Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An institutional investor is considering three mutual funds. The first is a Treasury bill (T-bill) money market fund that yields a sure rate of 6%,

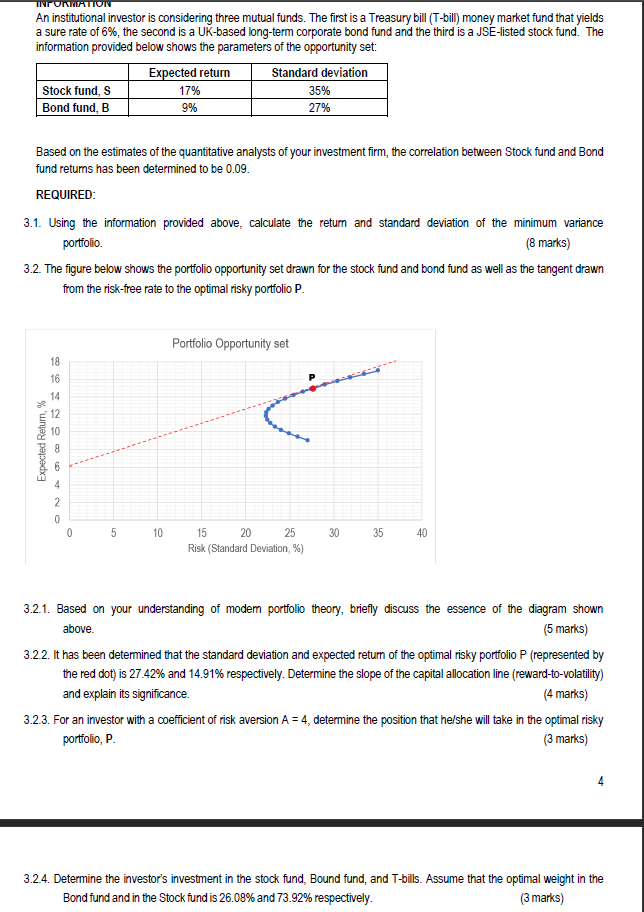

An institutional investor is considering three mutual funds. The first is a Treasury bill (T-bill) money market fund that yields a sure rate of 6%, the second is a UK-based long-term corporate bond fund and the third is a JSE-listed stock fund. The information provided below shows the parameters of the opportunity set: Based on the estimates of the quantitative analysts of your investment firm, the correlation between Stock fund and Bond fund retums has been determined to be 0.09 . REQUIRED: 3.1. Using the information provided above, calculate the return and standard deviation of the minimum variance portfolio. ( 8 marks) 3.2. The figure below shows the portfolio opportunity set drawn for the stock fund and bond fund as well as the tangent drawn from the risk-free rate to the optimal risky portfolio P. 3.2.1. Based on your understanding of modem portfolio theory, briefly discuss the essence of the diagram shown above. ( 5 marks) 3.2.2. It has been determined that the standard deviation and expected return of the optimal risky portfolio P (represented by the red dot) is 27.42% and 14.91% respectively. Determine the slope of the capital allocation line (reward-to-volatility) and explain its significance. (4 marks) 3.2.3. For an investor with a coefficient of risk aversion A=4, determine the position that he/she will take in the optimal risky portfolio, P. ( 3 marks) 4 3.2.4. Determine the investor's investment in the stock fund, Bound fund, and T-bills. Assume that the optimal weight in the Bond fund and in the Stock fund is 26.08% and 73.92% respectively

An institutional investor is considering three mutual funds. The first is a Treasury bill (T-bill) money market fund that yields a sure rate of 6%, the second is a UK-based long-term corporate bond fund and the third is a JSE-listed stock fund. The information provided below shows the parameters of the opportunity set: Based on the estimates of the quantitative analysts of your investment firm, the correlation between Stock fund and Bond fund retums has been determined to be 0.09 . REQUIRED: 3.1. Using the information provided above, calculate the return and standard deviation of the minimum variance portfolio. ( 8 marks) 3.2. The figure below shows the portfolio opportunity set drawn for the stock fund and bond fund as well as the tangent drawn from the risk-free rate to the optimal risky portfolio P. 3.2.1. Based on your understanding of modem portfolio theory, briefly discuss the essence of the diagram shown above. ( 5 marks) 3.2.2. It has been determined that the standard deviation and expected return of the optimal risky portfolio P (represented by the red dot) is 27.42% and 14.91% respectively. Determine the slope of the capital allocation line (reward-to-volatility) and explain its significance. (4 marks) 3.2.3. For an investor with a coefficient of risk aversion A=4, determine the position that he/she will take in the optimal risky portfolio, P. ( 3 marks) 4 3.2.4. Determine the investor's investment in the stock fund, Bound fund, and T-bills. Assume that the optimal weight in the Bond fund and in the Stock fund is 26.08% and 73.92% respectively Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started