Answered step by step

Verified Expert Solution

Question

1 Approved Answer

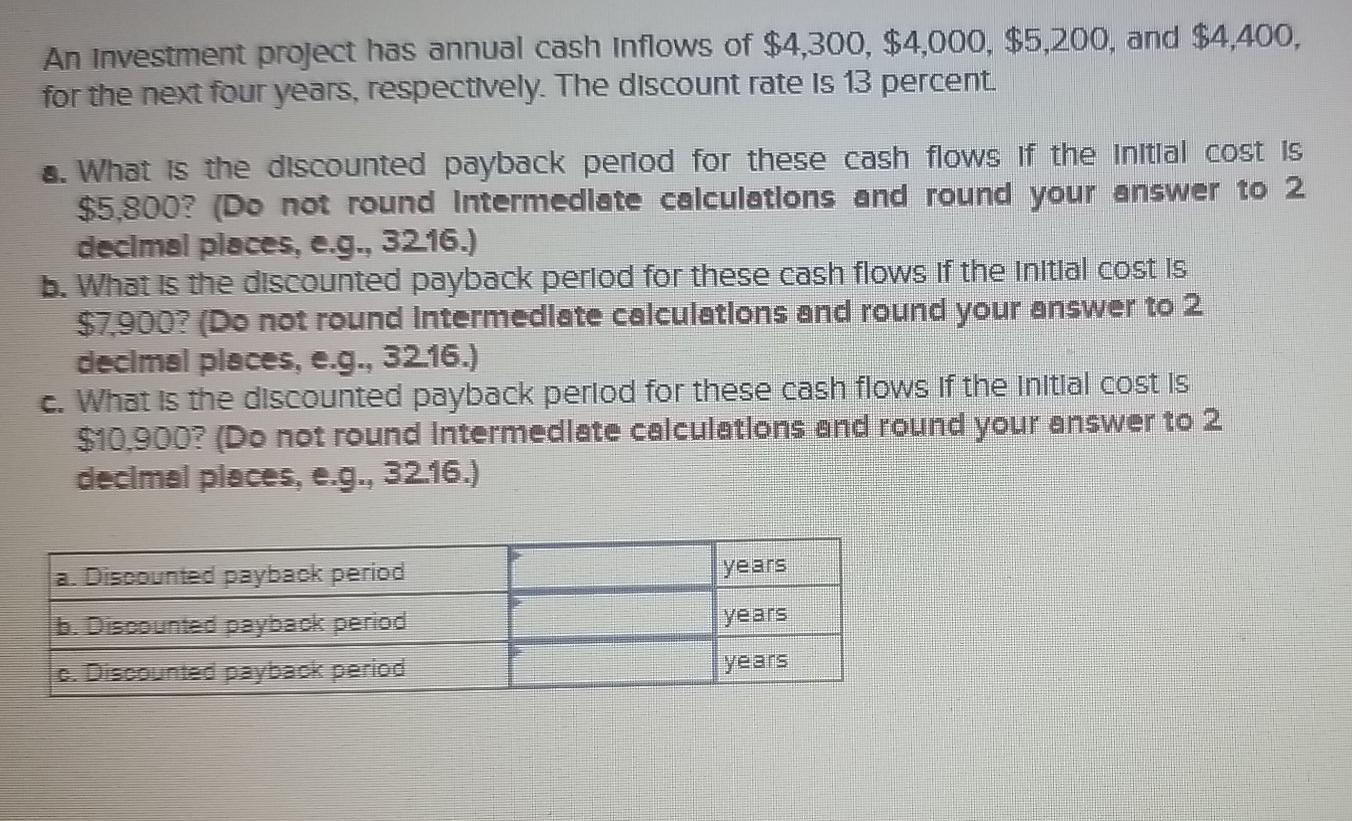

An Investment project has annual cash inflows of $4,300, $4,000, $5,200, and $4,400, for the next four years, respectively. The discount rate is 13 percent

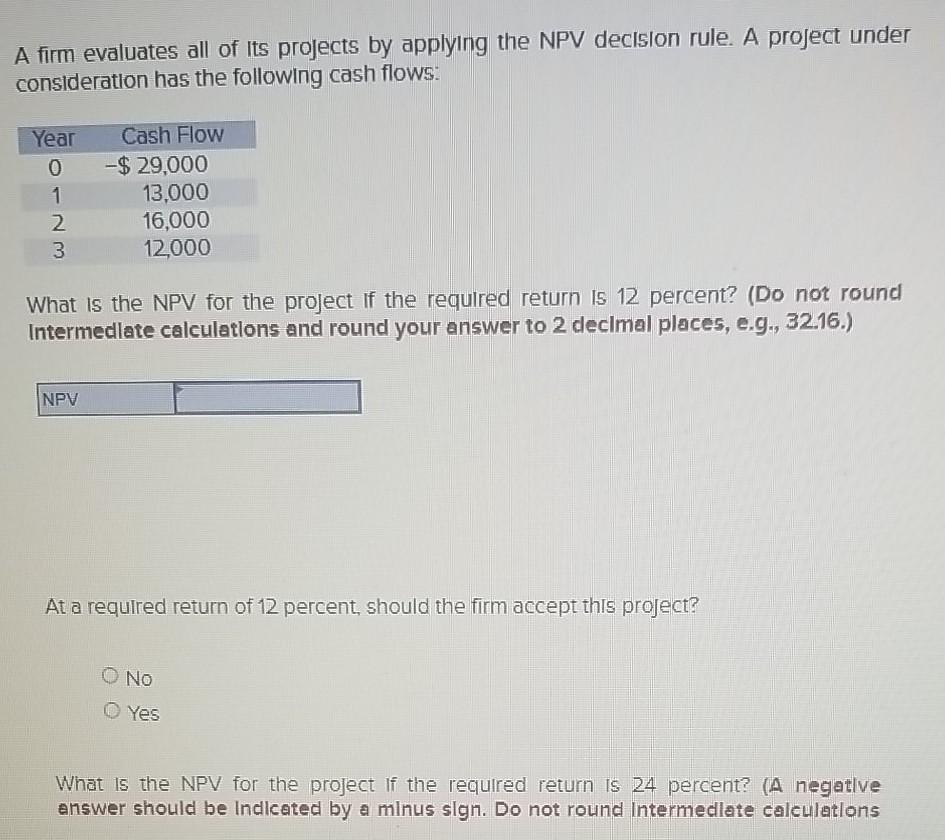

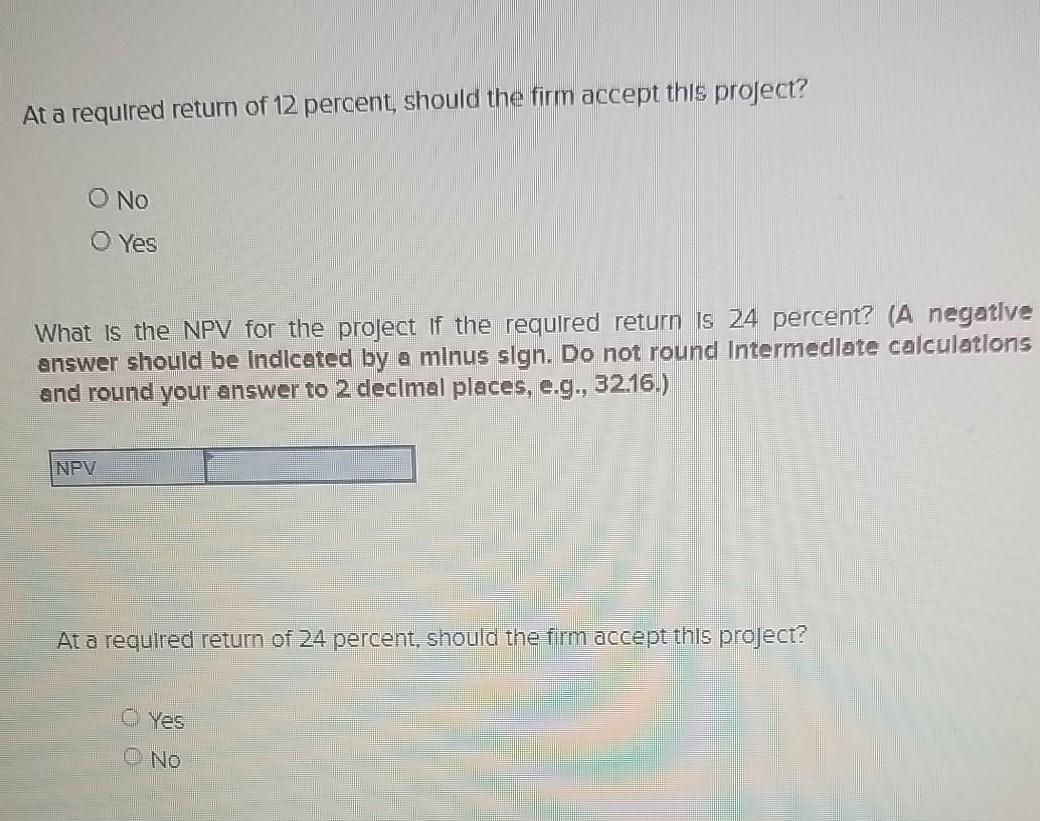

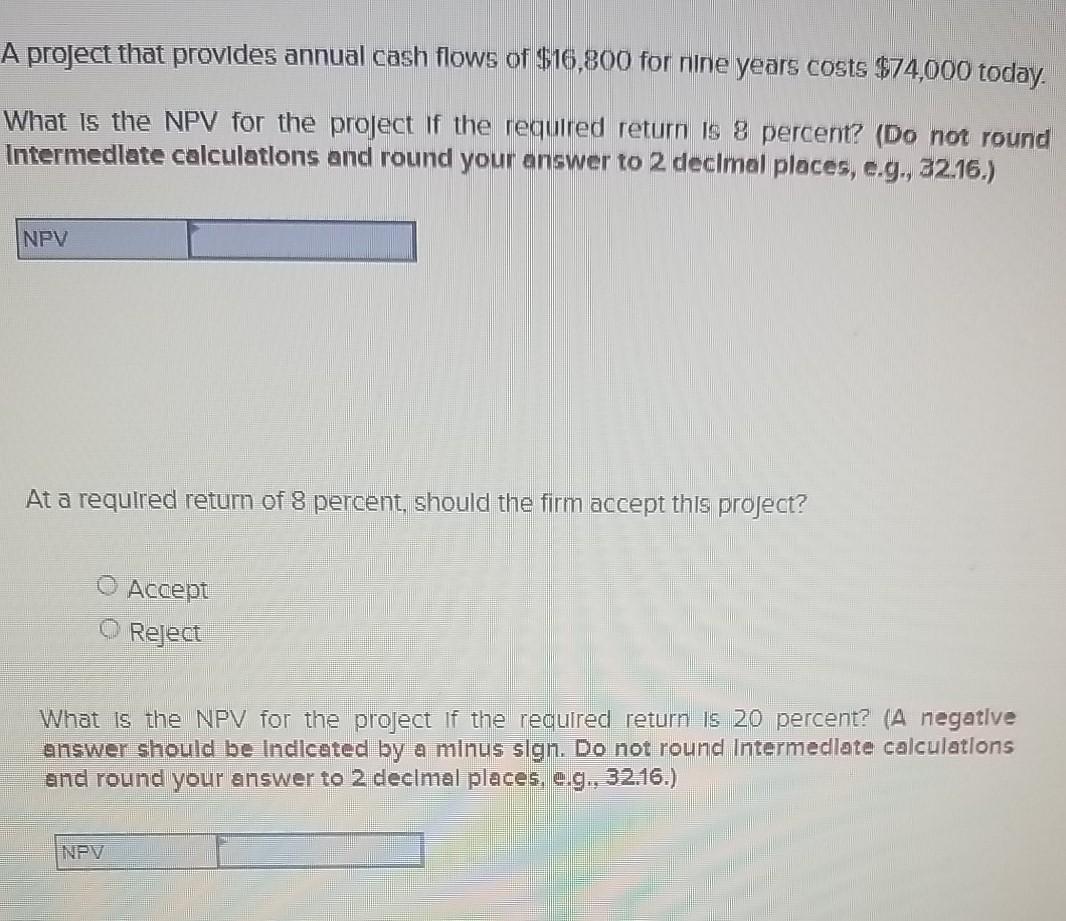

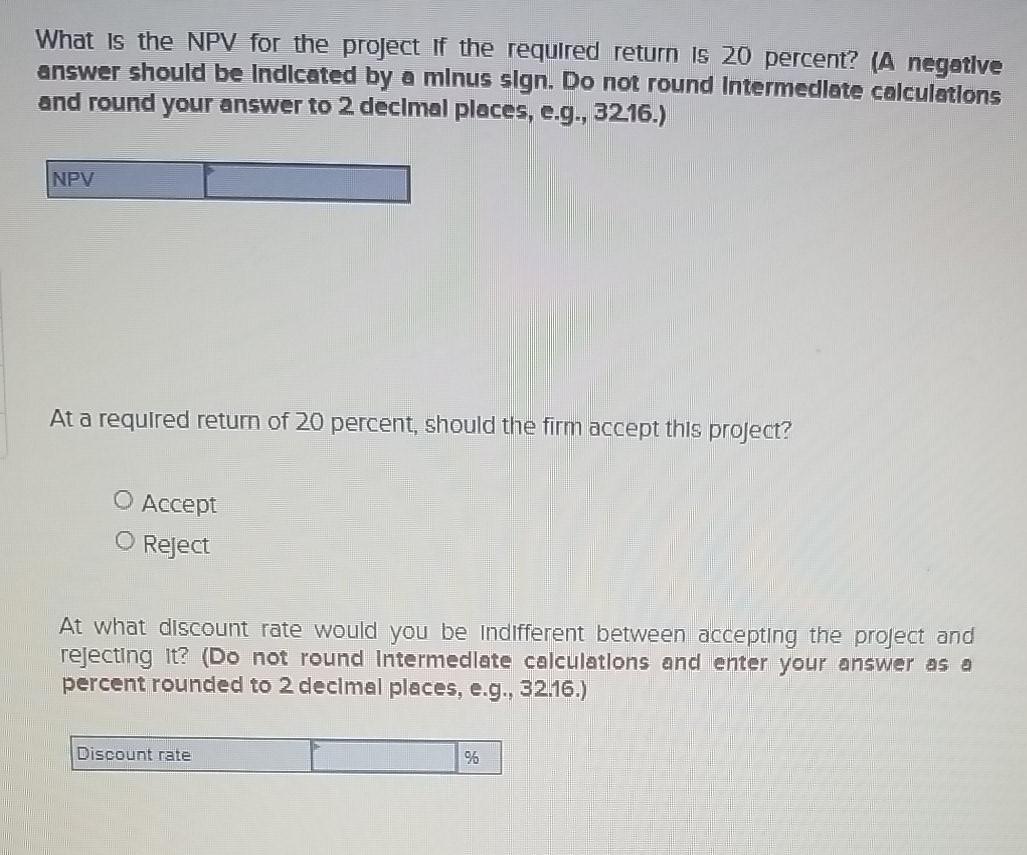

An Investment project has annual cash inflows of $4,300, $4,000, $5,200, and $4,400, for the next four years, respectively. The discount rate is 13 percent 8. What is the discounted payback period for these cash flows if the Initial cost is $5,800? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 3216.) b. What is the discounted payback period for these cash flows If the initial cost is $7.9007 (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 3216.) c. What is the discounted payback period for these cash flows if the initial cost is $10.900? (Do not round Intermedlate calculatlons and round your answer to 2 decimal places, e.g., 3216.) years 2. Discounted payback period b. Discounts ayback period e Discounts payback period years years A firm evaluates all of its projects by applying the NPV decision rule. A project under consideration has the following cash flows: - Year 0 1 2 3 Cash Flow -$ 29,000 13,000 16,000 12,000 What is the NPV for the project if the required return is 12 percent? (Do not round Intermedlate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV At a required return of 12 percent should the firm accept this project? O No Yes What is the NPV for the project if the required return is 24 percent? (A negative answer should be Indicated by a minus sign. Do not round Intermedlate calculations At a required return of 12 percent, should the firm accept this project? O No O Yes What is the NPV for the project if the required return is 24 percent? (A negative answer should be Indicated by a mlnus slgn. Do not round Intermedlate calculations and round your answer to 2 declmal places, e.g., 32.16.) NPV At a required return of 24 percent, should the firm accept this project? Yes oo ( NO A project that provides annual cash flows of $16,800 for nine years costs $74,000 today. What is the NPV for the project if the required return is 8 percent? (Do not round Intermedlate calculatlons and round your answer to 2 decimal places, e.g., 32.16.) NPV At a required return of 8 percent, should the firm accept this project? O Accept Reject What is the NPV for the project if the required return is 20 percent? (A negative answer should be Indicated by a minus sign. Do not round Intermedlate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV What is the NPV for the project If the required return is 20 percent? (A negative answer should be Indicated by a minus slgn. Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 3216.) NPV At a required retum of 20 percent, should the firm accept this project? O Accept O Reject At what discount rate would you be Indifferent between accepting the project and rejecting it? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Discount rate %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started