Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An insurance company borrows 50 million at an effective interest rate of 9% per annum. The insurance company uses the money to invest in

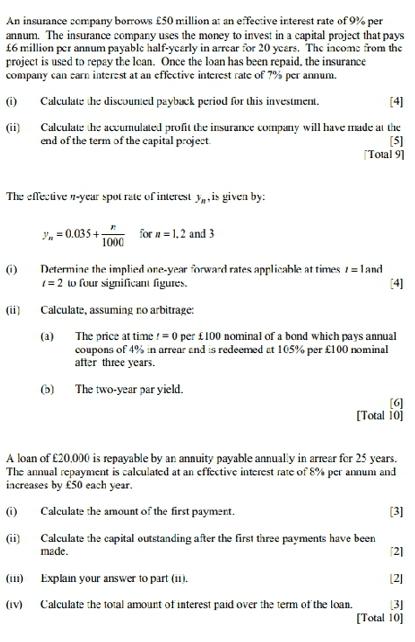

An insurance company borrows 50 million at an effective interest rate of 9% per annum. The insurance company uses the money to invest in a capital project that pays 6 million per annum payable half-yearly in arrear for 20 years. The income from the project is used to repay the lean. Once the loan has been repaid, the insurance company can earn interest at an effective interest rate of 7% per annum. Calculate the discounted payback period for this investment. [4] Calculate the accumulated profit the insurance company will have made at the end of the term of the capital project [5] [Total 9] () (ii) The effective n-year spot rate of interest y, is given by: (1) (1) (ii) =0.035+- Determine the implied ore-year forward rates applicable at times 1=1 and 1=2 to four significant figures. [4] (ii) Calculate, assuming no arbitrage: (a) (iv) 1000 for a = 1,2 and 3 The price at time != 0 per 100 nominal of a bond which pays annual coupons of 4% in arrear and is redeemed at 105% per 100 nominal after three years. (6) The two-year par yield. A loan of 20,000 is repayable by an annuity payable annually in arrear for 25 years. The annual repayment is calculated at an effective interest rate of 8% per annum and increases by 50 each year. Calculate the amount of the first payment. Calculate the capital outstanding after the first three payments have been made. Explain your answer to part (11). Calculate the total amount of interest paid over the term of the loan. [6] [Total 10] [3] [21 [2] [Total 10]

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of discounted payback period Loan amount 50 million Interest rate on loan 9 pa Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started