calculated as follows Loss 753 685 x 100000000 x 90360 200555556 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started