Question

An investment portfolio is a crucial element in the financial planning process. In this activity, you will develop investment portfolios for three clients based on

An investment portfolio is a crucial element in the financial planning process. In this activity, you will develop investment portfolios for three clients based on their risk tolerance.

Prompt

For this activity, use the Module Four Activity Template to develop investment portfolios for three clients: a conservative investor, a moderate investor, and an aggressive investor. Address the following criteria and justify your decisions on the basis of characteristics for each asset category:

- Select three investments for each asset category (cash and cash equivalents, bonds, and equities).

- For each portfolio, assign each investment a percentage of the portfolio based on the risk tolerance.

- Calculate projected annual rates of return for each investment.

- Explain how each portfolio represents the investor type based on the characteristics of each asset category and the asset allocation.

What to Submit

This activity must be submitted as an Excel document using the Module Four Activity Template provided.

?

A Conservative, moderate and Aggressive investment portfolio?

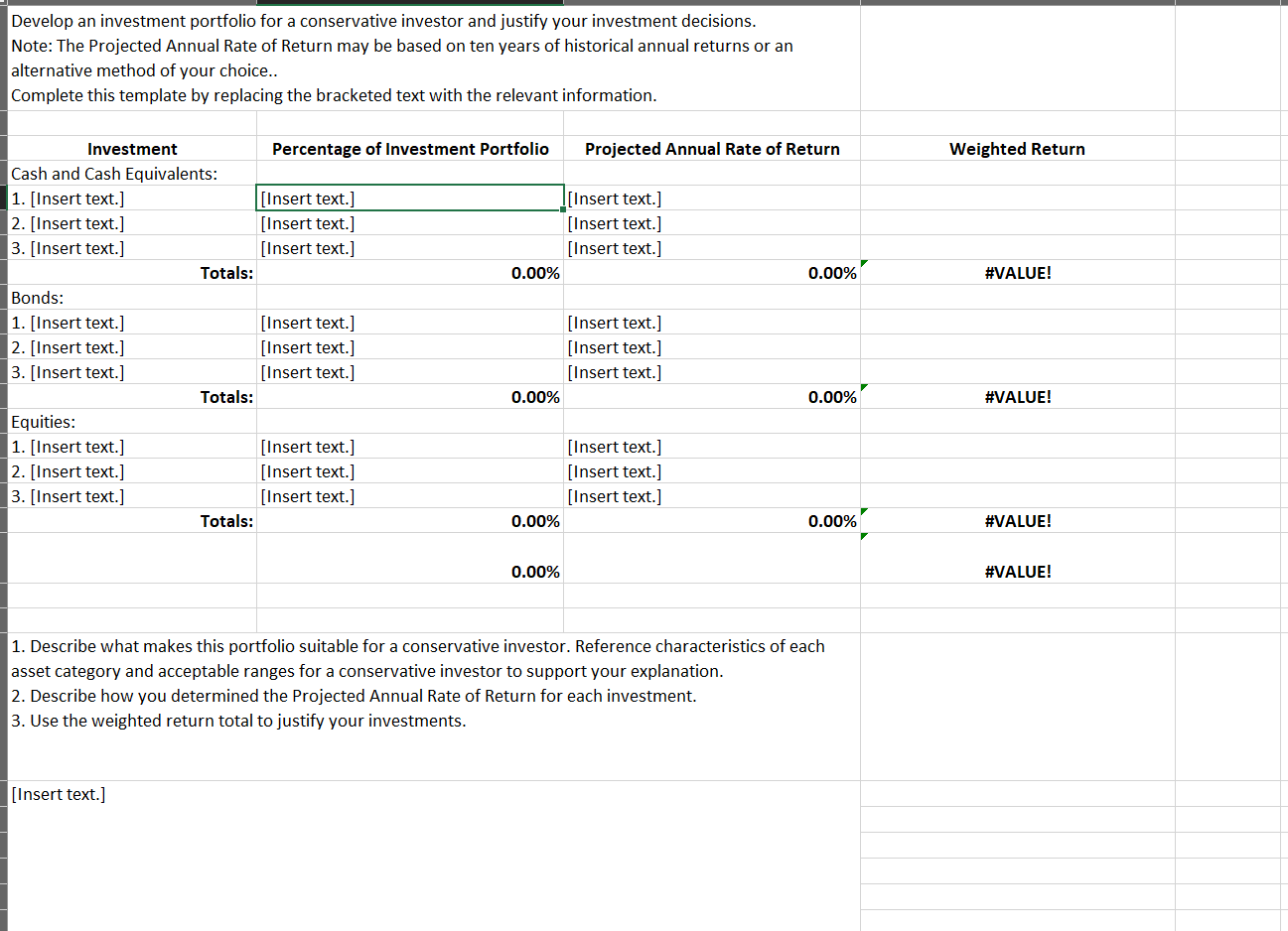

Develop an investment portfolio for a conservative investor and justify your investment decisions. Note: The Projected Annual Rate of Return may be based on ten years of historical annual returns or an alternative method of your choice.. Complete this template by replacing the bracketed text with the relevant information. Investment Cash and Cash Equivalents: 1. [Insert text.] 2. [Insert text.] 3. [Insert text.] Bonds: 1. [Insert text.] 2. [Insert text.] 3. [Insert text.] Equities: 1. [Insert text.] 2. [Insert text.] 3. [Insert text.] Totals: [Insert text.] Totals: Totals: Percentage of Investment Portfolio [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] 0.00% 0.00% 0.00% 0.00% Projected Annual Rate of Return [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] [Insert text.] 0.00% 0.00% 0.00% 1. Describe what makes this portfolio suitable for a conservative investor. Reference characteristics of each asset category and acceptable ranges for a conservative investor to support your explanation. 2. Describe how you determined the Projected Annual Rate of Return for each investment. 3. Use the weighted return total to justify your investments. Weighted Return #VALUE! #VALUE! #VALUE! #VALUE!

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Asset Categories Cash and Cash Equivalents This category includes lowrisk highly liquid investments such as savings accounts money market funds or shortterm certificates of deposit CDs Bonds This ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started