Question

An important problem in real estate is determining how to price homes to be sold. There are so many factors?size, age, and style of the

An important problem in real estate is determining how to price homes to be

sold. There are so many factors?size, age, and style of the home; number of

bedrooms and bathrooms; size of the lot; and so on?which makes setting a price

a challenging task. In this project, we will investigate the relationships among

typical characteristics of homes and home prices, identify key variables related

to pricing, and build linear regression models to predict prices based on property

characteristics. Our analysis will be based on the Mount Pleasant Real Estate Data

(available on stat.hawkeslearning.com). This data set includes information about 245 properties for sale in

three communities in the suburban town of Mount Pleasant, South Carolina, in 2017.

1.

Download the Mount Pleasant Real Estate

Data from stat.hawkeslearning.com and open

it with Microsoft Excel.

2.

To ensure the data contains comparable

properties, eliminate duplexes and properties

whose prices are outliers. What limitations

does this impose on our analysis?

3.

The statistical tools from the current chapter

focus on numeric data, so eliminate non-

numeric variables from the data. Does this

remove potentially useful information?

4.

Are there any redundant variables we

could eliminate?

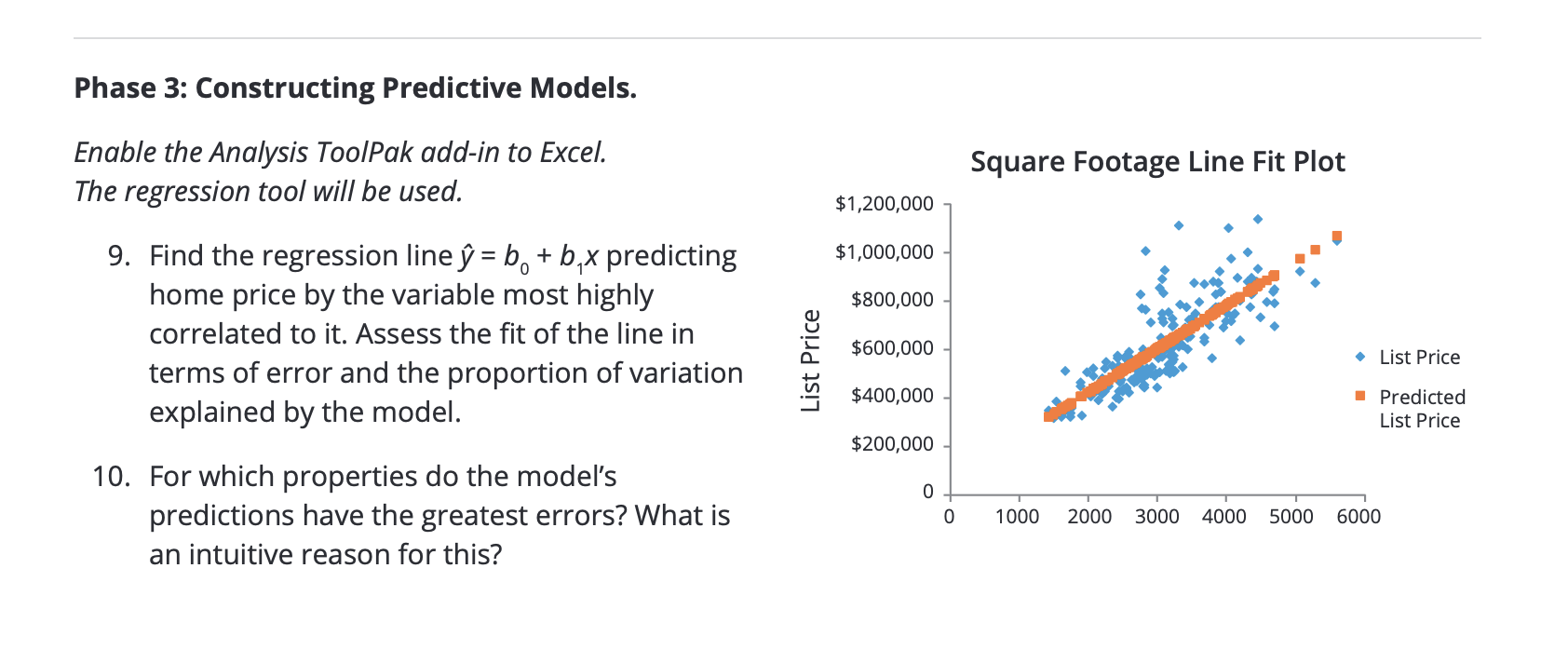

Phase 2: Discovering Relationships

5.

How strongly does each remaining variable

correlate to the price?

6.

Which variable correlates most strongly

with price?

7.

Are any variables weakly correlated with price?

Practically speaking, why do you think this

is true?

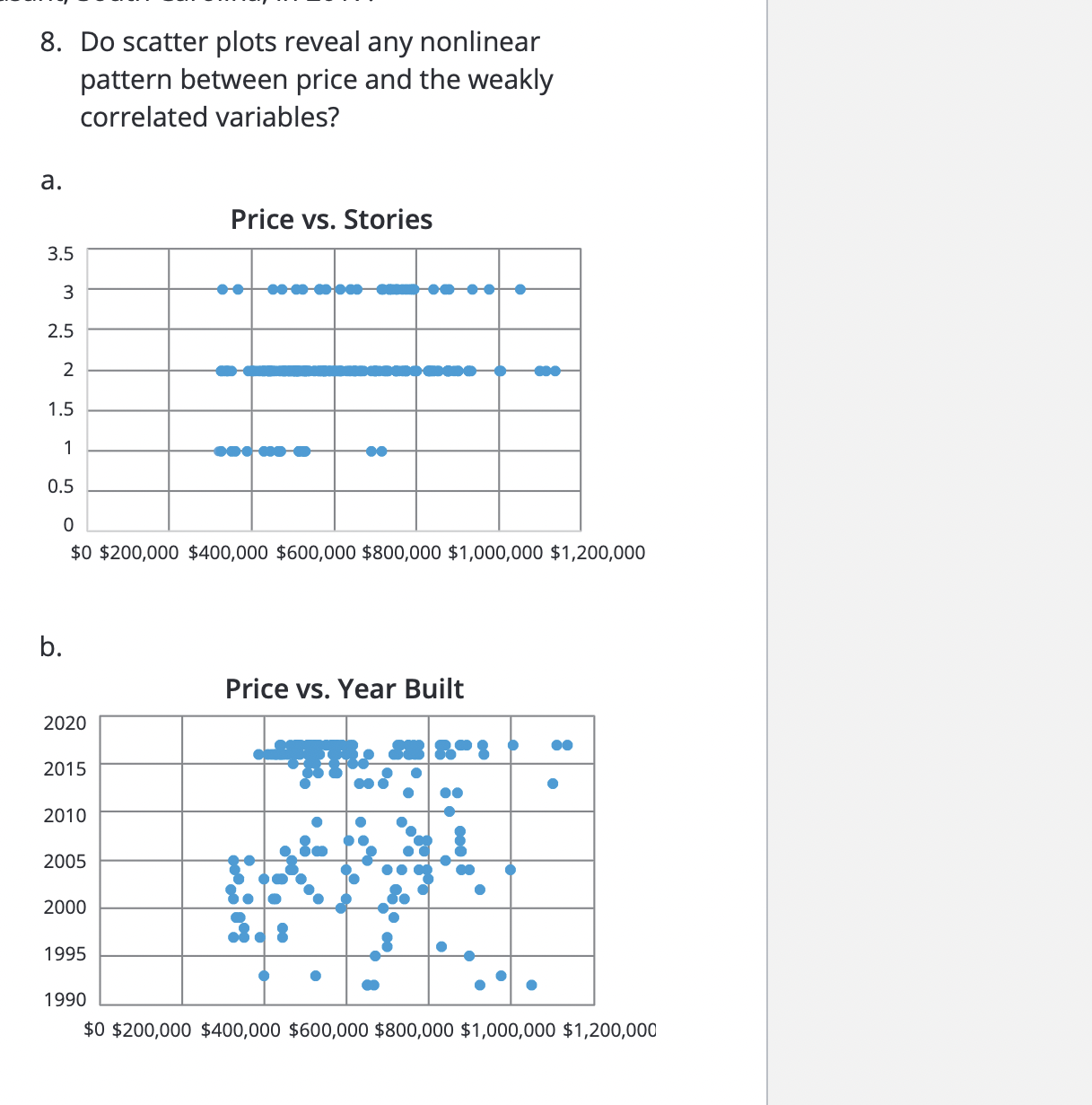

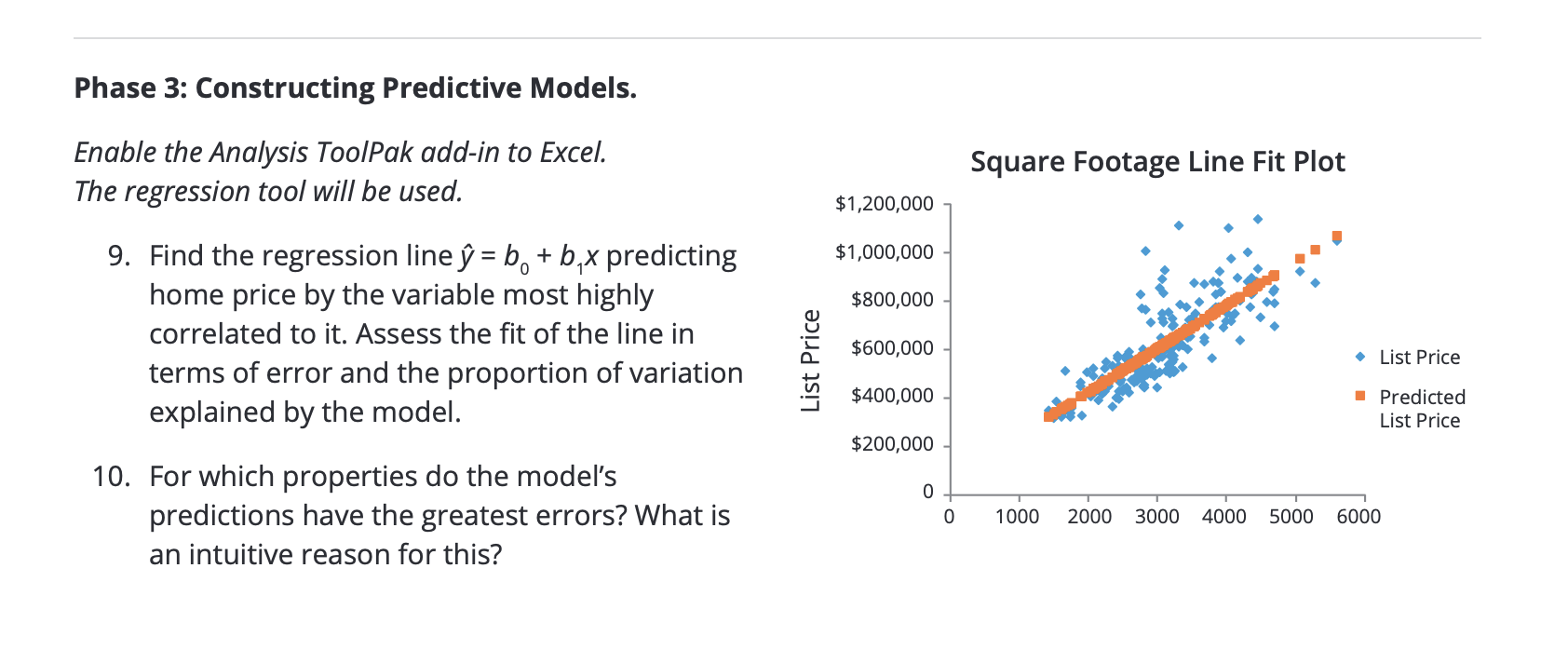

Enable the Analysis ToolPak add-in to Excel.

The regression tool will be used.

9.

Find the regression line

?

=

b

0

+

b

1

x

predicting

home price by the variable most highly

correlated to it. Assess the fit of the line in

terms of error and the proportion of variation

explained by the model.

10.

For which properties do the model's

predictions have the greatest errors? What is

an intuitive reason for this?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started