Answered step by step

Verified Expert Solution

Question

1 Approved Answer

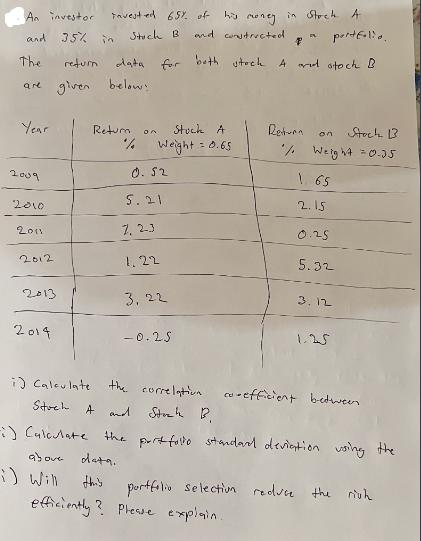

An investor and The are given Year 2009 2010 2011 2012 2013 2014 invested 65% of hu Stuck B 35% in return Retur. /

An investor and The are given Year 2009 2010 2011 2012 2013 2014 invested 65% of hu Stuck B 35% in return Retur. / on 0.52 data for both stock 4 and stock B below: Stuck A Weight = 0.65 5.21 7.2-3 1,22 money and constructed 3,22 -0.25 in Stock A 4 P efficiently? Please explain. portfolio. Return on Stock 13 / Weight = 0-35 1.65 2.15 0.25 5.32 3.12 1.25 i) Calculate the correlation. Stock A Stock B. -i) Calculate the port fallo standard deviation using the above data. i) Will co-efficient between portfolio selection reduce the righ

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the correlation coefficient between Stock A and Stock B we can use the formula Correlation coefficient CovarianceA B Standard DeviationA ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started