Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment portfolio consists of two stocks: 90% in Conservative Casualty and 10% in Limitless Inc. The returns (in %) on the two stocks

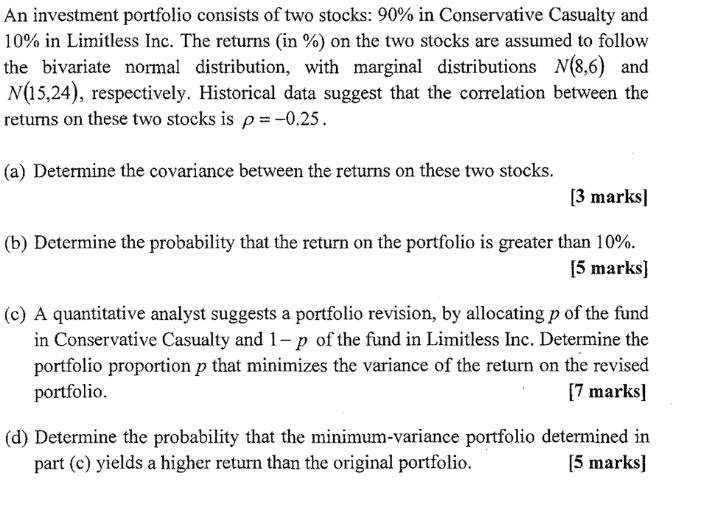

An investment portfolio consists of two stocks: 90% in Conservative Casualty and 10% in Limitless Inc. The returns (in %) on the two stocks are assumed to follow the bivariate normal distribution, with marginal distributions N(8,6) and N(15,24), respectively. Historical data suggest that the correlation between the returns on these two stocks is p= -0.25. (a) Determine the covariance between the returns on these two stocks. [3 marks] (b) Determine the probability that the return on the portfolio is greater than 10%. [5 marks] (c) A quantitative analyst suggests a portfolio revision, by allocating p of the fund in Conservative Casualty and 1-p of the fund in Limitless Inc. Determine the portfolio proportion p that minimizes the variance of the return on the revised portfolio. [7 marks] (d) Determine the probability that the minimum-variance portfolio determined in part (c) yields a higher return than the original portfolio. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets solve each part step by step a The covariance between two stocks in a bivariate normal distribu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started