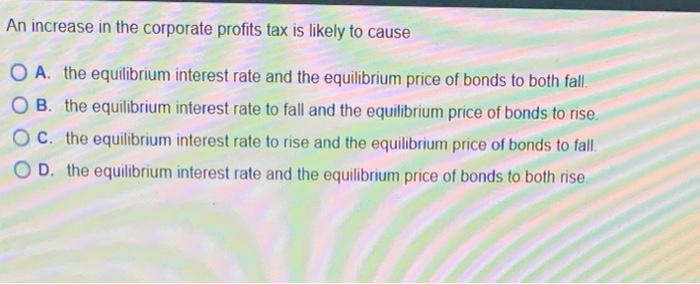

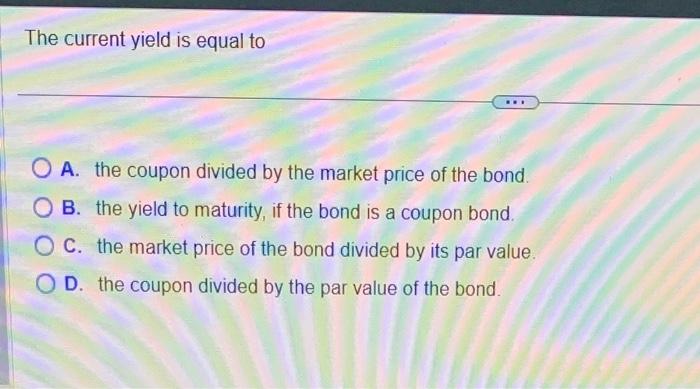

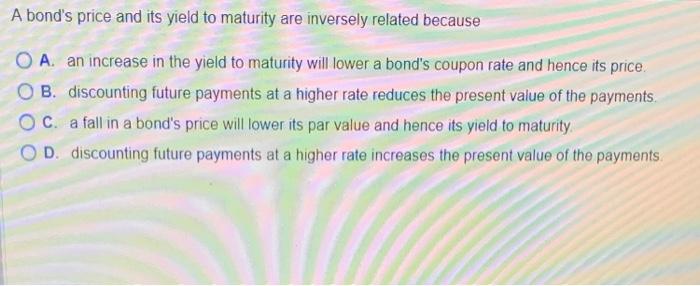

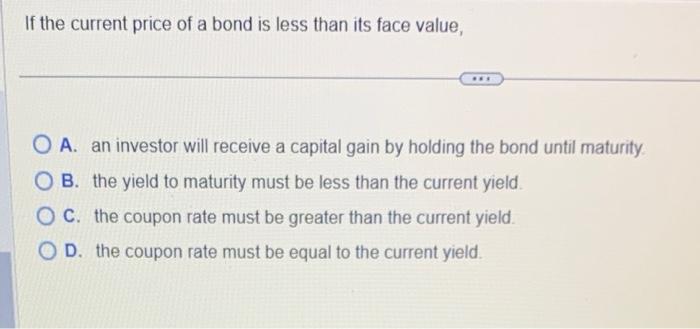

An increase in the corporate profits tax is likely to cause A. the equilibrium interest rate and the equilibrium price of bonds to both fall B. the equilibrium interest rate to fall and the equilibrium price of bonds to ris C. the equilibrium interest rate to rise and the equilibrium price of bonds to D. the equilibrium interest rate and the equilibrium price of bonds to both rise The current yield is equal to A. the coupon divided by the market price of the bond B. the yield to maturity, if the bond is a coupon bond C. the market price of the bond divided by its par value D. the coupon divided by the par value of the bond. A bond's price and its yield to maturity are inversely related because A. an increase in the yield to maturity will lower a bond's coupon rate and hence its price. B. discounting future payments at a higher rate reduces the present value of the payments. C. a fall in a bond's price will lower its par value and hence its yield to maturity. D. discounting future payments at a higher rate increases the present value of the payments. If the current price of a bond is less than its face value, A. an investor will receive a capital gain by holding the bond until maturity. B. the yield to maturity must be less than the current yield. C. the coupon rate must be greater than the current yield. D. the coupon rate must be equal to the current yield. As a result of higher expected inflation, A. the demand and supply curves for bonds both shift to the left and the equilibrium interest rate usually falls. B. the demand curve for bonds shifts to the left, the supply curve for bonds shifts to the right, and the equilibrium interest rate usually rises. C. the demand and supply curves for bonds both shift to the right and the equilibrium interest rate usually rises D. the demand curve for bonds shifts to the right, the supply curve for bonds shifts to the left, and the equilibrium interest rate usually rises. In comparing the yield to maturity on a Treasury bill with the yield on a discount basis on the same bill, we can say that the yield to maturity A. rises whenever the yield on a discount basis falls. B. will always be greater than the yield on a discount basis. C. Will always be less than the yield on a discount basis. D. will always be equal to the yield on a discount basis, provided the holding period is the same as the number of years to matunty Diversification is most effective in reducing A. all forms of risk B. systemic risk C. market risk D. idiosyncratic risk If bond investors think they lack enough details to evaluate the likelihood of defaults on certain bonds, this will result in higher. A. expected inflation B. liquidity C. expected return D. information costs