Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An institution has a liability to pay 15,000 per annum, half-yearly in arrears, forever. (i) Calculate the present value and volatility of the liability

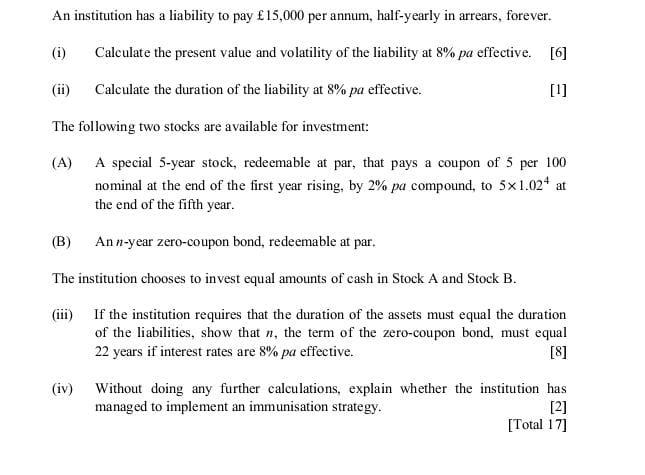

An institution has a liability to pay 15,000 per annum, half-yearly in arrears, forever. (i) Calculate the present value and volatility of the liability at 8% pa effective. [6] Calculate the duration of the liability at 8% pa effective. [1] The following two stocks are available for investment: (A) A special 5-year stock, redeemable at par, that pays a coupon of 5 per 100 nominal at the end of the first year rising, by 2% pa compound, to 51.02* at the end of the fifth year. (B) Ann-year zero-coupon bond, redeemable at par. The institution chooses to invest equal amounts of cash in Stock A and Stock B. (iii) If the institution requires that the duration of the assets must equal the duration of the liabilities, show that n, the term of the zero-coupon bond, must equal 22 years if interest rates are 8% pa effective. [8] (iv) Without doing any further calculations, explain whether the institution has managed to implement an immunisation strategy. [2] [Total 17]

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value and volatility of the liability we can use the following formulas Present Value C1 r C1 r2 C1 r3 Volatility C2 2 r2 1 r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started