a. An investor buys a 4.4% annual coupon payment bond with six years to maturity. The bond has a yield-to-maturity of 6%. The par value

a. An investor buys a 4.4% annual coupon payment bond with six years to maturity. The bond has a yield-to-maturity of 6%. The par value is $1000.

i. Determine the market price of the bond.

ii. Calculate the bond’s duration and modified duration.

iii. If the YTM decreases to 5.5%, what is the predicted dollar change in price using the duration concept?

b

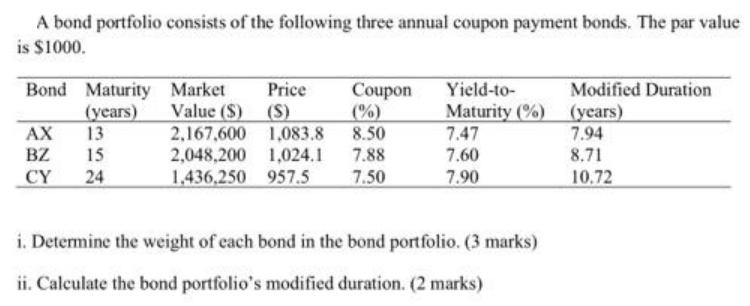

A bond portfolio consists of the following three annual coupon payment bonds. The par value is $1000. Modified Duration Bond Maturity Market (years) 13 Price Value (S) (S) 2,167,600 1,083.8 2,048,200 1,024.1 1,436.250 957.5 Yield-to- Coupon (%) 8.50 7.88 Maturity (%) (years) 7.47 AX 7.94 BZ 15 7.60 8.71 CY 24 7.50 7.90 10.72 i. Detemine the weight of each bond in the bond portfolio. (3 marks) ii. Caleulate the bond portfolio's modified duration. (2 marks)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Part i Price of the bond ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started