Answered step by step

Verified Expert Solution

Question

1 Approved Answer

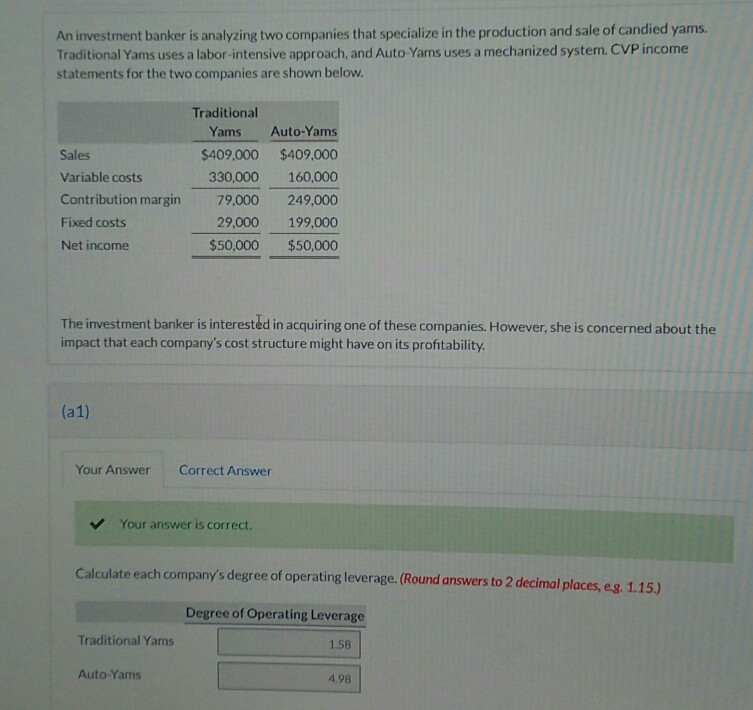

An investment banker is analyzing two companies that specialize in the production and sale of candied yams. Traditional Yams uses a labor-intensive approach, and Auto-Yams

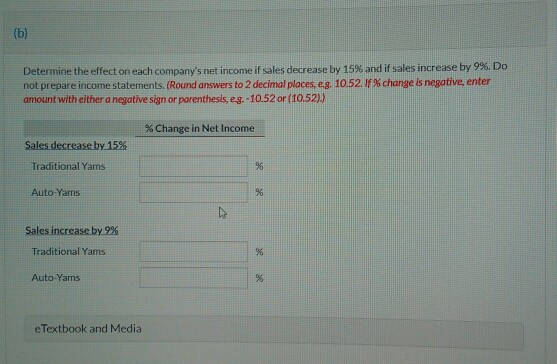

An investment banker is analyzing two companies that specialize in the production and sale of candied yams. Traditional Yams uses a labor-intensive approach, and Auto-Yams uses a mechanized system. CVP income statements for the two companies are shown below. Sales Variable costs Contribution margin Fixed costs Net income Traditional Yams $409,000 330.000 79.000 29.000 $50,000 Auto-Yams $409,000 160,000 249.000 199,000 $50,000 The investment banker is interested in acquiring one of these companies. However, she is concerned about the impact that each company's cost structure might have on its profitability. (a1) Your Answer Correct Answer Your answer is correct. Calculate each company's degree of operating leverage. (Round answers to 2 decimal places, eg. 1.15) Degree of Operating Leverage 1.58 Traditional Yarns Auto-Yams 4.98 (b) Determine the effect on each company's net income if sales decrease by 15% and if sales increase by 9%. Do not prepare income statements. (Round answers to 2 decimal places, eg. 10.52. If % change is negative, enter amount with either a negative sign or parenthesis, e.g.-10.52 or (1052) % Change in Net Income Sales decrease by 15% Traditional Yams Auto-Yams Sales increase by 9% Traditional Yams Auto-Yams e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started