Question

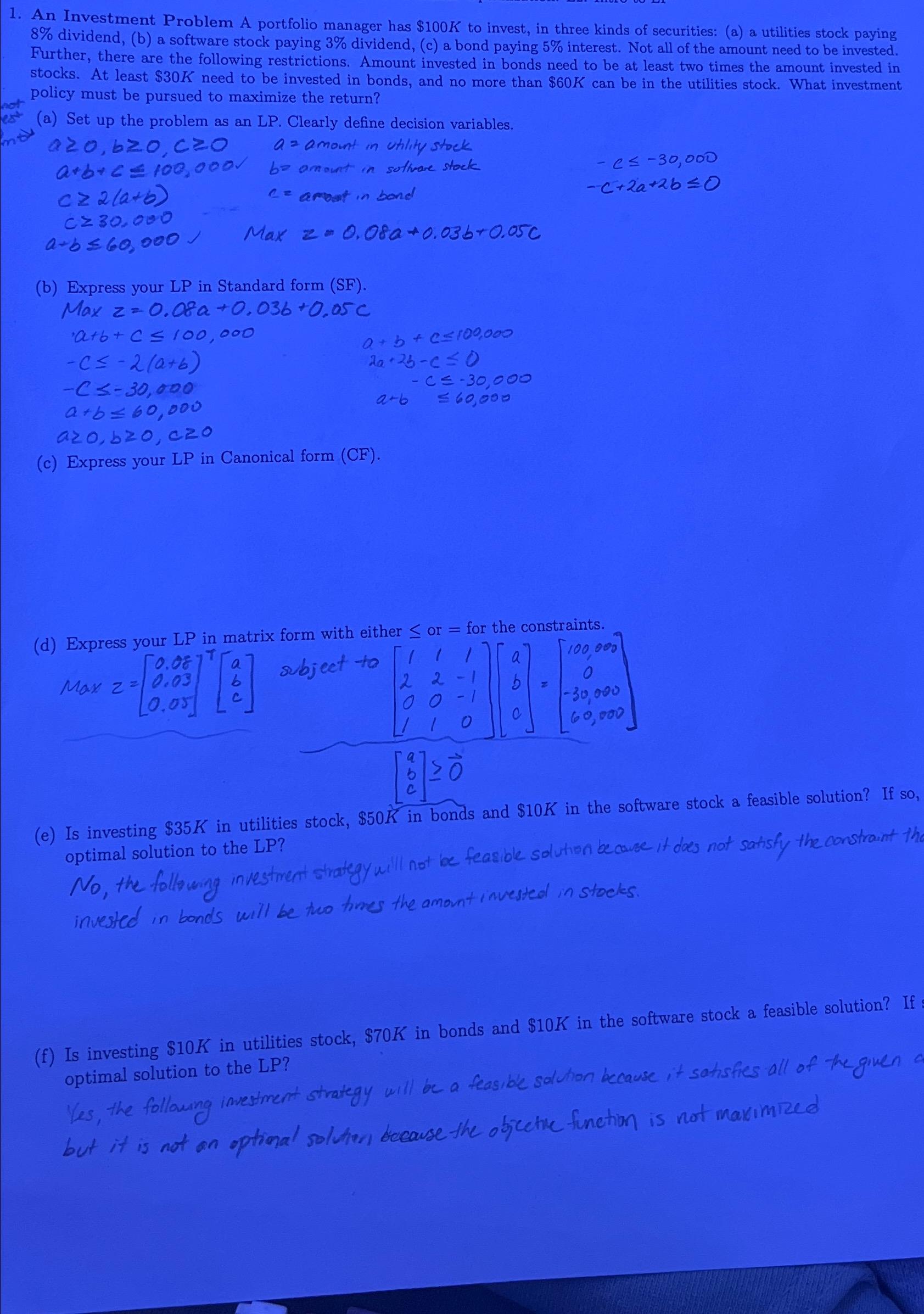

An Investment Problem A portfolio manager has $100K to invest, in three kinds of securities: (a) a utilities stock paying 8% dividend, (b) a software

An Investment Problem A portfolio manager has

$100Kto invest, in three kinds of securities: (a) a utilities stock paying

8%dividend, (b) a software stock paying

3%dividend, (c) a bond paying

5%interest. Not all of the amount need to be invested. Further, there are the following restrictions. Amount invested in bonds need to be at least two times the amount invested in stocks. At least

$30Kneed to be invested in bonds, and no more than

$60Kcan be in the utilities stock. What investment policy must be pursued to maximize the return?\ (a) Set up the problem as an LP. Clearly define decision variables.\

a>=0,b>=0,c>=0,a= amoint in utility stock \ a+b+c=2(a+b),c= arront in bond \ -c=30,000\ -c+2a+2b\

c>=30.000\ a+b\ (b) Express your LP in Standard form (SF).\

Max z=0.08a+0.036+0.05c,\ a+b+c\

a>=0,b>=0,c>=0\ (c) Express your LP in Canonical form (CF).\ (d) Express your LP in matrix form with either

or

= for the constraints.\

Express your LP in matrix form with either =vec(0)\ Is investing $35K in utilities stock, $50K in bonds and $10K in the soft \ (e) Is investing

$35K in utilities stock,

$50K in bonds and

$10K in the software stock a feasible solution? If so, optimal solution to the LP?\ No, the following investmen strategy will not be feasible solution be cause it does not satisfy the constraint the invested in bonds will be two thres the amont invested in stoeles.\ (f) Is investing

$10K in utilities stock,

$70K in bonds and

$10K in the software stock a feasible solution? optimal solution to the LP?\ Yes, the following imestrent strategy will be a feasibe solution because it satisfies all of the given but it is not on optional soluten because the objetic function is not maximized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started