Question

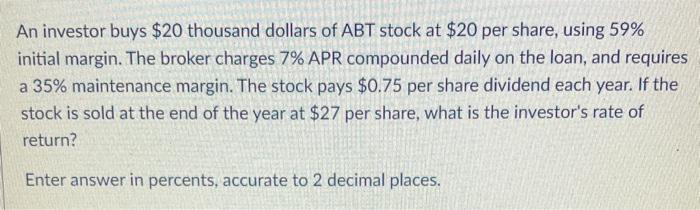

An investor buys $20 thousand dollars of ABT stock at $20 per share, using 59% initial margin. The broker charges 7% APR compounded daily

An investor buys $20 thousand dollars of ABT stock at $20 per share, using 59% initial margin. The broker charges 7% APR compounded daily on the loan, and requires a 35% maintenance margin. The stock pays $0.75 per share dividend each year. If the stock is sold at the end of the year at $27 per share, what is the investor's rate of return? Enter answer in percents, accurate to 2 decimal places.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

12th edition

978-0133075403, 133075354, 9780133423938, 133075400, 013342393X, 978-0133075359

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App