Answered step by step

Verified Expert Solution

Question

1 Approved Answer

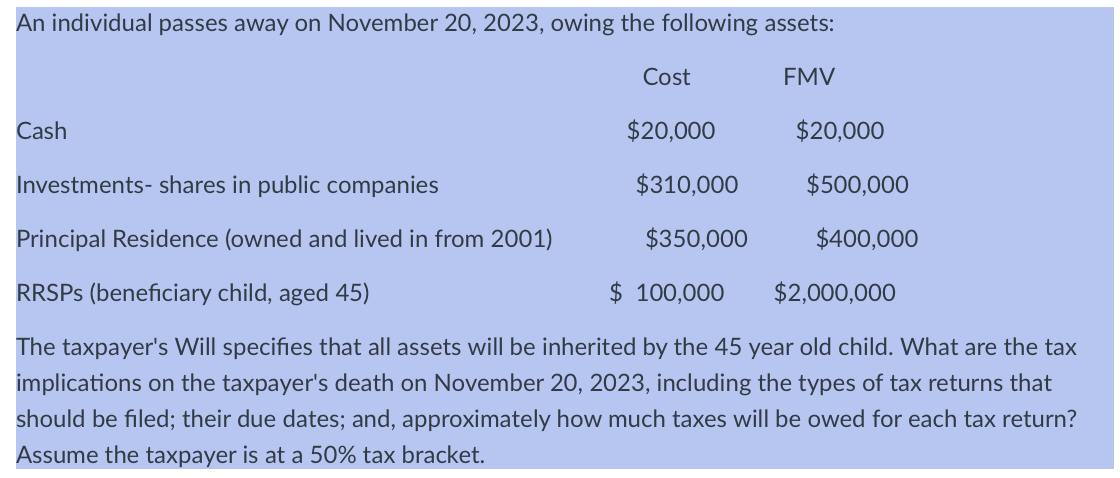

An individual passes away on November 20, 2023, owing the following assets: Cost FMV Cash $20,000 $20,000 Investments- shares in public companies $310,000 $500,000

An individual passes away on November 20, 2023, owing the following assets: Cost FMV Cash $20,000 $20,000 Investments- shares in public companies $310,000 $500,000 Principal Residence (owned and lived in from 2001) $350,000 $400,000 RRSPs (beneficiary child, aged 45) $ 100,000 $2,000,000 The taxpayer's Will specifies that all assets will be inherited by the 45 year old child. What are the tax implications on the taxpayer's death on November 20, 2023, including the types of tax returns that should be filed; their due dates; and, approximately how much taxes will be owed for each tax return? Assume the taxpayer is at a 50% tax bracket.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Upon the taxpayers death there are several tax implications and filings to consider 1 Final Individual Income Tax Return T1 Return Due Date Generally ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dc74b70163_962182.pdf

180 KBs PDF File

663dc74b70163_962182.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started