Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An increase in commodity prices would increase the company's sales in USD terms, all else being equal. On the other hand, the appreciation of

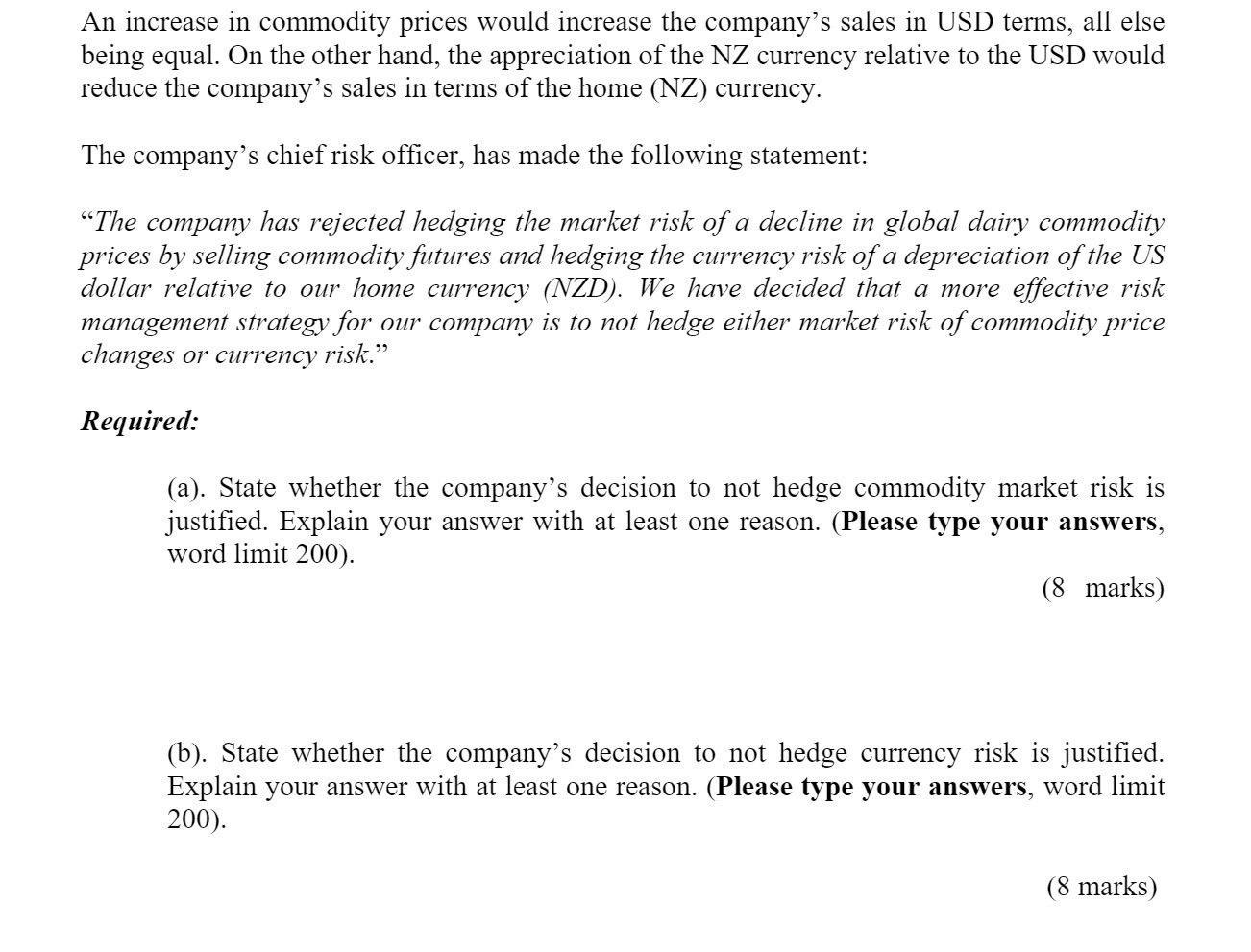

An increase in commodity prices would increase the company's sales in USD terms, all else being equal. On the other hand, the appreciation of the NZ currency relative to the USD would reduce the company's sales in terms of the home (NZ) currency. The company's chief risk officer, has made the following statement: "The company has rejected hedging the market risk of a decline in global dairy commodity prices by selling commodity futures and hedging the currency risk of a depreciation of the US dollar relative to our home currency (NZD). We have decided that a more effective risk management strategy for our company is to not hedge either market risk of commodity price changes or currency risk." Required: (a). State whether the company's decision to not hedge commodity market risk is justified. Explain your answer with at least one reason. (Please type your answers, word limit 200). (8 marks) (b). State whether the company's decision to not hedge currency risk is justified. Explain your answer with at least one reason. (Please type your answers, word limit 200). (8 marks)

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The companys decision to not hedge commodity market risk may be justified under certain circumstan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started