Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment company considers to purchase of the Apartment Lakeshore project. The year 1 NOI is expected to be $2,000,000, and based on the

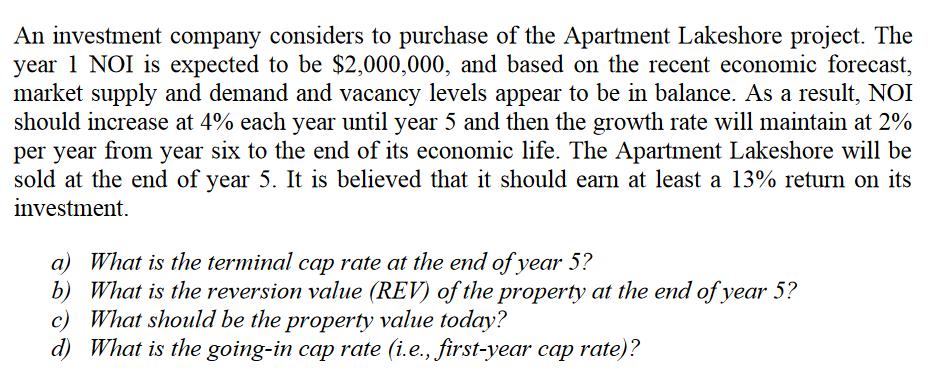

An investment company considers to purchase of the Apartment Lakeshore project. The year 1 NOI is expected to be $2,000,000, and based on the recent economic forecast, market supply and demand and vacancy levels appear to be in balance. As a result, NOI should increase at 4% each year until year 5 and then the growth rate will maintain at 2% per year from year six to the end of its economic life. The Apartment Lakeshore will be sold at the end of year 5. It is believed that it should earn at least a 13% return on its investment. a) What is the terminal cap rate at the end of year 5? b) What is the reversion value (REV) of the property at the end of year 5? c) What should be the property value today? d) What is the going-in cap rate (i.e., first-year cap rate)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the terminal cap rate at the end of year 5 we can use the formula for the terminal ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started