Question

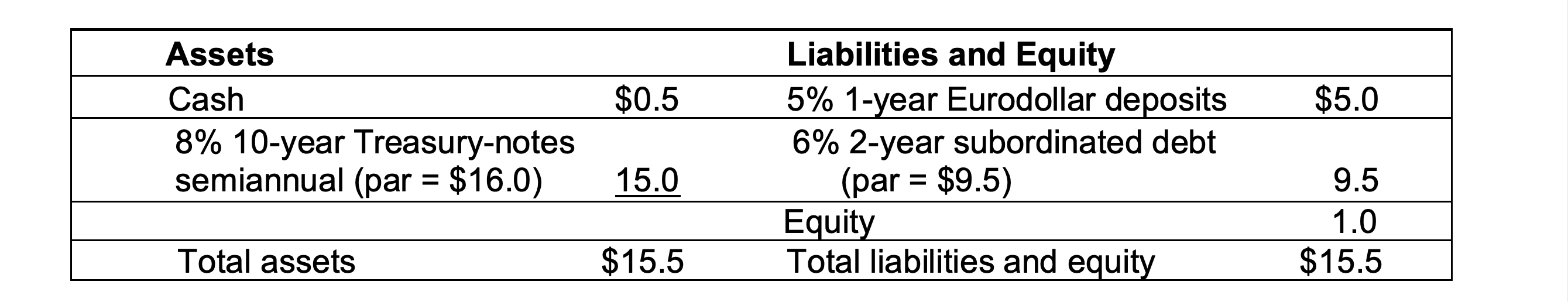

An investment bank based in USA and specializing in fixed-income assets has the following balance sheet (in millions). Amounts are in market values and all

An investment bank based in USA and specializing in fixed-income assets has the following balance sheet (in millions). Amounts are in market values and all interest rates are annual unless indicated otherwise.

a. Briefly explain whether the investment bank have sufficient liquid assets per the net capital rule? Is the investment bank in compliance with the Securities and Exchange Commission (SEC) Rule 15C 3-1?

b. Assume that the rates on all assets rise 15 basis points and, on all liabilities, rise 25 basis points (per year). Briefly explain whether the FI will be in compliance with the SEC Rule 15C 3-1?

$0.5 $5.0 Assets Cash 8% 10-year Treasury-notes semiannual (par = $16.0) Liabilities and Equity 5% 1-year Eurodollar deposits 6% 2-year subordinated debt (par = $9.5) Equity Total liabilities and equity 15.0 9.5 1.0 $15.5 Total assets $15.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started