Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An insurance company has just written single premium contracts that require it to make payments to policyholders of 10,000,000 in five years' ime. The

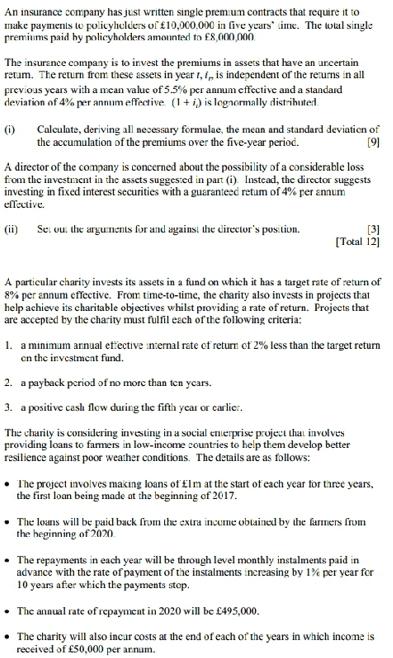

An insurance company has just written single premium contracts that require it to make payments to policyholders of 10,000,000 in five years' ime. The total single premiums paid by policyholders amounted to 8,000,000 The insurance company is to invest the premiums in assets that have an uncertain retum. The return from these assets in year t, f, is independent of the returns in all previous years with a mean value of 5.5% per annum effective and a standard deviation of 4% per annum effective (1+i) is lognormally distributed (i) Calculate, deriving all necessary formulae, the mean and standard deviation of the accumulation of the premiums over the five-year period. [9] A director of the company is concerned about the possibility of a considerable loss from the investment in the assets suggested in part (i). Instead, the director suggests investing in fixed interest securities with a guaranteed retum of 4% per annum effective. (ii) Set out the arguments for and against the director's position. [3] [Total 12] A particular charity invests its assets in a fund on which it has a target rate of return of 8% per annum effective. From time-to-time, the charity also invests in projects that help achieve its charitable objectives whilst providing a rate of return. Projects that are accepted by the charity must fulfil each of the following criteria: 1. a minimum annual effective internal rate of return of 2% less than the target return en the investment fund. 2. a payback period of no more than ten years. 3. a positive cash flow during the fifth year or carlier. The charity is considering investing in a social enterprise project that involves providing loans to farmers in low-income countries to help them develop better resilience against poor weather conditions. The details are as follows: The project involves making loans of Elm at the start of each year for three years. the first loan being made at the beginning of 2017. The loans will be paid back from the extra income obtained by the farmers from the beginning of 2020 The repayments in each year will be through level monthly instalments paid in advance with the rate of payment of the instalments increasing by 1% per year for 10 years after which the payments stop. The annual rate of repayment in 2020 will be 495,000. The charity will also incar costs at the end of each of the years in which income is received of 50,000 per arnum.

Step by Step Solution

★★★★★

3.23 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Part ii Arguments for and Against Directors Position For Directors Position Investing in Fixed Inter...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started