Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment analyst has just informed you that the Genting Malaysia (GM) share price is going to have a large movement/volatility in the next

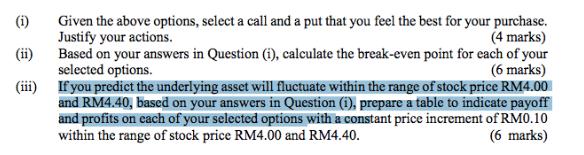

An investment analyst has just informed you that the Genting Malaysia (GM) share price is going to have a large movement/volatility in the next 3 months. However, you are uncertain about the exact movement of the stock. The following 30-day (time to maturity) European options on GM are available in the market now. The information on the option's maturity, strike price and premium is represented in sequence as follows: 30-day GM. RM4.10 call @ RM0.12 30-day GM. RM4.20 call @ RM0.15 30-day GM. RM4.10 put @ RM0.10 30-day GM. RM4.20 put @ RM0.08 (i) (ii) (iii) Given the above options, select a call and a put that you feel the best for your purchase. Justify your actions. (4 marks) Based on your answers in Question (i), calculate the break-even point for each of your selected options. (6 marks) If you predict the underlying asset will fluctuate within the range of stock price RM4.00 and RM4.40, based on your answers in Question (i), prepare a table to indicate payoff and profits on each of your selected options with a constant price increment of RM0.10 within the range of stock price RM4.00 and RM4.40. (6 marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started