Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment bank has developed a new indicator for tracking international currency values using the cost of an iPad (8th generation) 32GB as a

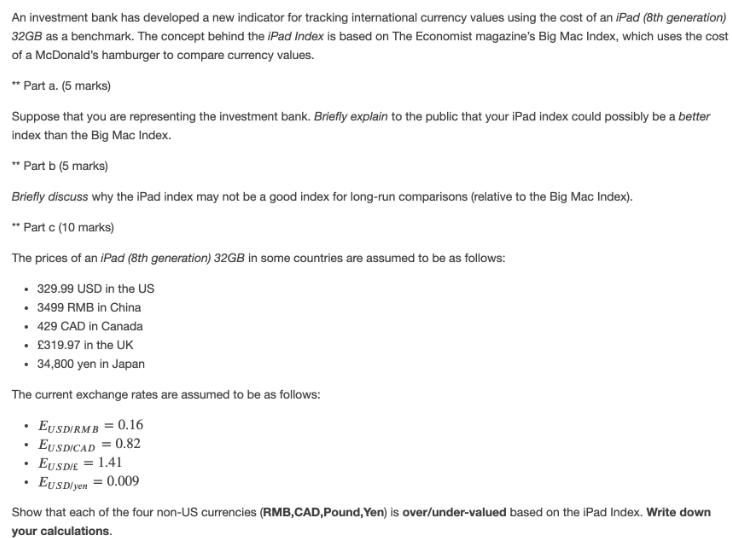

An investment bank has developed a new indicator for tracking international currency values using the cost of an iPad (8th generation) 32GB as a benchmark. The concept behind the iPad Index is based on The Economist magazine's Big Mac Index, which uses the cost of a McDonald's hamburger to compare currency values. ** Part a. (5 marks) Suppose that you are representing the investment bank. Briefly explain to the public that your iPad index could possibly be a better index than the Big Mac Index. ** Part b (5 marks) Briefly discuss why the iPad index may not be a good index for long-run comparisons (relative to the Big Mac Index). **Part c (10 marks) The prices of an iPad (8th generation) 32GB in some countries are assumed to be as follows: . 329.99 USD in the US 3499 RMB in China 429 CAD in Canada 319.97 in the UK 34,800 yen in Japan The current exchange rates are assumed to be as follows: EUSDIRMB = 0.16 EUSDICAD=0.82 EUSDIE = 1.41 EUSD/yen = 0.009 . . Show that each of the four non-US currencies (RMB,CAD,Pound, Yen) is over/under-valued based on the iPad Index. Write down your calculations.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part a As representatives of the investment bank we believe that the iPad Index could potentially be a superior index compared to the Big Mac Index for several reasons Technology reflects broad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started