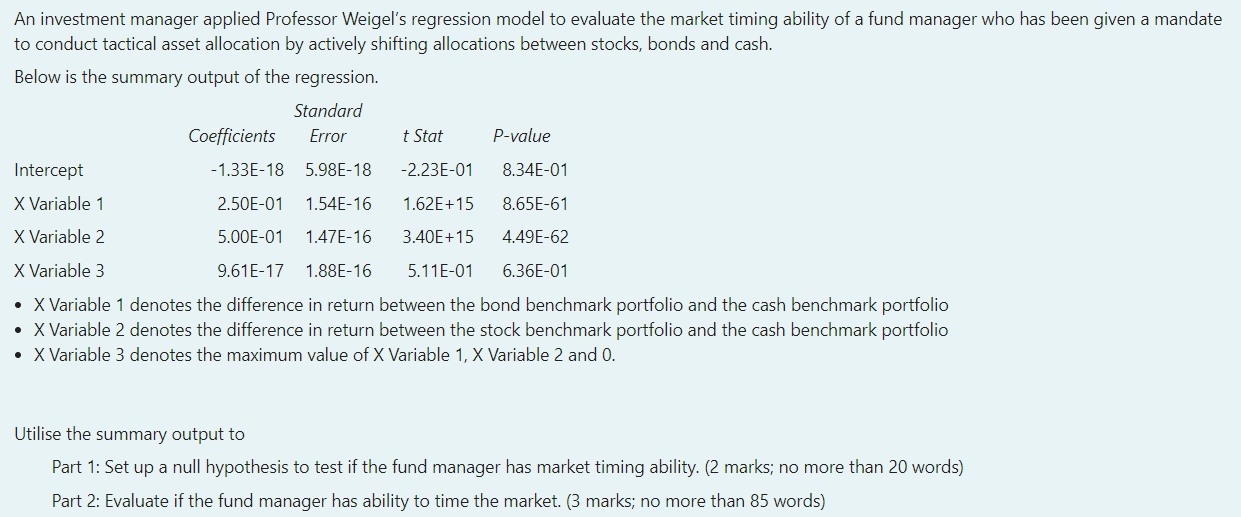

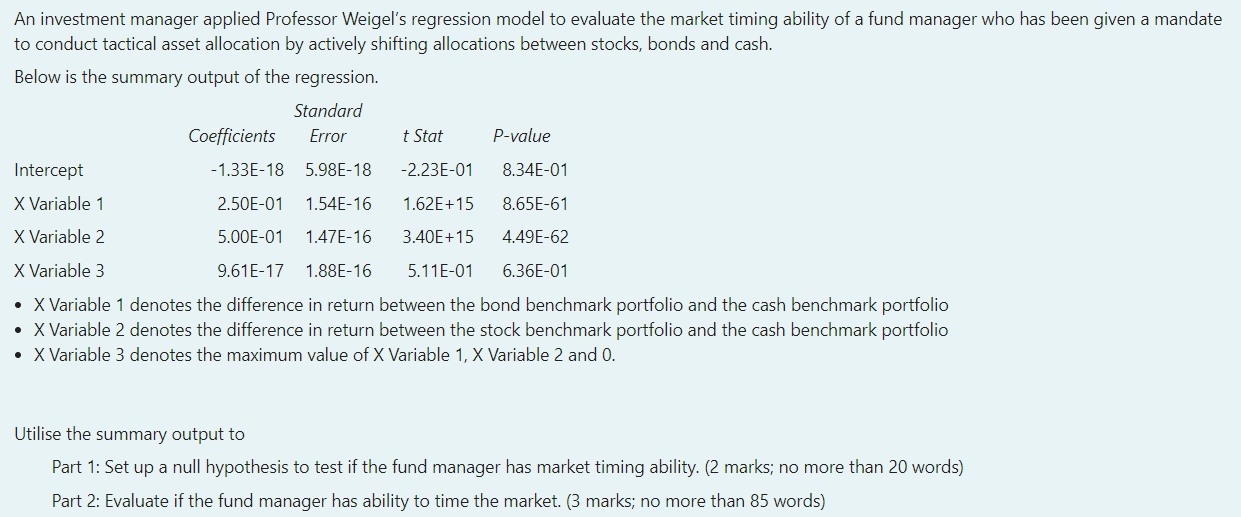

An investment manager applied Professor Weigel's regression model to evaluate the market timing ability of a fund manager who has been given a mandate to conduct tactical asset allocation by actively shifting allocations between stocks, bonds and cash. Below is the summary output of the regression. Standard Coefficients Error t Stat P-value Intercept -1.33E-18 5.98E-18 -2.23E-01 8.34E-01 X Variable 1 2.50E-01 1.54E-16 1.62E+15 8.65E-61 5.00E-01 1.47E-16 3.40E+15 4.49E-62 X Variable 2 X Variable 3 9.61E-17 1.88E-16 5.11E-01 6.36E-01 X Variable 1 denotes the difference in return between the bond benchmark portfolio and the cash benchmark portfolio X Variable 2 denotes the difference in return between the stock benchmark portfolio and the cash benchmark portfolio X Variable 3 denotes the maximum value of X Variable 1, X Variable 2 and 0. Utilise the summary output to Part 1: Set up a null hypothesis to test if the fund manager has market timing ability. (2 marks; no more than 20 words) Part 2: Evaluate if the fund manager has ability to time the market. (3 marks; no more than 85 words) An investment manager applied Professor Weigel's regression model to evaluate the market timing ability of a fund manager who has been given a mandate to conduct tactical asset allocation by actively shifting allocations between stocks, bonds and cash. Below is the summary output of the regression. Standard Coefficients Error t Stat P-value Intercept -1.33E-18 5.98E-18 -2.23E-01 8.34E-01 X Variable 1 2.50E-01 1.54E-16 1.62E+15 8.65E-61 5.00E-01 1.47E-16 3.40E+15 4.49E-62 X Variable 2 X Variable 3 9.61E-17 1.88E-16 5.11E-01 6.36E-01 X Variable 1 denotes the difference in return between the bond benchmark portfolio and the cash benchmark portfolio X Variable 2 denotes the difference in return between the stock benchmark portfolio and the cash benchmark portfolio X Variable 3 denotes the maximum value of X Variable 1, X Variable 2 and 0. Utilise the summary output to Part 1: Set up a null hypothesis to test if the fund manager has market timing ability. (2 marks; no more than 20 words) Part 2: Evaluate if the fund manager has ability to time the market. (3 marks; no more than 85 words)