Question

An important part of every audit is examining vendors invoices processed after year end. Related to cutoff, as discussed in Module VI, this set of

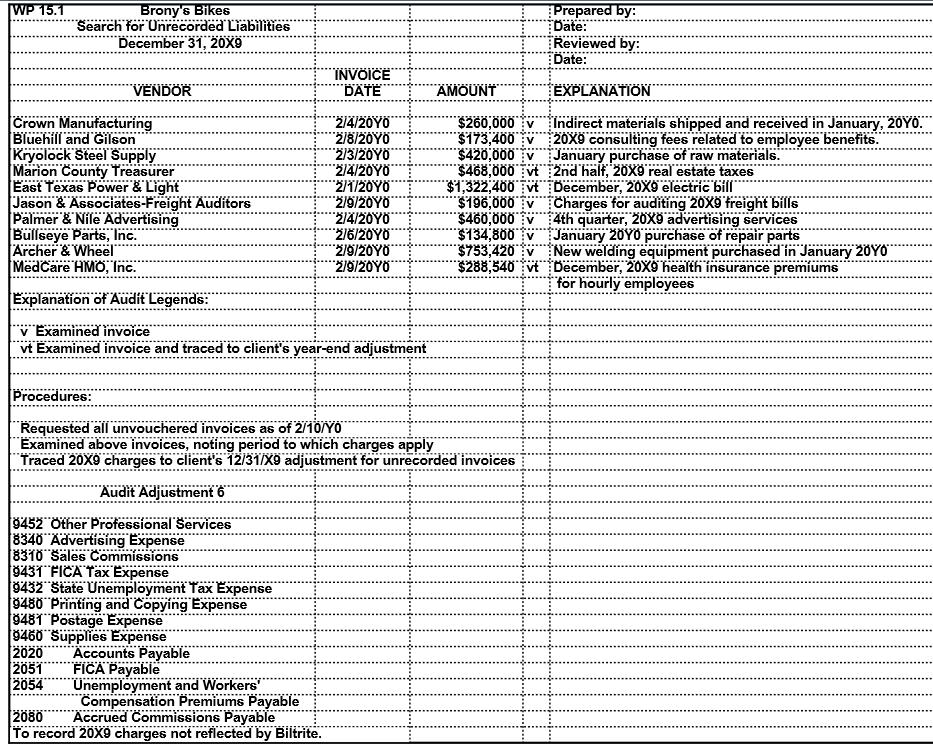

An important part of every audit is examining vendors’ invoices processed after year end. Related to cutoff, as discussed in Module VI, this set of procedures has the purpose of determining that no significant invoices pertaining to the year being audited have been omitted from recorded liabilities. Derick has asked that you examine the document prepared by Cheryl Lucas and entitled “Search for Unrecorded Liabilities,” and review it for necessary audit adjustments.

Requirements:

1. Retrieve the file labeled “20X9 Liab.” (LINK) Comment on the adequacy of the procedures performed by Lucas.

2. Assuming that you found the following additional unrecorded charges pertaining to 20X9, draft Audit

Adjustment 6 at the bottom of WP 15.1:

a. Sales commissions $366,900

b. Employer’s payroll taxes: FICA $94,000, state unemployment $126,000

c. Printing and copying $27,800

d. Postage $22,300

e. Office supplies $18,6002

3. Print or Save the document.

WP 15.1 Brony's Bikes Search for Unrecorded Liabilities December 31, 20X9 VENDOR Crown Manufacturing Bluehill and Gilson Kryolock Steel Supply Marion County Treasurer East Texas Power & Light Jason & Associates-Freight Auditors Palmer & Nile Advertising Bullseye Parts, Inc. Archer & Wheel MedCare HMO, Inc. Explanation of Audit Legends: v Examined invoice vt Examined invoice and traced to client's year-end adjustment 9452 Other Professional Services 8340 Advertising Expense 8310 Sales Commissions 2051 2054 9431 FICA Tax Expense 9432 State Unemployment Tax Expense 9480 Printing and Copying Expense 9481 Postage Expense 9460 Supplies Expense 2020 INVOICE DATE Accounts Payable FICA Payable Unemployment and Workers Compensation Premiums Payable 2080 Accrued Commissions Payable To record 20X9 charges not reflected by Biltrite. 2/4/20Y0 2/8/20Y0 2/3/20Y0 2/4/20Y0 2/1/20Y0 2/9/20Y0 2/4/20Y0 2/6/20Y0 2/9/20Y0 2/9/20Y0 AMOUNT Procedures: Requested all unvouchered invoices as of 2/10/YO Examined above invoices, noting period to which charges apply Traced 20X9 charges to client's 12/31/X9 adjustment for unrecorded invoices Audit Adjustment 6 $260,000 v $173,400 v $420,000 v $468,000 vt $1,322,400 vt $196,000 v $460,000 v $134,800 v $753,420 $288,540 vt Prepared by: Date: Reviewed by: Date: EXPLANATION Indirect materials shipped and received in January, 20Y0. 20X9 consulting fees related to employee benefits. January purchase of raw materials. 2nd half, 20X9 real estate taxes December, 20X9 electric bill Charges for auditing 20X9 freight bills 4th quarter, 20X9 advertising services January 20Y0 purchase of repair parts New welding equipment purchased in January 20Y0 December, 20X9 health insurance premiums for hourly employees

Step by Step Solution

3.42 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started