Question

An initial investment of $60,000 in Novak's Bunks is expected to pay off greatly-but not equally-in each of the next 5 years. The company

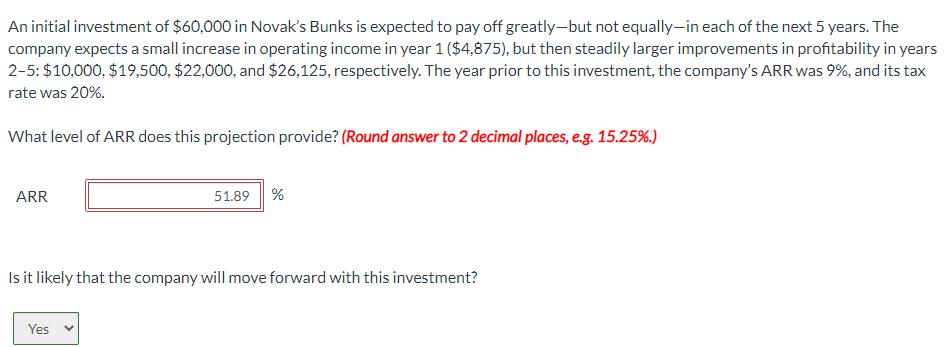

An initial investment of $60,000 in Novak's Bunks is expected to pay off greatly-but not equally-in each of the next 5 years. The company expects a small increase in operating income in year 1 ($4,875), but then steadily larger improvements in profitability in years 2-5: $10,000, $19,500, $22,000, and $26,125, respectively. The year prior to this investment, the company's ARR was 9%, and its tax rate was 20%. What level of ARR does this projection provide? (Round answer to 2 decimal places, e.g. 15.25%.) ARR 51.89 % Is it likely that the company will move forward with this investment? Yes

Step by Step Solution

3.32 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Calculus Early Transcendentals

Authors: William L. Briggs, Lyle Cochran, Bernard Gillett

2nd edition

321954428, 321954424, 978-0321947345

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App