Answered step by step

Verified Expert Solution

Question

1 Approved Answer

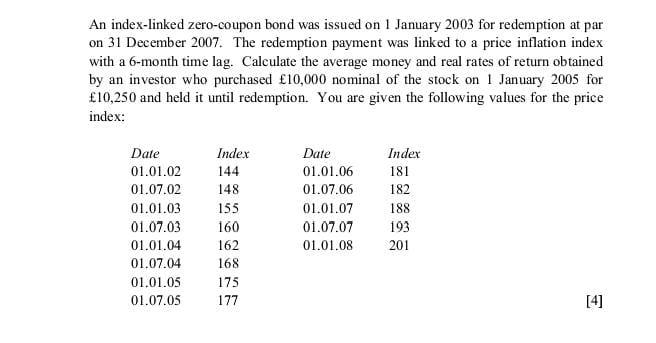

An index-linked zero-coupon bond was issued on 1 January 2003 for redemption at par on 31 December 2007. The redemption payment was linked to

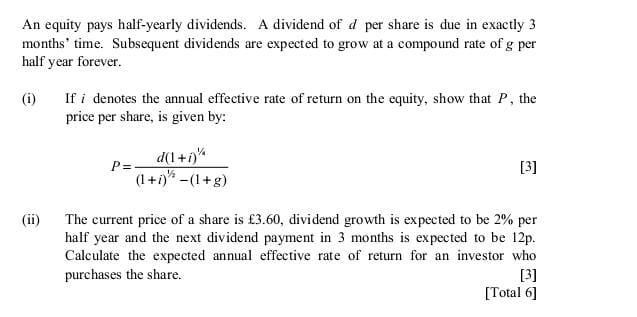

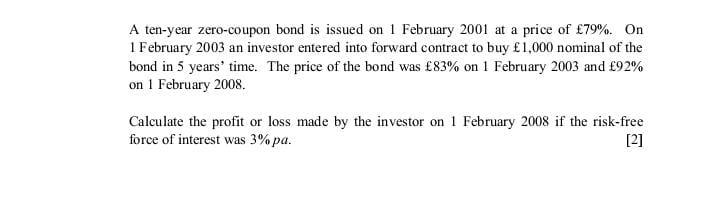

An index-linked zero-coupon bond was issued on 1 January 2003 for redemption at par on 31 December 2007. The redemption payment was linked to a price inflation index with a 6-month time lag. Calculate the average money and real rates of return obtained by an investor who purchased 10,000 nominal of the stock on 1 January 2005 for 10,250 and held it until redemption. You are given the following values for the price index: Date 01.01.02 01.07.02 01.01.03 01.07.03 01.01.04 01.07.04 01.01.05 01.07.05 Index 144 148 155 160 162 168 175 177 Date 01.01.06 01.07.06 01.01.07 01.07.07 01.01.08 Index 181 182] 188 193 201 [4] An equity pays half-yearly dividends. A dividend of d per share is due in exactly 3 months' time. Subsequent dividends are expected to grow at a compound rate of g per half year forever. (i) If i denotes the annual effective rate of return on the equity, show that P, the price per share, is given by: d(1+i) (1+i)" -(1+g) P=- [3] The current price of a share is 3.60, dividend growth is expected to be 2% per half year and the next dividend payment in 3 months is expected to be 12p. Calculate the expected annual effective rate of return for an investor who purchases the share. [3] [Total 6] A ten-year zero-coupon bond is issued on 1 February 2001 at a price of 79%. On 1 February 2003 an investor entered into forward contract to buy 1,000 nominal of the bond in 5 years' time. The price of the bond was 83% on 1 February 2003 and 92% on 1 February 2008. Calculate the profit or loss made by the investor on 1 February 2008 if the risk-free force of interest was 3% pa. [2]

Step by Step Solution

★★★★★

3.45 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed stepbystep calculations 1 Redemption amount calculation Index value at issuanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started