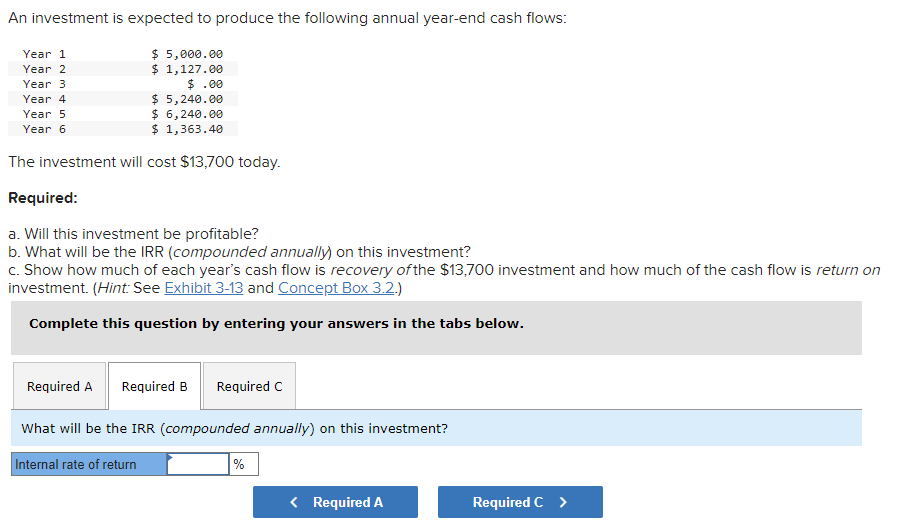

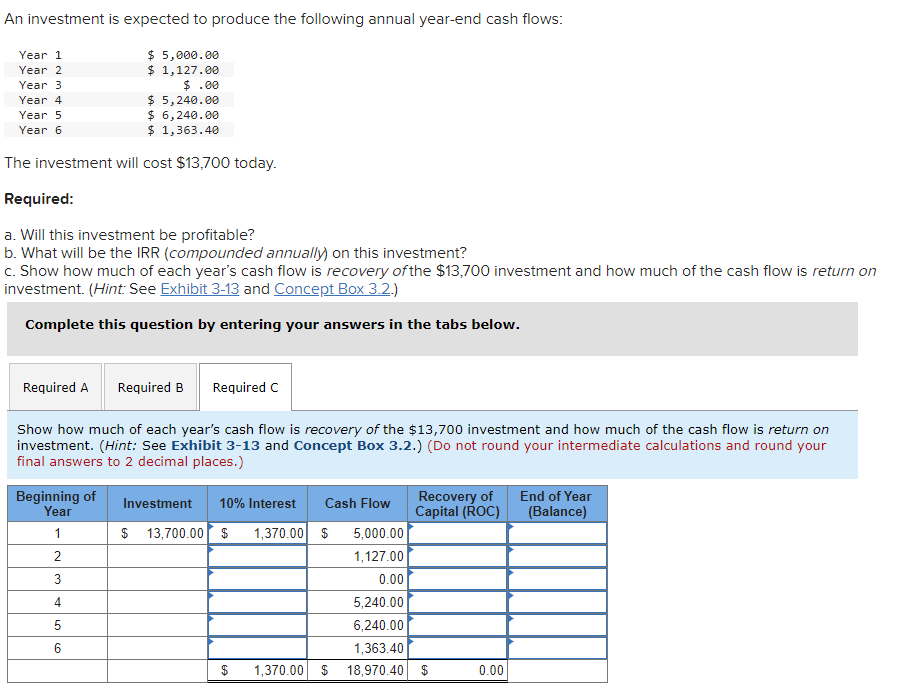

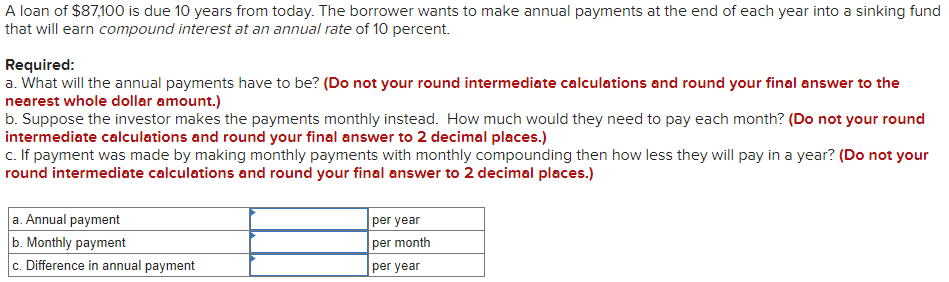

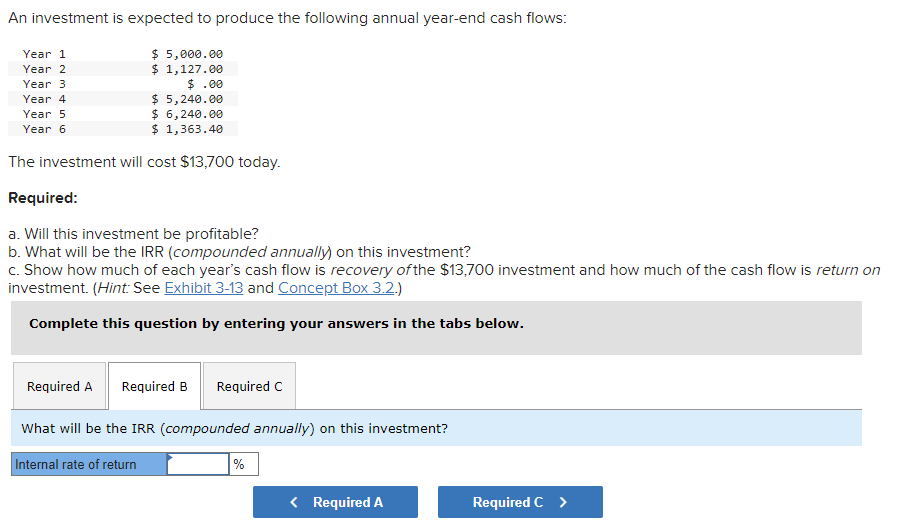

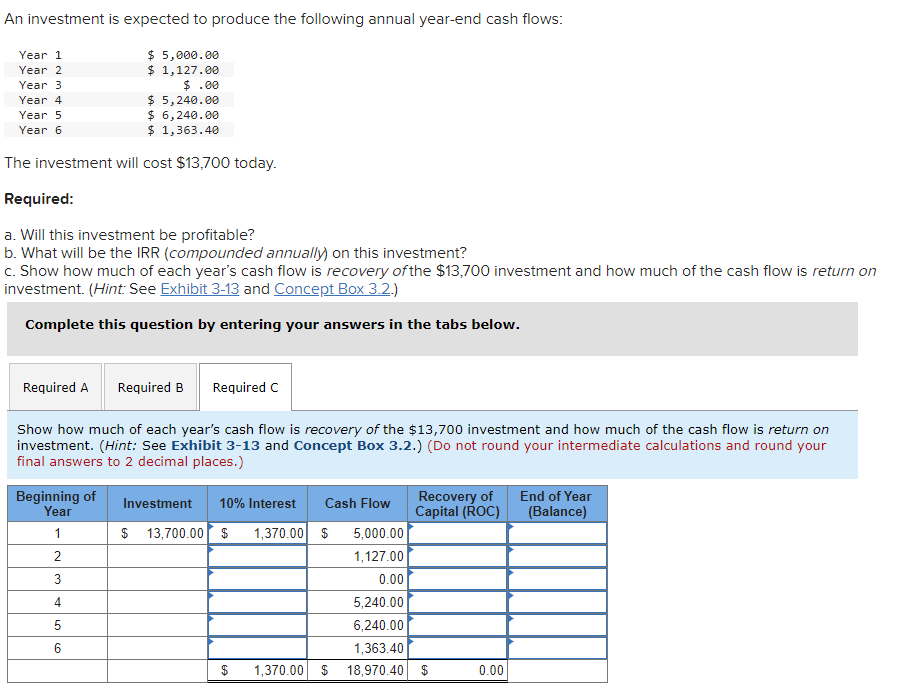

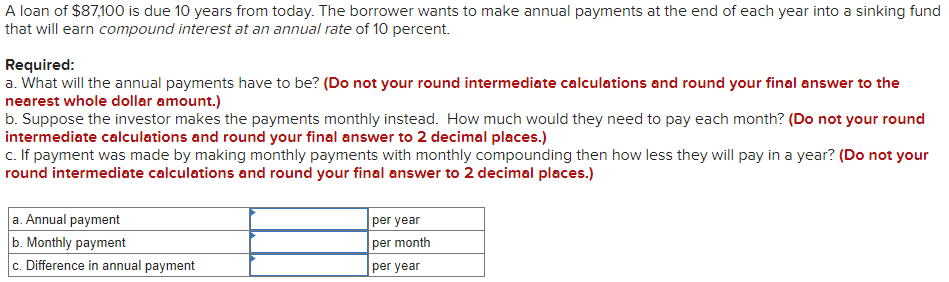

An investment is expected to produce the following annual year-end cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ 5,000.00 $ 1,127.00 $ .00 $ 5,240.00 $ 6,240.00 $ 1,363.40 The investment will cost $13,700 today. Required: a. Will this investment be profitable? b. What will be the IRR (compounded annually on this investment? c. Show how much of each year's cash flow is recovery of the $13,700 investment and how much of the cash flow is return on investment. (Hint: See Exhibit 3-13 and Concept Box 3.2.) Complete this question by entering your answers in the tabs below. Required A Required B Required C What will be the IRR (compounded annually) on this investment? Internal rate of return % An investment is expected to produce the following annual year-end cash flows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ 5,000.00 $ 1,127.00 $.00 $ 5,240.00 $ 6,240.00 $ 1,363.40 The investment will cost $13,700 today. Required: a. Will this investment be profitable? b. What will be the IRR (compounded annually on this investment? c. Show how much of each year's cash flow is recovery of the $13,700 investment and how much of the cash flow is return on investment. (Hint: See Exhibit 3-13 and Concept Box 3.2.) Complete this question by entering your answers in the tabs below. Required A Required B Required C Show how much of each year's cash flow is recovery of the $13,700 investment and how much of the cash flow is return on investment. (Hint: See Exhibit 3-13 and Concept Box 3.2.) (Do not round your intermediate calculations and round your final answers to 2 decimal places.) End of Year (Balance) Beginning of Year 1 2 3 Investment 10% Interest Cash Flow Recovery of Capital (ROC) $ 13,700.00 $ 1,370.00 $ 5,000.00 1,127.00 0.00 5,240.00 6,240.00 1,363.40 $ 1,370.00 $ 18,970.40 $ 0.00 4 ) 6 A loan of $87,100 is due 10 years from today. The borrower wants to make annual payments at the end of each year into a sinking fund that will earn compound interest at an annual rate of 10 percent. Required: a. What will the annual payments have to be? (Do not your round intermediate calculations and round your final answer to the nearest whole dollar amount.) b. Suppose the investor makes the payments monthly instead. How much would they need to pay each month? (Do not your round intermediate calculations and round your final answer to 2 decimal places.) c. If payment was made by making monthly payments with monthly compounding then how less they will pay in a year? (Do not your round intermediate calculations and round your final answer to 2 decimal places.) a. Annual payment b. Monthly payment c. Difference in annual payment per year per month per year