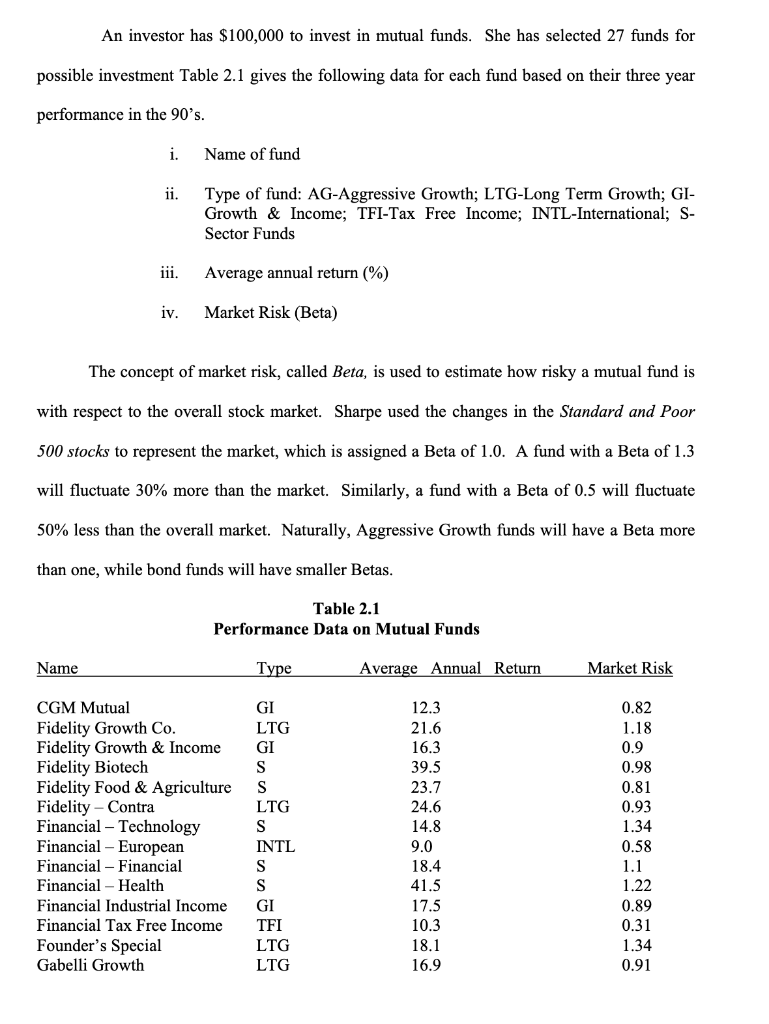

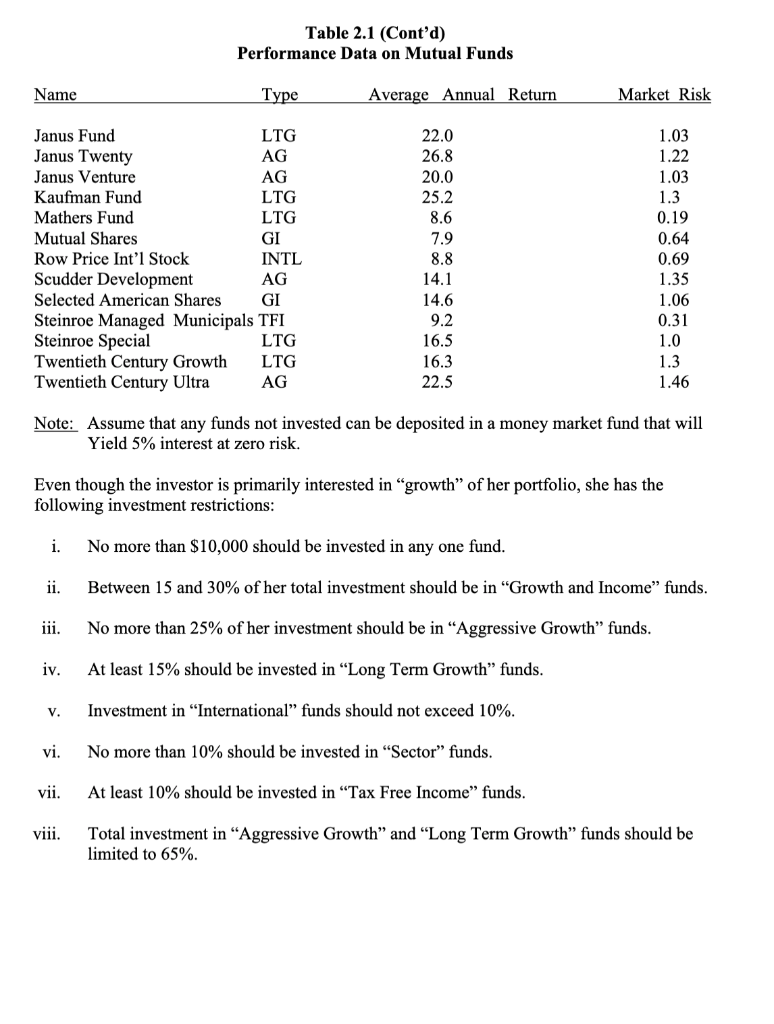

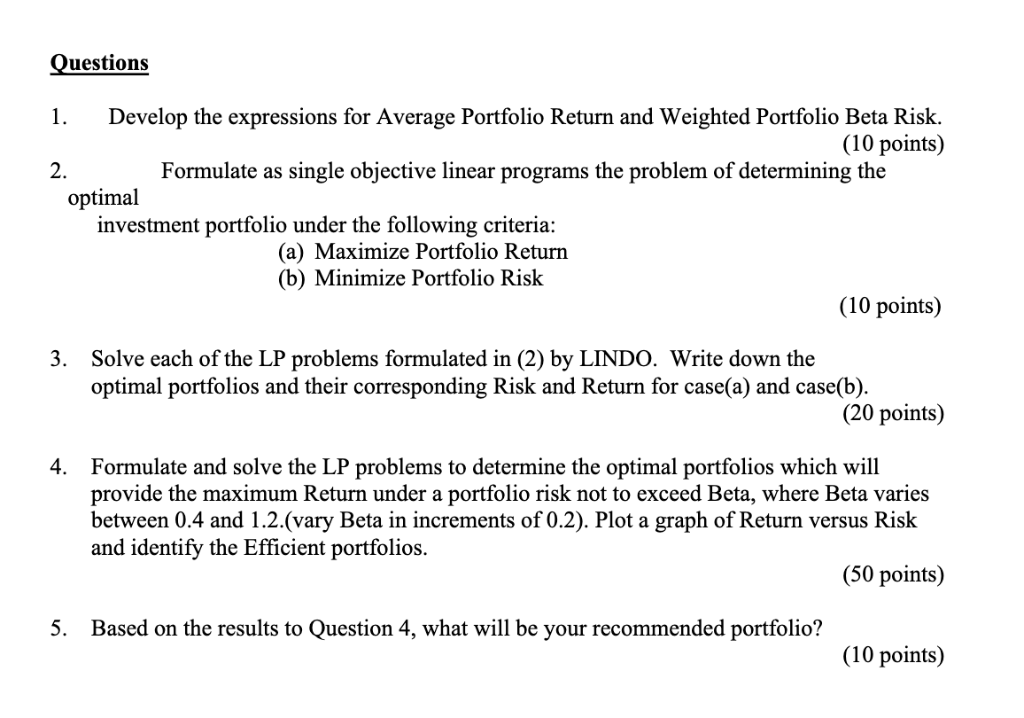

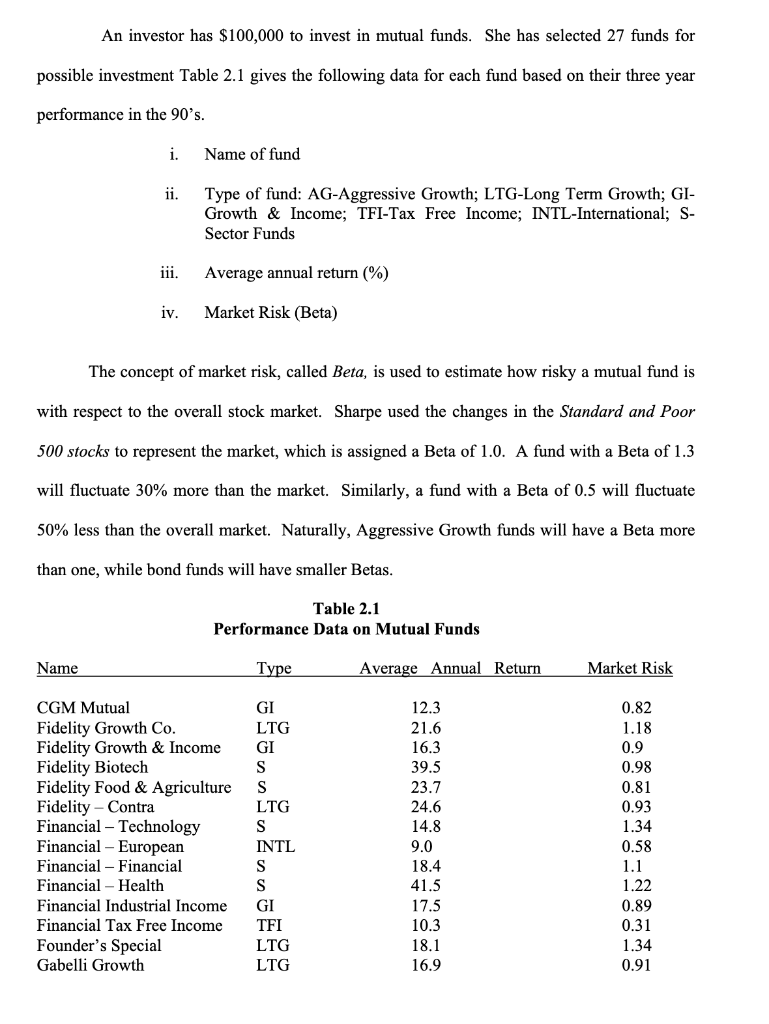

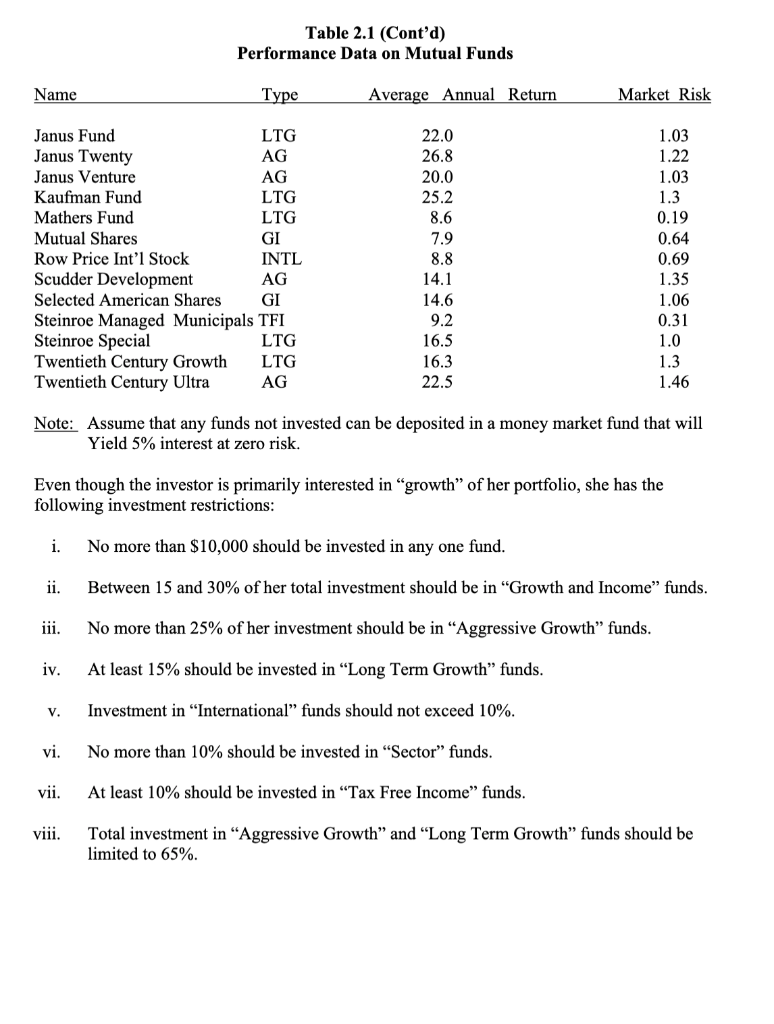

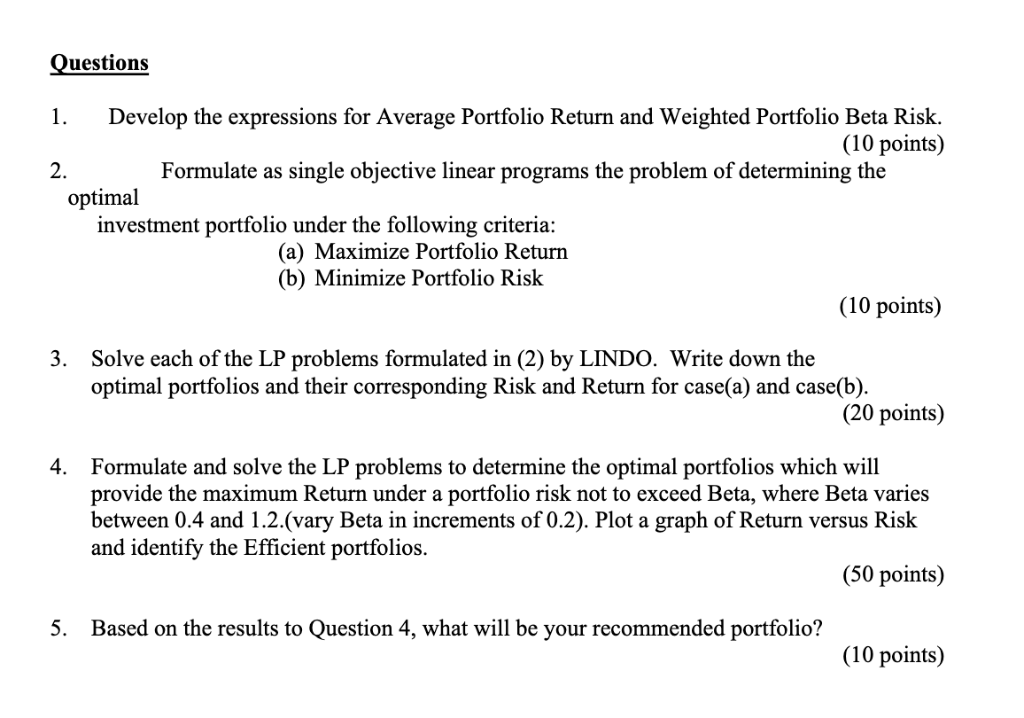

An important problem faced by financial analysts in investment companies (banks, mutual funds, insurance companies) and individual investors is the determination of optimal investment portfolios. A portfolio specifies the amount invested in different securities which may include bonds, common stocks, bank CD's, treasury notes, and others. Much of the earlier investment decisions were made by seat-of-the-pant approaches. Markowitz (1,2), in the 50's, pioneered the development of the modern portfolio theory, which uses mathematical programming models to analyze the portfolio selection problem. By quantifying the trade-offs between risks and returns, he showed how an investor can diversify portfolios such that the portfolio risk can be reduced without sacrificing returns. Based on Markowitz's work, Sharp (3) introduced the concept of market risk, and developed a linear programming model for portfolio analysis. For their pioneering work in modern portfolio theory, both Markowitz and Sharpe shared the 1990 Nobel Prize in Economics. In this case study, we shall illustrate their work through a mutual fund selection problem. An investor has $100,000 to invest in mutual funds. She has selected 27 funds for possible investment Table 2.1 gives the following data for each fund based on their three year performance in the 90's i.Name of fund ii. Type of fund: AG-Aggressive Growth; LTG-Long Term Growth; GI Growth & Income; TFI-Tax Free Income; INTL-International; S- Sector Funds Average annual return (%) Market Risk (Beta) 111. iv. The concept of market risk, called Beta, is used to estimate how risky a mutual fund is with respect to the overall stock market. Sharpe used the changes in the Standard and Poor 500 stocks to represent the market, which is assigned a Beta of 1.0. A fund with a Beta of 1.3 will fluctuate 30% more than the market. Similarly, a fund with a Beta of 0.5 will fluctuate 50% less than the overall market. Naturally, Aggressive Growth funds will have a Beta more than one, while bond funds will have smaller Betas Table 2.1 Performance Data on Mutual Funds Name Average Annual Return Market Risk CGM Mutual Fidelity Growth Co Fidelity Growth & Income GI Fidelity Biotech Fidelity Food & AgricultureS Fidelity- Contra Financial - Technology Financial -European Financial - Financial Financial- Health Financial Industrial Income GI Financial Tax Free Income TFI Founder's Special Gabelli Growth 12.3 21.6 16.3 39.5 23.7 24.6 14.8 9.0 18.4 41.5 17.5 10.3 18.1 16.9 0.82 1.18 0.9 0.98 0.81 0.93 1.34 0.58 GI LTG LTG INTL 1.22 0.89 0.31 1.34 0.91 LTG LTG Table 2.1 (Cont'd) Performance Data on Mutual Funds Name Average Annual Return Market Risk Janus Fund Janus Twenty Janus Venture Kaufman Fund Mathers Fund Mutual Shares Row Price Int'l Stock Scudder Development Selected American SharesGI Steinroe Managed Municipals TFI Steinroe Special Twentieth Century GrowthLTG Twentieth Century Ultra LTG AG AG LTG LTG GI INTL AG 22.0 26.8 20.0 25.2 8.6 7.9 8.8 14.1 14.6 9.2 16.5 16.3 22.5 1.03 1.22 1.03 0.19 0.64 0.69 1.35 1.06 0.31 LTG AG 1.46 Note: Assume that any funds not invested can be deposited in a money market fund that will Yield 5% interest at zero risk. Even though the investor is primarily interested in "growth" of her portfolio, she has the following investment restrictions: i. No more than S10,000 should be invested in any one fund Between 15 and 30% of her total investment should be in "Growth and income" funds No more than 25% of her investment should be in "Aggressive Growth" funds At least 15% should be invested in "Long Term Growth" funds Investment in "International funds should not exceed 10% No more than 10% should be invested in "Sector" finds At least 10% should be invested in "Tax Free Income" funds Total investment in "Aggressive Growth" and "Long Term Growth" funds should be iv. vi. vii. viii. limited to 65% Questions 1 Develop the expressions for Average Portfolio Return and Weighted Portfolio Beta Risk. 2. 10 points) Formulate as single objective linear programs the problem of determining the optimal investment portfolio under the following criteria: (a) Maximize Portfolio Return (b) Minimize Portfolio Risk (10 points) 3. Solve each of the LP problems formulated in (2) by LINDO. Write down the optimal portfolios and their corresponding Risk and Return for case(a) and case(b). (20 points) Formulate and solve the LP problems to determine the optimal portfolios which will provide the maximum Return under a portfolio risk not to exceed Beta, where Beta varies between 0.4 and 1.2.(vary Beta in increments of 0.2). Plot a graph of Return versus Risk and identify the Efficient portfolios. 4. 50 points) 5. Based on the results to Question 4, what will be your recommended portfolio? (10 points) An important problem faced by financial analysts in investment companies (banks, mutual funds, insurance companies) and individual investors is the determination of optimal investment portfolios. A portfolio specifies the amount invested in different securities which may include bonds, common stocks, bank CD's, treasury notes, and others. Much of the earlier investment decisions were made by seat-of-the-pant approaches. Markowitz (1,2), in the 50's, pioneered the development of the modern portfolio theory, which uses mathematical programming models to analyze the portfolio selection problem. By quantifying the trade-offs between risks and returns, he showed how an investor can diversify portfolios such that the portfolio risk can be reduced without sacrificing returns. Based on Markowitz's work, Sharp (3) introduced the concept of market risk, and developed a linear programming model for portfolio analysis. For their pioneering work in modern portfolio theory, both Markowitz and Sharpe shared the 1990 Nobel Prize in Economics. In this case study, we shall illustrate their work through a mutual fund selection problem. An investor has $100,000 to invest in mutual funds. She has selected 27 funds for possible investment Table 2.1 gives the following data for each fund based on their three year performance in the 90's i.Name of fund ii. Type of fund: AG-Aggressive Growth; LTG-Long Term Growth; GI Growth & Income; TFI-Tax Free Income; INTL-International; S- Sector Funds Average annual return (%) Market Risk (Beta) 111. iv. The concept of market risk, called Beta, is used to estimate how risky a mutual fund is with respect to the overall stock market. Sharpe used the changes in the Standard and Poor 500 stocks to represent the market, which is assigned a Beta of 1.0. A fund with a Beta of 1.3 will fluctuate 30% more than the market. Similarly, a fund with a Beta of 0.5 will fluctuate 50% less than the overall market. Naturally, Aggressive Growth funds will have a Beta more than one, while bond funds will have smaller Betas Table 2.1 Performance Data on Mutual Funds Name Average Annual Return Market Risk CGM Mutual Fidelity Growth Co Fidelity Growth & Income GI Fidelity Biotech Fidelity Food & AgricultureS Fidelity- Contra Financial - Technology Financial -European Financial - Financial Financial- Health Financial Industrial Income GI Financial Tax Free Income TFI Founder's Special Gabelli Growth 12.3 21.6 16.3 39.5 23.7 24.6 14.8 9.0 18.4 41.5 17.5 10.3 18.1 16.9 0.82 1.18 0.9 0.98 0.81 0.93 1.34 0.58 GI LTG LTG INTL 1.22 0.89 0.31 1.34 0.91 LTG LTG Table 2.1 (Cont'd) Performance Data on Mutual Funds Name Average Annual Return Market Risk Janus Fund Janus Twenty Janus Venture Kaufman Fund Mathers Fund Mutual Shares Row Price Int'l Stock Scudder Development Selected American SharesGI Steinroe Managed Municipals TFI Steinroe Special Twentieth Century GrowthLTG Twentieth Century Ultra LTG AG AG LTG LTG GI INTL AG 22.0 26.8 20.0 25.2 8.6 7.9 8.8 14.1 14.6 9.2 16.5 16.3 22.5 1.03 1.22 1.03 0.19 0.64 0.69 1.35 1.06 0.31 LTG AG 1.46 Note: Assume that any funds not invested can be deposited in a money market fund that will Yield 5% interest at zero risk. Even though the investor is primarily interested in "growth" of her portfolio, she has the following investment restrictions: i. No more than S10,000 should be invested in any one fund Between 15 and 30% of her total investment should be in "Growth and income" funds No more than 25% of her investment should be in "Aggressive Growth" funds At least 15% should be invested in "Long Term Growth" funds Investment in "International funds should not exceed 10% No more than 10% should be invested in "Sector" finds At least 10% should be invested in "Tax Free Income" funds Total investment in "Aggressive Growth" and "Long Term Growth" funds should be iv. vi. vii. viii. limited to 65% Questions 1 Develop the expressions for Average Portfolio Return and Weighted Portfolio Beta Risk. 2. 10 points) Formulate as single objective linear programs the problem of determining the optimal investment portfolio under the following criteria: (a) Maximize Portfolio Return (b) Minimize Portfolio Risk (10 points) 3. Solve each of the LP problems formulated in (2) by LINDO. Write down the optimal portfolios and their corresponding Risk and Return for case(a) and case(b). (20 points) Formulate and solve the LP problems to determine the optimal portfolios which will provide the maximum Return under a portfolio risk not to exceed Beta, where Beta varies between 0.4 and 1.2.(vary Beta in increments of 0.2). Plot a graph of Return versus Risk and identify the Efficient portfolios. 4. 50 points) 5. Based on the results to Question 4, what will be your recommended portfolio? (10 points)