An income statement follows this general format:

| Revenue | $1000 |

| Cost of Goods Sold | $300 |

| Gross Profit | $700 |

| Operating Expenses | $400 |

| Operating Income | $300 |

| Interest Expense | $25 |

| Income Tax Expense | $83 |

| Net Income | $193 |

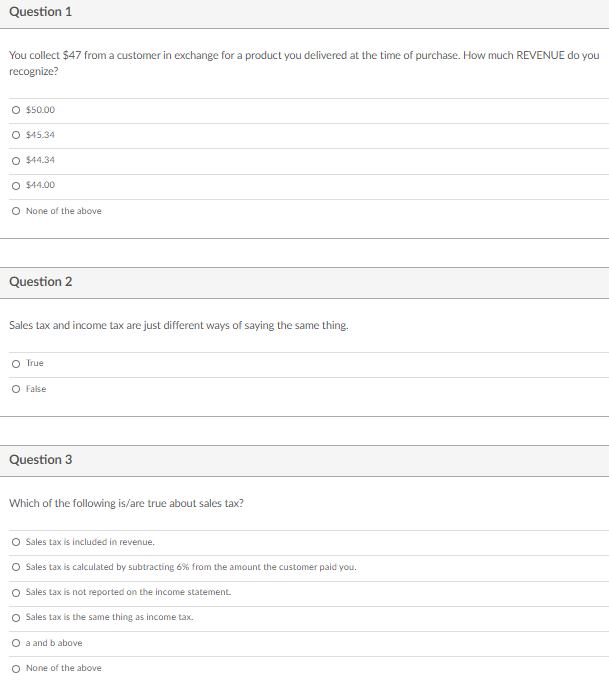

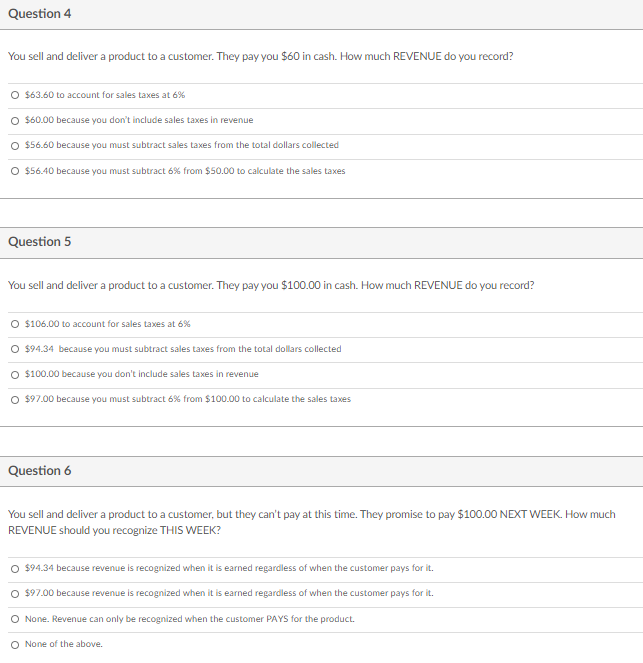

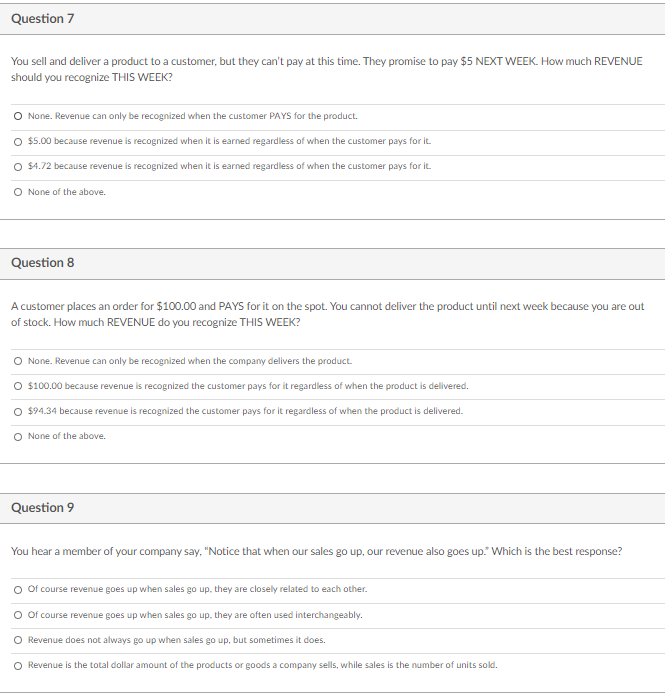

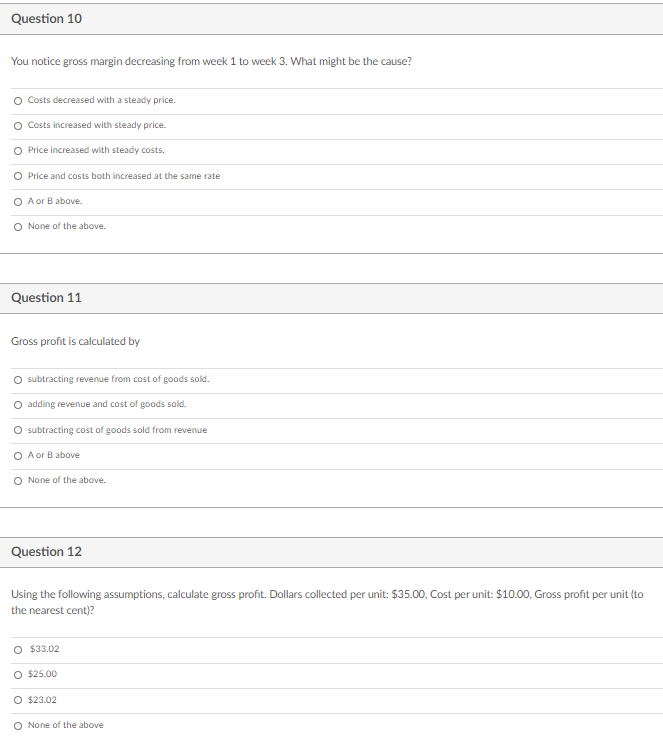

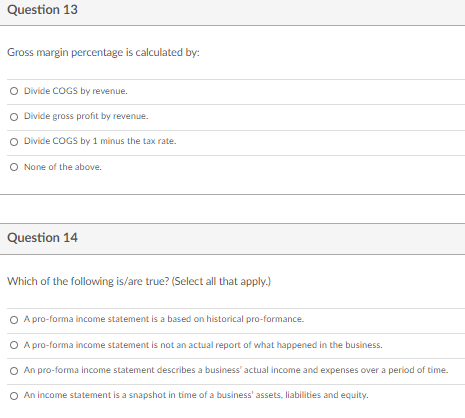

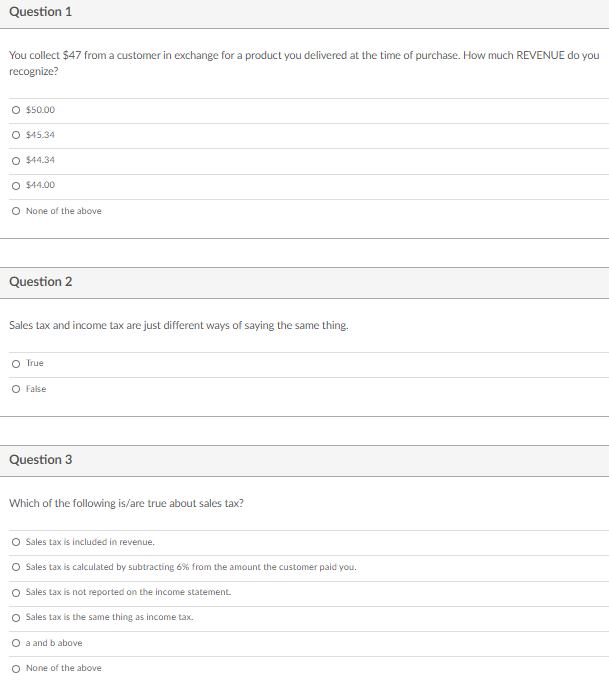

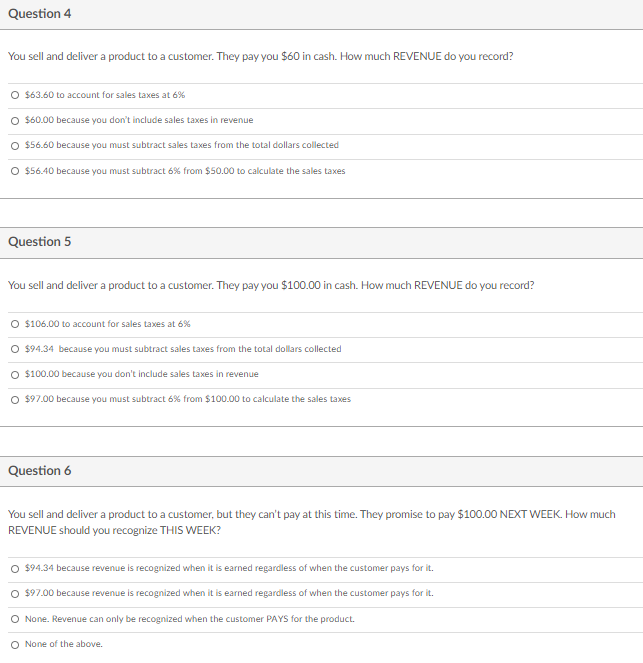

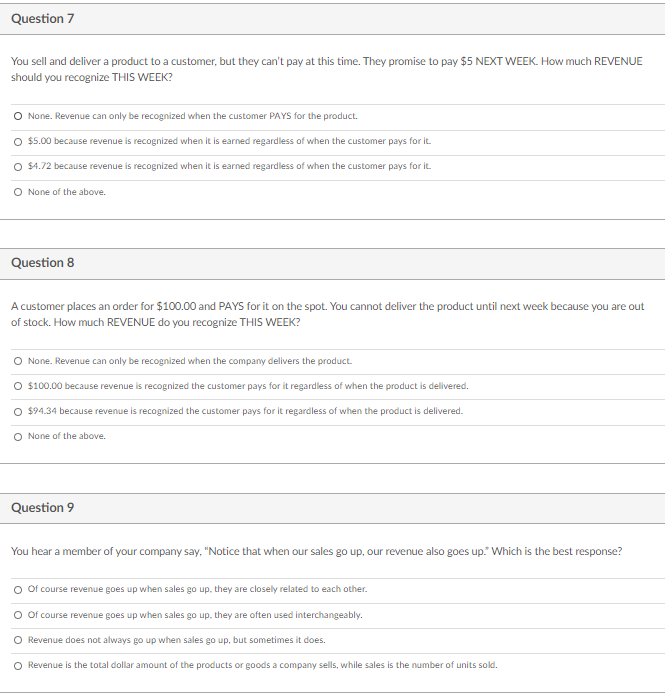

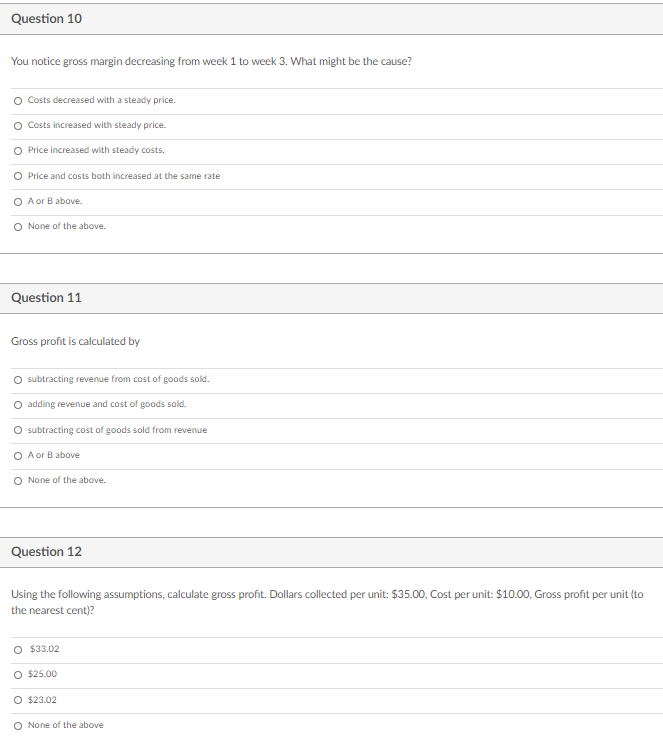

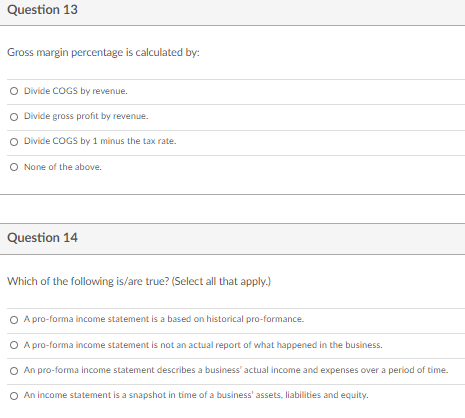

Question 1 You collect $47 from a customer in exchange for a product you delivered at the time of purchase. How much REVENUE do you recognize? O $50.00 O $45.34 O $44.34 O $44.00 O None of the above Question 2 Sales tax and income tax are just different ways of saying the same thing. True O False Question 3 Which of the following is/are true about sales tax? Sales tax is included in revenue. Sales tax is calculated by subtracting 6% from the amount the customer paid you. Sales tax is not reported on the income statement. Sales tax is the same thing as income tax. O a and b above O None of the above Question 4 You sell and deliver a product to a customer. They pay you $60 in cash. How much REVENUE do you record? O $63.60 to account for sales taxes at 6% O $60.00 because you don't include sales taxes in revenue $56.60 because you must subtract sales taxes from the total dollars collected O $56.40 because you must subtract 6% from $50.00 to calculate the sales taxes Question 5 You sell and deliver a product to a customer. They pay you $100.00 in cash. How much REVENUE do you record? O $106.00 to account for sales taxes at 6% O $94.34 because you must subtract sales taxes from the total dollars collected O $100.00 because you don't include sales taxes in revenue $97.00 because you must subtract 6% from $100.00 to calculate the sales taxes Question 6 You sell and deliver a product to a customer, but they can't pay at this time. They promise to pay $100.00 NEXT WEEK. How much REVENUE should you recognize THIS WEEK? $94.34 because revenue is recognized when it is earned regardless of when the customer pays for it. $97.00 because revenue is recognized when it is earned regardless of when the customer pays for it. None. Revenue can only be recognized when the customer PAYS for the product. None of the above. Question 7 You sell and deliver a product to a customer, but they can't pay at this time. They promise to pay $5 NEXT WEEK. How much REVENUE should you recognize THIS WEEK? None. Revenue can only be recognized when the customer PAYS for the product. $5.00 because revenue is recognized when it is earned regardless of when the customer pays for it O $4.72 because revenue is recognized when it is earned regardless of when the customer pays for it O None of the above. Question 8 A customer places an order for $100.00 and PAYS for it on the spot. You cannot deliver the product until next week because you are out of stock. How much REVENUE do you recognize THIS WEEK? None. Revenue can only be recognized when the company delivers the product O $100.00 because revenue is recognized the customer pays for it regardless of when the product is delivered. $94.34 because revenue is recognized the customer pays for it regardless of when the product is delivered. O None of the above. Question 9 You hear a member of your company say, "Notice that when our sales go up, our revenue also goes up." Which is the best response? Of course revenue goes up when sales go up, they are closely related to each other. o Of course revenue goes up when sales go up, they are often used interchangeably. Revenue does not always go up when sales go up, but sometimes it does. o O Revenue is the total dollar amount of the products or goods a company sells, while sales is the number of units sold. Question 10 You notice gross margin decreasing from week 1 to week 3. What might be the cause? Costs decreased with a steady price. o Costs increased with steady price. Price increased with steady costs. O Price and costs both increased at the same rate O A or B above. O None of the above. Question 11 Gross profit is calculated by subtracting revenue from cost of goods sold. adding revenue and cost of goods sold. subtracting cost of goods sold from revenue O A or B above O None of the above. Question 12 Using the following assumptions, calculate gross profit. Dollars collected per unit: $35.00, Cost per unit: $10.00. Gross profit per unit (to the nearest cent)? O $33.02 O $25.00 O $23.02 O None of the above Question 13 Gross margin percentage is calculated by: Divide COGS by revenue. O Divide gross profit by revenue. Divide COGS by 1 minus the tax rate. None of the above. Question 14 Which of the following is/are true? (Select all that apply.) O A pro-forma income statement is a based on historical pro-formance. O A pro-forma income statement is not an actual report of what happened in the business. An pro-forma income statement describes a business' actual income and expenses over a period of time. An income statement is a snapshot in time of a business' assets. liabilities and equity. Question 1 You collect $47 from a customer in exchange for a product you delivered at the time of purchase. How much REVENUE do you recognize? O $50.00 O $45.34 O $44.34 O $44.00 O None of the above Question 2 Sales tax and income tax are just different ways of saying the same thing. True O False Question 3 Which of the following is/are true about sales tax? Sales tax is included in revenue. Sales tax is calculated by subtracting 6% from the amount the customer paid you. Sales tax is not reported on the income statement. Sales tax is the same thing as income tax. O a and b above O None of the above Question 4 You sell and deliver a product to a customer. They pay you $60 in cash. How much REVENUE do you record? O $63.60 to account for sales taxes at 6% O $60.00 because you don't include sales taxes in revenue $56.60 because you must subtract sales taxes from the total dollars collected O $56.40 because you must subtract 6% from $50.00 to calculate the sales taxes Question 5 You sell and deliver a product to a customer. They pay you $100.00 in cash. How much REVENUE do you record? O $106.00 to account for sales taxes at 6% O $94.34 because you must subtract sales taxes from the total dollars collected O $100.00 because you don't include sales taxes in revenue $97.00 because you must subtract 6% from $100.00 to calculate the sales taxes Question 6 You sell and deliver a product to a customer, but they can't pay at this time. They promise to pay $100.00 NEXT WEEK. How much REVENUE should you recognize THIS WEEK? $94.34 because revenue is recognized when it is earned regardless of when the customer pays for it. $97.00 because revenue is recognized when it is earned regardless of when the customer pays for it. None. Revenue can only be recognized when the customer PAYS for the product. None of the above. Question 7 You sell and deliver a product to a customer, but they can't pay at this time. They promise to pay $5 NEXT WEEK. How much REVENUE should you recognize THIS WEEK? None. Revenue can only be recognized when the customer PAYS for the product. $5.00 because revenue is recognized when it is earned regardless of when the customer pays for it O $4.72 because revenue is recognized when it is earned regardless of when the customer pays for it O None of the above. Question 8 A customer places an order for $100.00 and PAYS for it on the spot. You cannot deliver the product until next week because you are out of stock. How much REVENUE do you recognize THIS WEEK? None. Revenue can only be recognized when the company delivers the product O $100.00 because revenue is recognized the customer pays for it regardless of when the product is delivered. $94.34 because revenue is recognized the customer pays for it regardless of when the product is delivered. O None of the above. Question 9 You hear a member of your company say, "Notice that when our sales go up, our revenue also goes up." Which is the best response? Of course revenue goes up when sales go up, they are closely related to each other. o Of course revenue goes up when sales go up, they are often used interchangeably. Revenue does not always go up when sales go up, but sometimes it does. o O Revenue is the total dollar amount of the products or goods a company sells, while sales is the number of units sold. Question 10 You notice gross margin decreasing from week 1 to week 3. What might be the cause? Costs decreased with a steady price. o Costs increased with steady price. Price increased with steady costs. O Price and costs both increased at the same rate O A or B above. O None of the above. Question 11 Gross profit is calculated by subtracting revenue from cost of goods sold. adding revenue and cost of goods sold. subtracting cost of goods sold from revenue O A or B above O None of the above. Question 12 Using the following assumptions, calculate gross profit. Dollars collected per unit: $35.00, Cost per unit: $10.00. Gross profit per unit (to the nearest cent)? O $33.02 O $25.00 O $23.02 O None of the above Question 13 Gross margin percentage is calculated by: Divide COGS by revenue. O Divide gross profit by revenue. Divide COGS by 1 minus the tax rate. None of the above. Question 14 Which of the following is/are true? (Select all that apply.) O A pro-forma income statement is a based on historical pro-formance. O A pro-forma income statement is not an actual report of what happened in the business. An pro-forma income statement describes a business' actual income and expenses over a period of time. An income statement is a snapshot in time of a business' assets. liabilities and equity