Question

An investment advisor is considering four different investment options for a client. The return of each option depends on the state of the economy over

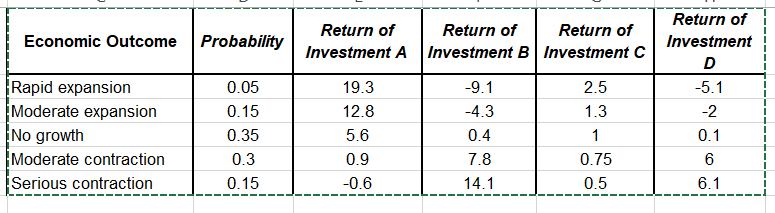

An investment advisor is considering four different investment options for a client. The return of each option depends on the state of the economy over the next year (ranging from rapid expansion to strong contraction).The investment company's economists have estimated probabilities for each of these states of the economy, as well as the returns of each investment under each of these circumstances. The data is summarized in the spreadsheet below.

(Tip: If you have trouble accessing the file, please try a different browser. Some browsers do not support all functions in Blackboard.)

(A) What is the expected annual return of each investment?

(B) What is the standard deviation of the annual return of each investment?

(C) Calculate the correlations between all 4 investment returns.

(D) The investor is rather risk-averse and would like to pick two investments to limit his risks. Which two investments would you recommend if you were the advisor? Explain your choice.

(E) Please attach your work in an Excel spreadsheet in the next question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started