Question

An insurance company must make a payment of $19,487.17 in 7 years. The market interest rate is 10%, which means the present value of

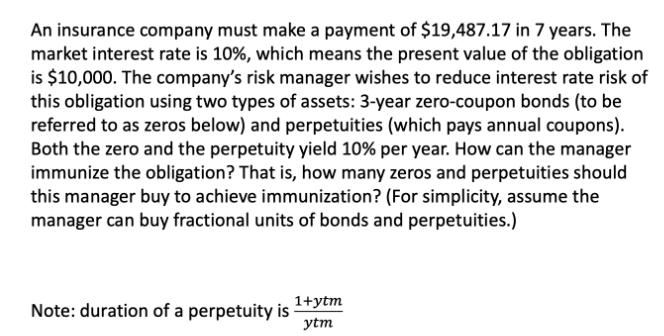

An insurance company must make a payment of $19,487.17 in 7 years. The market interest rate is 10%, which means the present value of the obligation is $10,000. The company's risk manager wishes to reduce interest rate risk of this obligation using two types of assets: 3-year zero-coupon bonds (to be referred to as zeros below) and perpetuities (which pays annual coupons). Both the zero and the perpetuity yield 10% per year. How can the manager immunize the obligation? That is, how many zeros and perpetuities should this manager buy to achieve immunization? (For simplicity, assume the manager can buy fractional units of bonds and perpetuities.) Note: duration of a perpetuity is 1+ytm ytm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To immunize the obligation the risk manager needs to match the d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Horngren, Harrison, Oliver

3rd Edition

978-0132497992, 132913771, 132497972, 132497999, 9780132913775, 978-0132497978

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App