Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An insurance agent offers services to clients who are concemed about their personal financial planning for retirement to emphasize the advantages of an early start

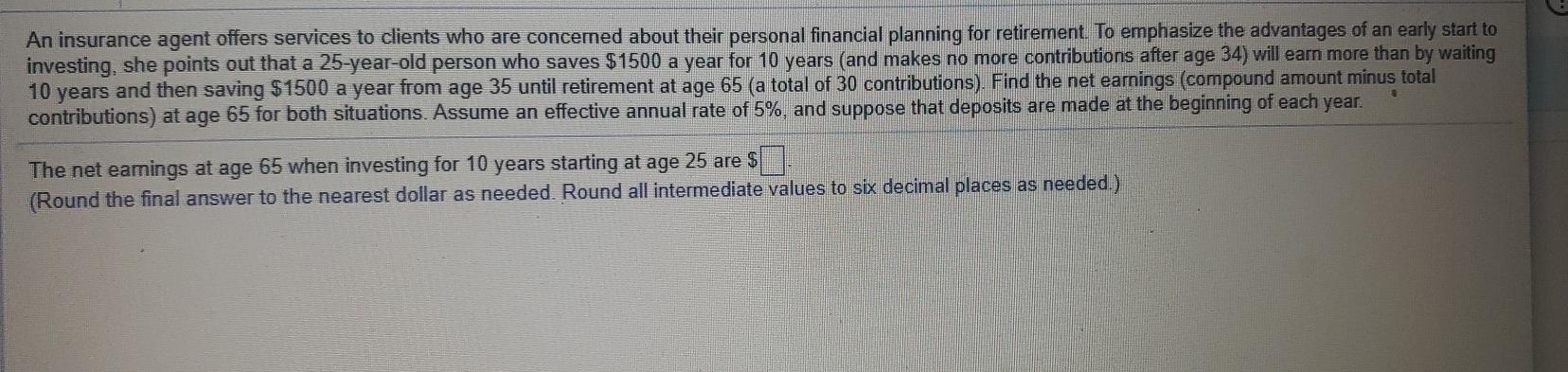

An insurance agent offers services to clients who are concemed about their personal financial planning for retirement to emphasize the advantages of an early start to investing, she points out that a 25-year-old person who saves $1500 a year for 10 years (and makes no more contributions after age 34) will earn more than by waiting 10 years and then saving $1500 a year from age 35 until retirement at age 65 (a total of 30 contributions). Find the net earnings (compound amount minus total contributions) at age 65 for both situations. Assume an effective annual rate of 5%, and suppose that deposits are made at the beginning of each year. The net earings at age 65 when investing for 10 years starting at age 25 are $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started