Question

An investment has an initial cost of $300,000 and a life of four years. This investment will be depreciated by $60,000 a year and will

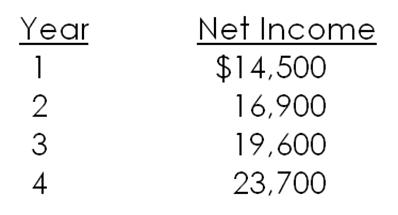

An investment has an initial cost of $300,000 and a life of four years. This investment will be depreciated by $60,000 a year and will generate the net income shown below. Should this project be accepted based on the average accounting rate of return (AAR) if the required rate is 9.5 percent? Why or why not?

A. | Yes, because the AAR less than 9.5 percent |

B. | Yes, because the AAR is 9.5 percent |

C. | Yes, because the AAR is greater than 9.5 percent |

D. | No, because the AAR is 9.5 percent |

E. | No, because the AAR is greater than 9.5 percent |

Net Income $14,500 16,900 Year 2 19,600 4 23,700

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F. Brigham, Phillip R. Daves

12th edition

1285850033, 978-1305480698, 1305480694, 978-0357688236, 978-1285850030

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App