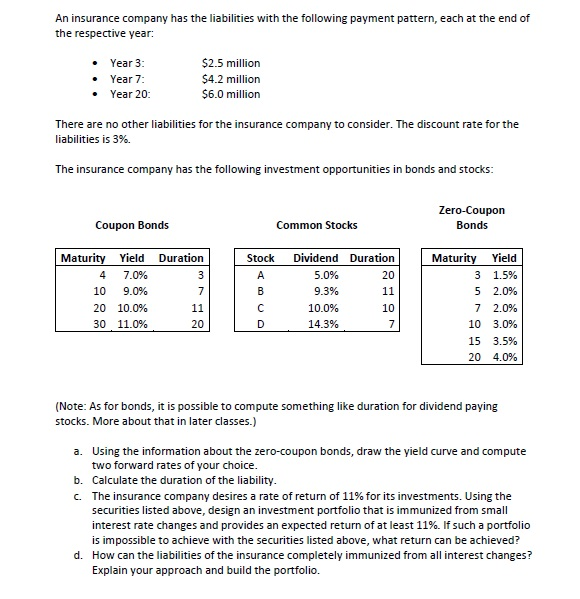

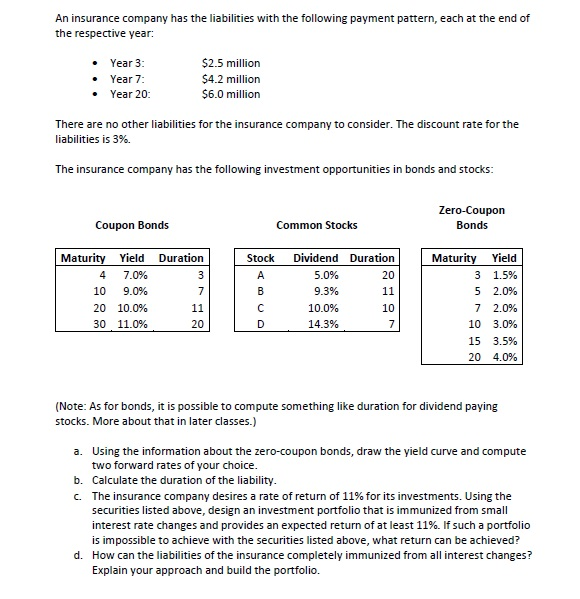

An insurance company has the liabilities with the following payment pattern, each at the end of he respective year: Year 3 Year 7: Year 20 $2.5 million $4.2 million $6.0 million There are no other liabilities for the insurance company to consider. The discount rate for the liabilities is 3%. The insurance company has the following investment opportunities in bonds and stocks Zero-Coupon Bonds Coupon Bonds Common Stocks Yield Duration Stock Dividend Duration 20 Yield 3 1.5% 5 2.0% 7 2.0% 10 3.0% 15 3.5% 20 4.0% Matur Matur 47.0% 10 9.0% 20 10.0% 30 11.0% 5.0% 9.3% 10.0% 14.3% 10 20 (Note: As for bonds, it is possible to compute something like duration for dividend paying stocks. More about that in later classes.) Using the information about the zero-coupon bonds, draw the yield curve and compute two forward rates of your choice Calculate the duration of the liability The insurance company desires a rate of return of 11% for its investments. Using the securities listed above, design an investment portfolio that is immunized from smal interest rate changes and provides an expected return of at least 11%. If such a portfolio is impossible to achieve with the securities listed above, what return can be achieved? How can the liabilities of the insurance completely immunized from all interest changes? Explain your approach and build the portfolio. a. b. C. d. An insurance company has the liabilities with the following payment pattern, each at the end of he respective year: Year 3 Year 7: Year 20 $2.5 million $4.2 million $6.0 million There are no other liabilities for the insurance company to consider. The discount rate for the liabilities is 3%. The insurance company has the following investment opportunities in bonds and stocks Zero-Coupon Bonds Coupon Bonds Common Stocks Yield Duration Stock Dividend Duration 20 Yield 3 1.5% 5 2.0% 7 2.0% 10 3.0% 15 3.5% 20 4.0% Matur Matur 47.0% 10 9.0% 20 10.0% 30 11.0% 5.0% 9.3% 10.0% 14.3% 10 20 (Note: As for bonds, it is possible to compute something like duration for dividend paying stocks. More about that in later classes.) Using the information about the zero-coupon bonds, draw the yield curve and compute two forward rates of your choice Calculate the duration of the liability The insurance company desires a rate of return of 11% for its investments. Using the securities listed above, design an investment portfolio that is immunized from smal interest rate changes and provides an expected return of at least 11%. If such a portfolio is impossible to achieve with the securities listed above, what return can be achieved? How can the liabilities of the insurance completely immunized from all interest changes? Explain your approach and build the portfolio. a. b. C. d